Lesson 5: Aave - The Monolithic Standard

🎧 Lesson Podcast

🎬 Video Overview

Lesson 5: Aave - The Monolithic Standard

🎯 Core Concept: The DeFi Lending Hegemon

Aave stands as the undisputed leader in decentralized lending, managing over $70 billion in total value locked (TVL) and commanding approximately 60% market share. Its dominance stems from a "safety-first" approach, extensive auditing, and strategic evolution from V3's fragmented pools to V4's unified Hub and Spoke architecture.

Why Aave Matters: For beginners, Aave offers the lowest-risk entry point into DeFi lending, with insurance options, consumer-friendly interfaces, and the largest liquidity pools in the industry.

🏗️ Aave V3: The Legacy Standard

Core Architecture

The Monolithic Pool Model:

All assets pooled together into shared liquidity reserves

Simple UX: Deposit Asset A, Borrow Asset B

Cross-collateralization enabled (use multiple assets as collateral)

Unified risk management via governance

Key Features:

1. High Efficiency Mode (eMode)

Allows extremely high LTVs (up to 97%) for correlated assets

Example: USDC/USDT pairs can leverage at 97% LTV

Designed for forex-style arbitrage and yield farming

Risk: Small depegs (like USDC's $0.87 in March 2023) can trigger instant liquidations

2. Isolation Mode

Allows listing newer, volatile assets safely

Restrictions:

Can only borrow stablecoins (USDC, USDT, DAI)

