Lesson 10: Risk Management and Hedging

🎧 Lesson Podcast

🎬 Video Overview

Lesson 10: Risk Management and Hedging

🎯 Core Concept: Professional Risk Management

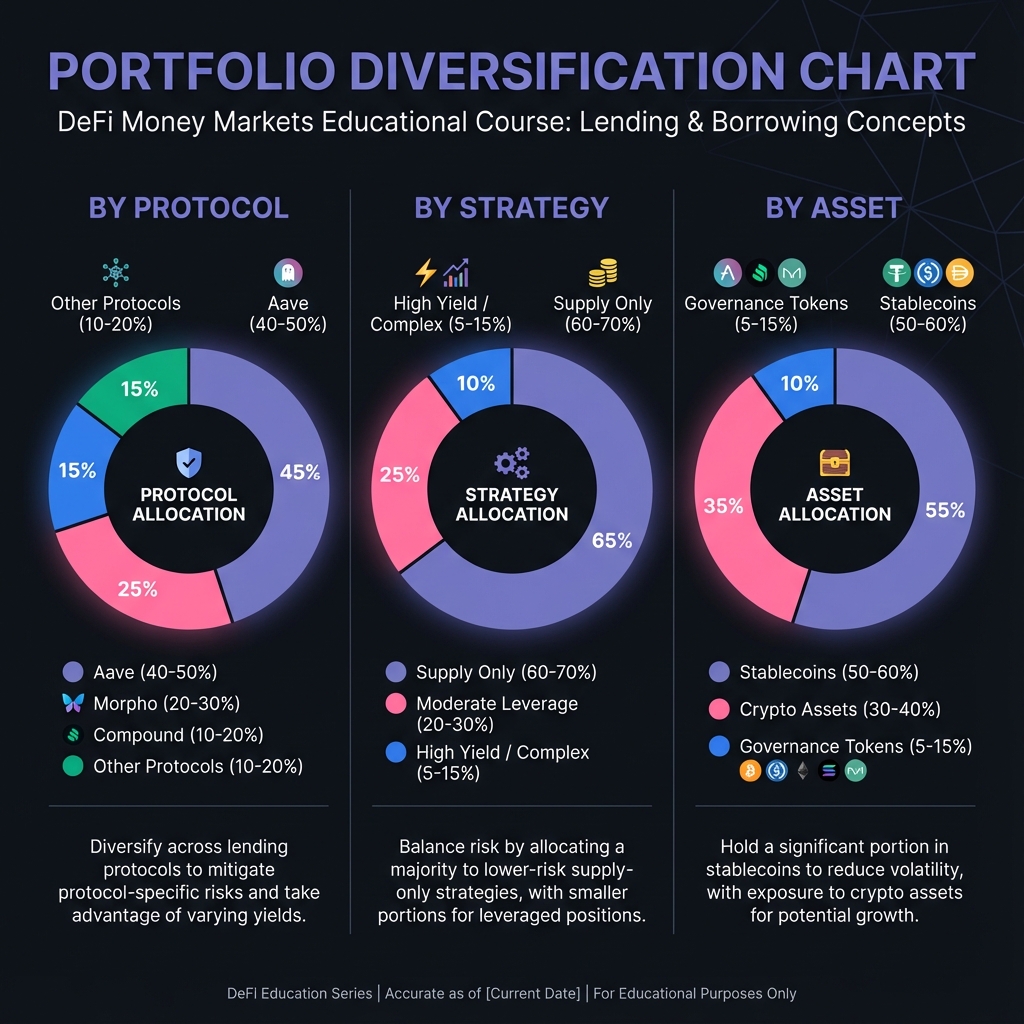

📊 Portfolio Diversification

Multi-Protocol Strategy

Correlation Analysis

🛡️ Liquidation Protection Strategies

Health Factor Monitoring Systems

Dynamic Collateral Management

Automated Protection Mechanisms