Cannot use other assets as collateral simultaneously

Debt ceiling caps total borrowing

Purpose: Firewall to prevent contagion from risky assets

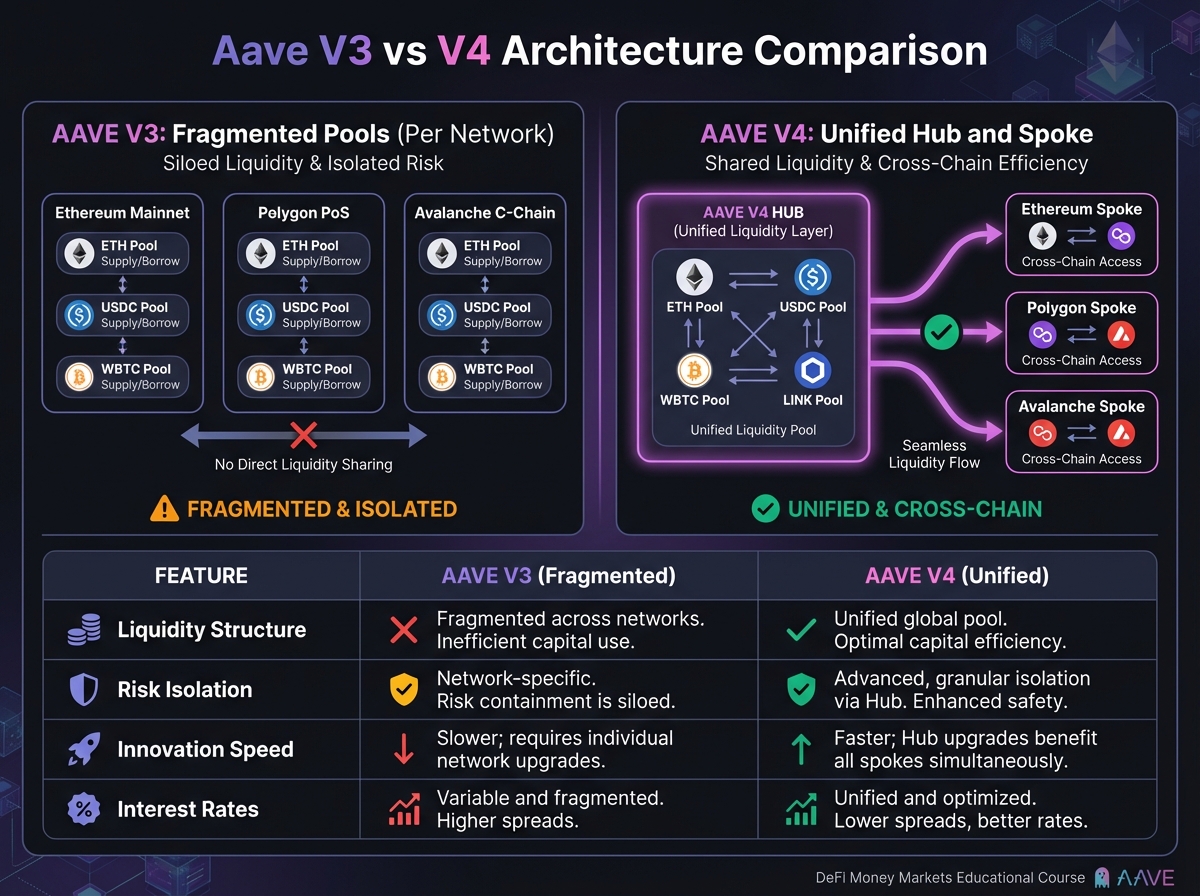

3. The Fragmentation Problem

Each network deployment (Ethereum, Arbitrum, Optimism) is independent

Liquidity cannot flow between pools

Forces bootstrap costs for new deployments

Creates inconsistent interest rates across chains

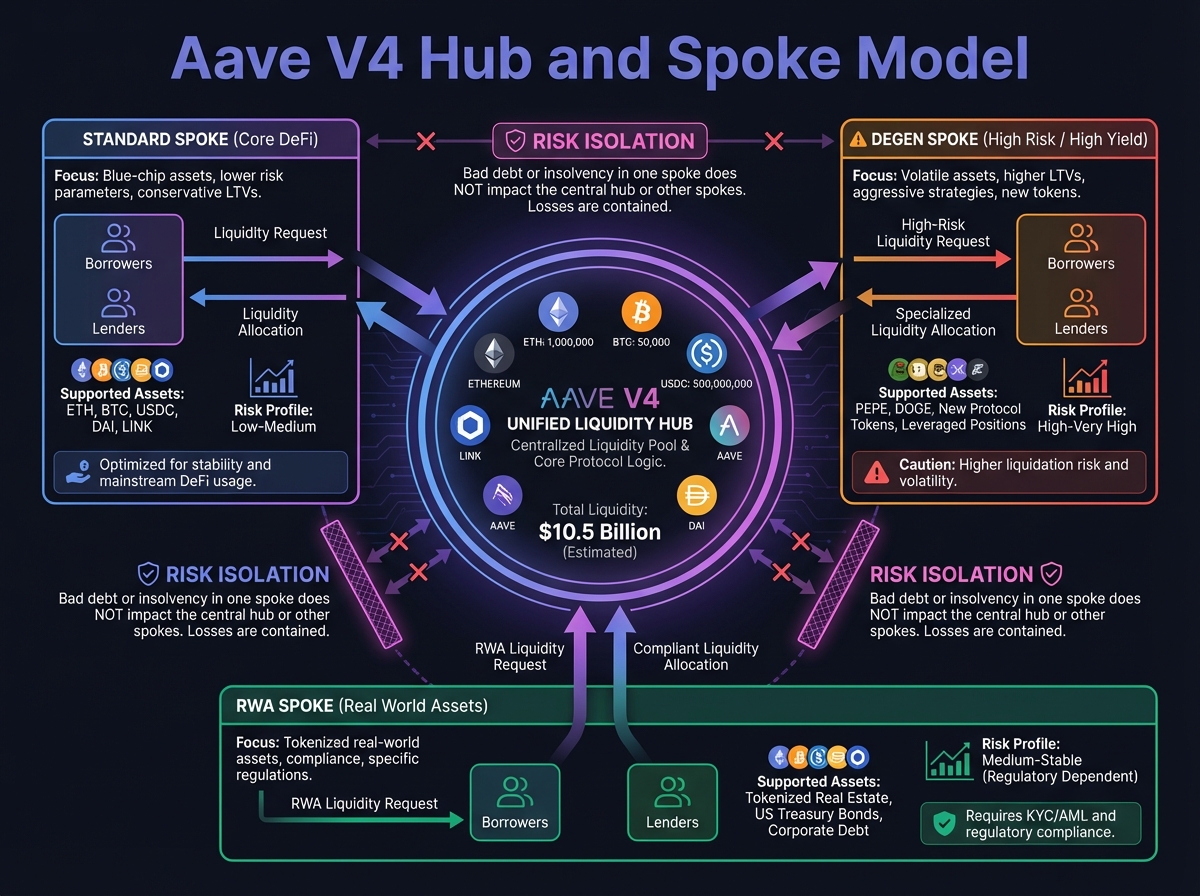

🚀 Aave V4: The Hub and Spoke Revolution

The Unified Liquidity Layer

The Hub:

Central settlement layer for all assets on a network

Consolidates all protocol-wide liquidity

Manages core accounting and solvency

Does not interact directly with users

The Spokes:

User-facing modules with specific lending logic

Customizable risk parameters per Spoke

Examples:

Standard Spoke (like V3)

Degen Spoke (high-risk meme coins)

RWA Spoke (Horizon, institutional)

Risk isolation at the Spoke level

Benefits of V4:

100% Capital Reuse: Deposits in Hub serve all Spokes simultaneously

Fast Innovation: Add new Spokes without liquidity migration

Dynamic Risk: Adjust LTV/rates based on volatility in real-time

Soft Liquidations: Partial liquidations preserve user positions

ERC-4626 Standard: Vault shares compatible with all DeFi

Architecture Comparison

Liquidity

Fragmented pools

Unified Hub

Risk Isolation

Asset-level (Isolation Mode)

Spoke-level (module isolation)

Innovation Speed

Slow (requires migration)

Fast (add Spoke, tap existing liquidity)

Interest Rates

Static curves

Dynamic/fuzzy logic

Accounting

aTokens (rebasing)

Vault shares (ERC-4626)