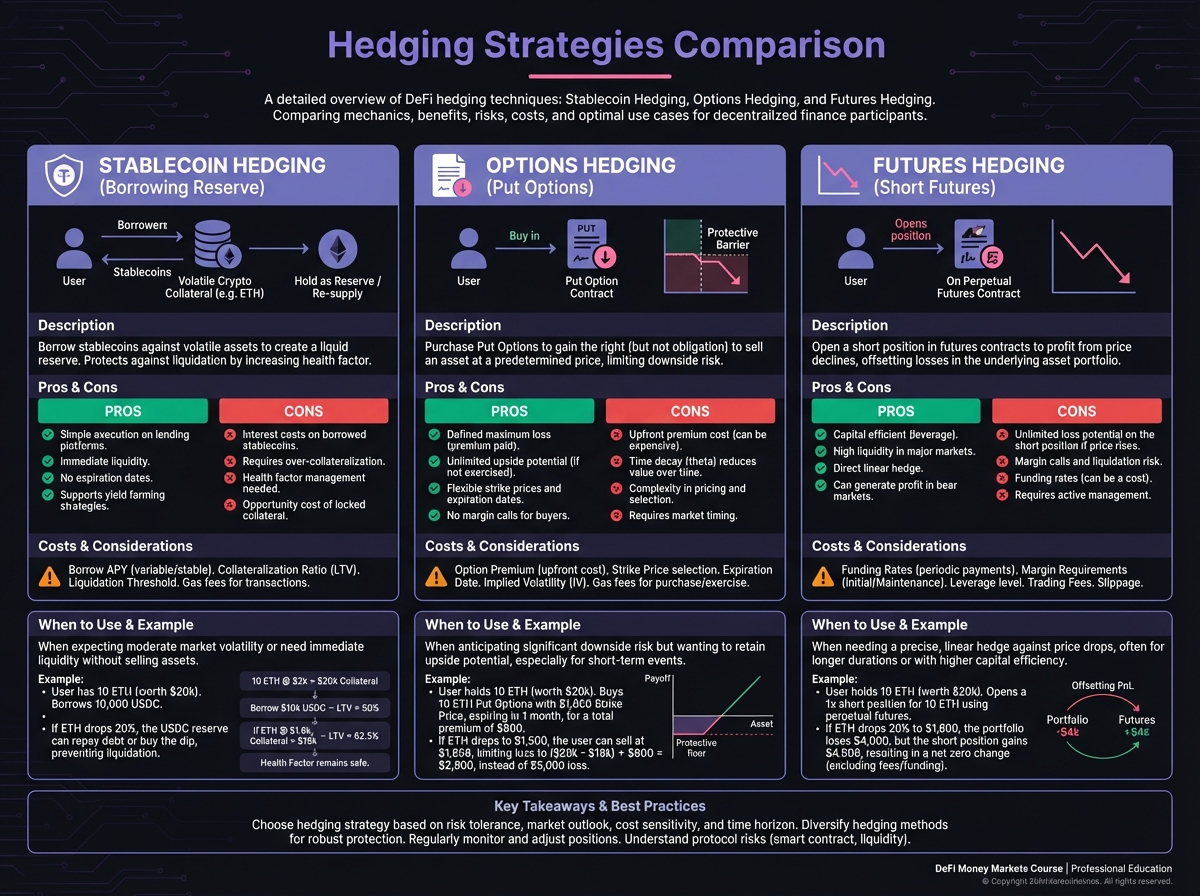

🔄 Hedging Strategies

Understanding Hedging

Common Hedging Techniques

Partial Hedging

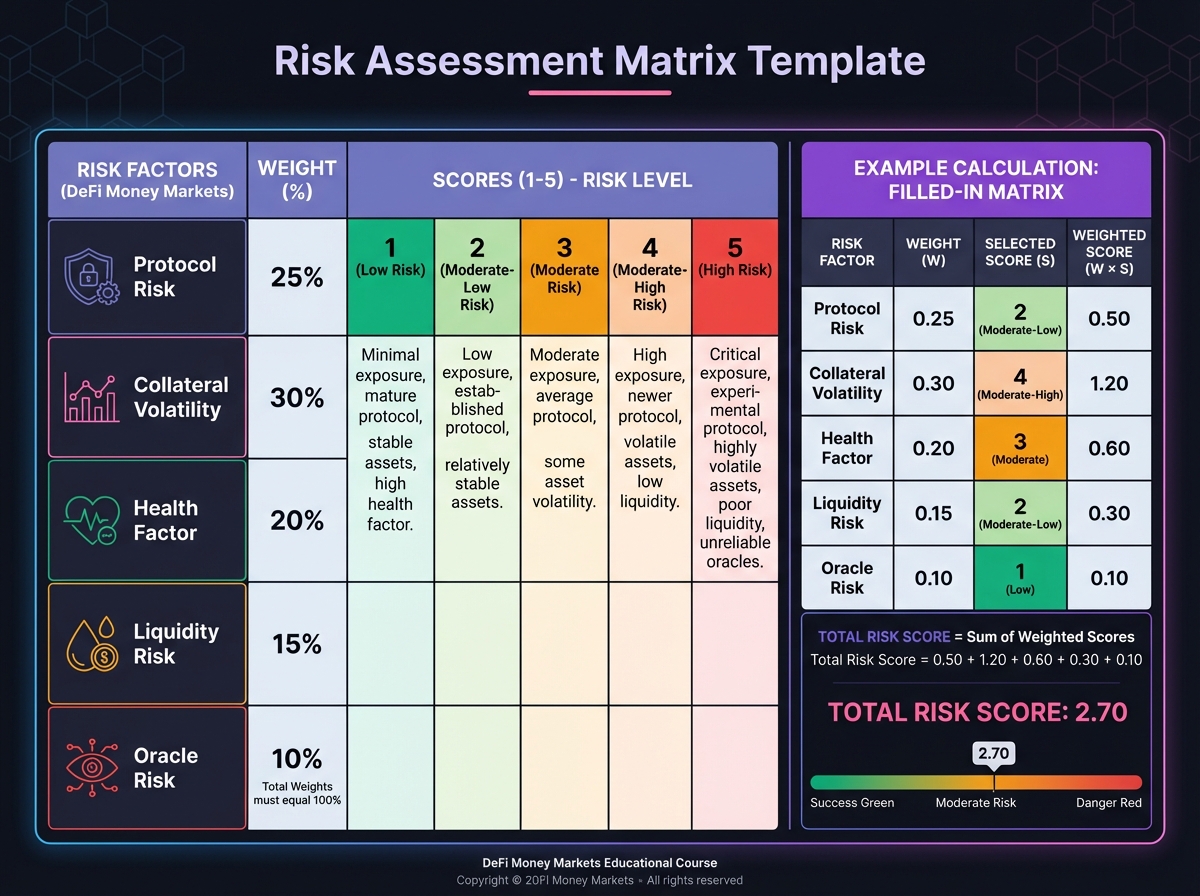

🏗️ Risk Management Framework

Risk Assessment Matrix

Factor

Score (1-5)

Weight

Weighted Score

Position Sizing Framework

Stress Testing

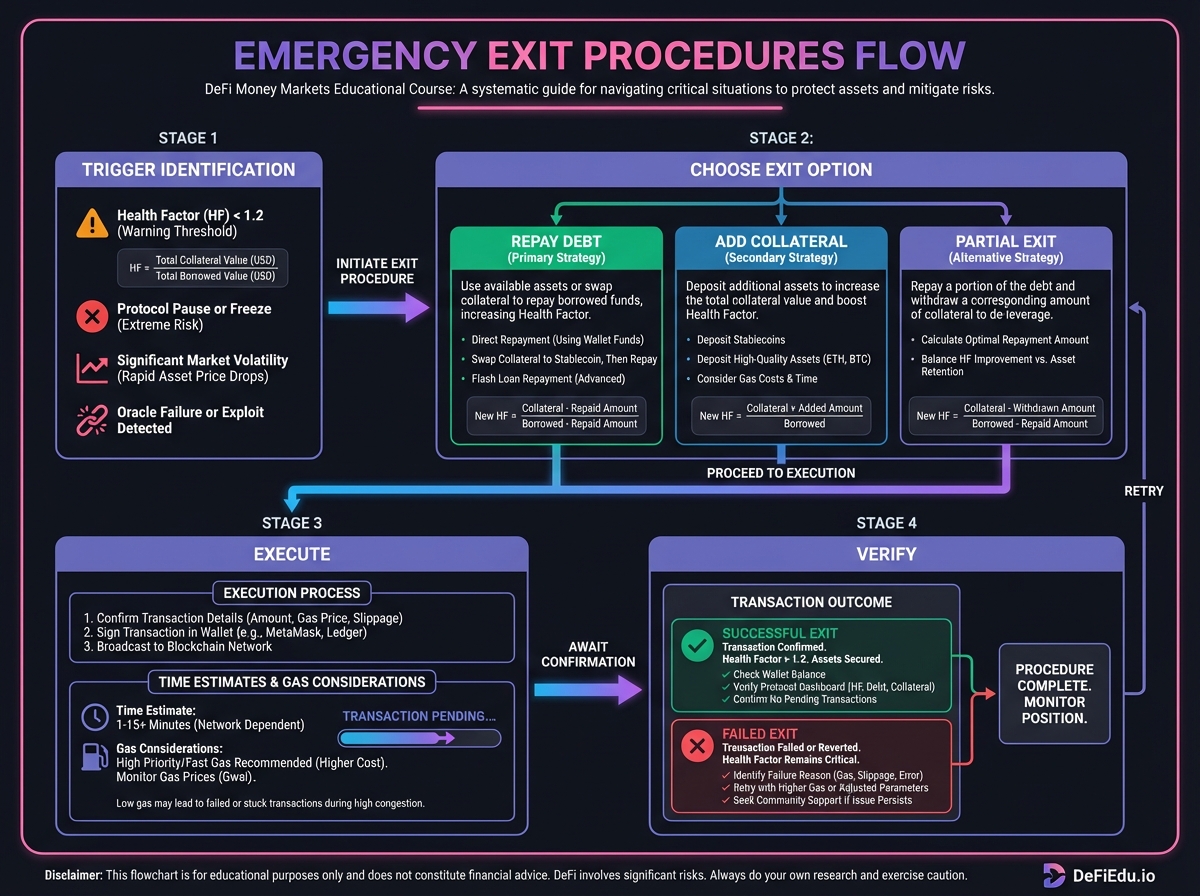

🚨 Emergency Exit Procedures

When to Exit

Exit Execution

Exit Timing

📈 Risk-Adjusted Returns

Sharpe Ratio (Simplified)

Sortino Ratio

🎯 Risk Management Best Practices

Daily Practices

Weekly Practices

Monthly Practices

🎓 Beginner's Corner

🔬 Advanced Deep-Dive: Correlation Hedging

Portfolio Correlation Matrix

📊 Real-World Example: Risk Management

Interactive Risk Assessment Checklist

🔑 Key Takeaways

🚀 Next Steps

Last updated