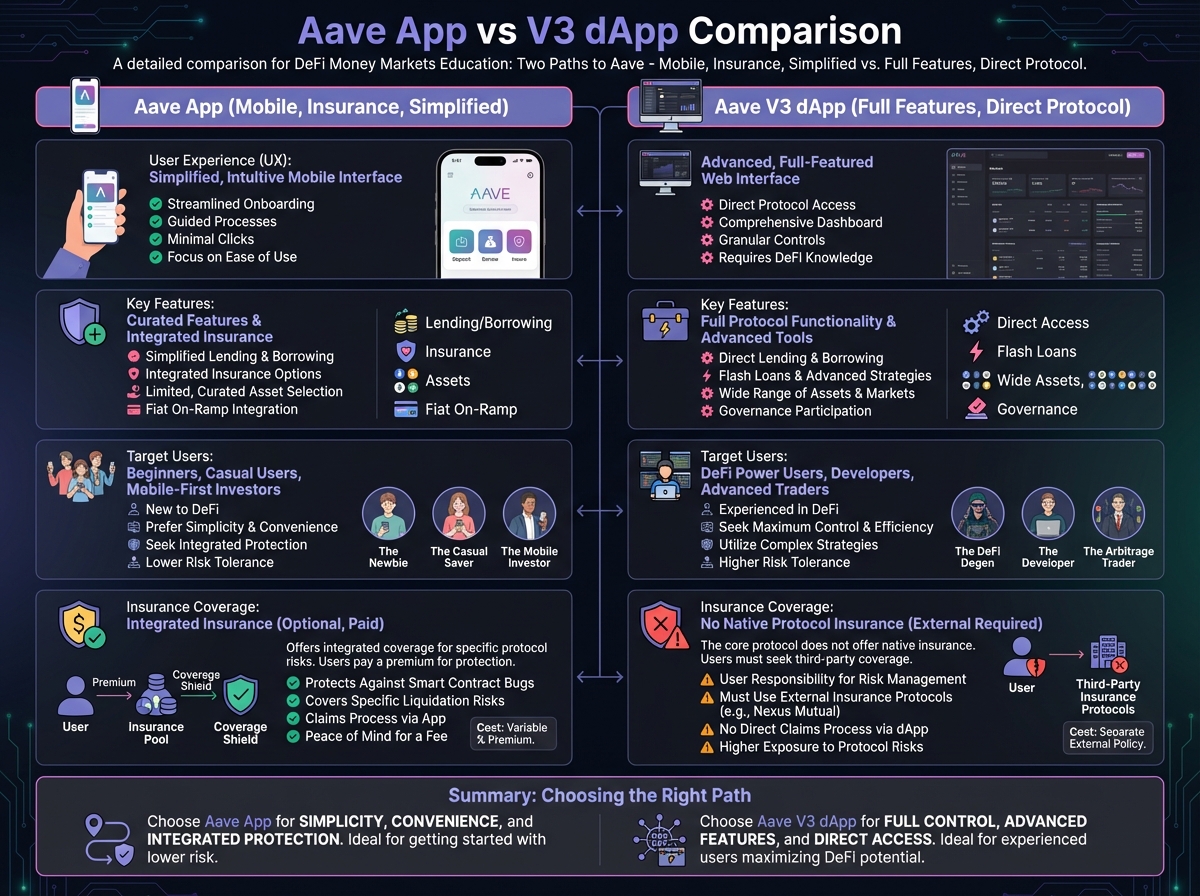

📱 The Two Paths to Aave

Path A: The Aave App (Recommended for Beginners)

The "DeFi Mullet" Strategy: Fintech in the front, DeFi in the back.

Features:

Mobile app (iOS, Android)

Clean, bank-like interface

Abstracts gas fees and complex signing

Critical: $1M insurance coverage per account

Yields: 5-9% APY on stablecoins

Best For:

Retail savers

Capital preservation focus

Users wanting insurance protection

Simplified yield earning

The Insurance Layer:

Coverage for smart contract failures

Coverage for technical exploits

Combines Umbrella Safety Module + external coverage

First-of-its-kind protection in DeFi

Path B: Aave V3 dApp (Direct Protocol)

Full Protocol Access:

Web interface at app.aave.com

Direct smart contract interaction

Can use crypto as collateral

Full feature access

Network Selection:

Recommended for beginners: Arbitrum or Base (low gas)

Advanced users: Ethereum Mainnet (maximum liquidity)

Available on: Ethereum, Arbitrum, Optimism, Base, Polygon, Avalanche, Scroll

Operational Guide:

Connect wallet

Switch to L2 (Arbitrum/Base)

Supply assets (toggle collateral OFF for supply-only)

Borrow (if desired, monitor Health Factor)

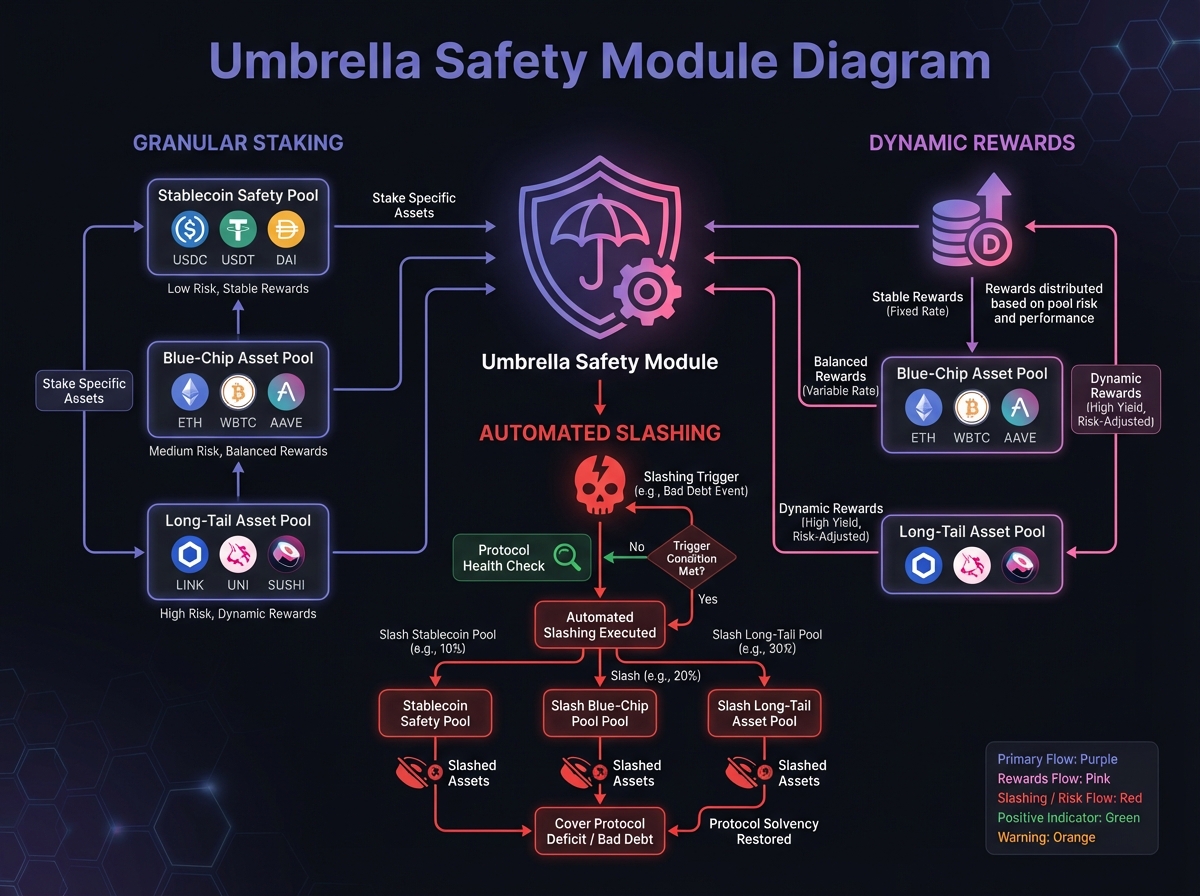

🛡️ Risk Management: Umbrella Safety Module

Automated Solvency Protection

Legacy Safety Module:

Users staked AAVE tokens

Slashing required governance vote (slow, political)

Risked tokens for assets they didn't use

Umbrella Upgrade:

Automated slashing: Smart contracts detect deficits, slash immediately

Granular staking: Stake specific assets (aUSDC) to insure specific markets

Incentive alignment: Stakers protect what they understand

Dynamic rewards: Higher rewards for under-insured markets

How It Works:

Stake yield-bearing assets (aUSDC, aETH) into Safety Pools

Each pool covers specific asset classes

If bad debt occurs, relevant pool is slashed automatically

Creates internal insurance market

Risk Stewards: Real-Time Protection

The Problem: DAO governance takes 3-5 days; markets move in seconds.

The Solution: Risk Stewards (Chaos Labs) with automated oracles.

Capabilities:

Monitor liquidity depth on CEXs

Track on-chain volatility

Automatically adjust Supply/Borrow caps

Adjust interest rate curves based on utilization duration

Example: If CRV liquidity dries up on Binance, Risk Oracle lowers caps immediately to prevent manipulation attacks.

🏛️ Aave Horizon: The Institutional Bridge

The RWA Integration

Horizon Overview:

Permissioned deployment for Real-World Assets

Hybrid model: permissioned collateral, permissionless borrowing

$600M+ TVL by late 2025

How It Works:

Institutions tokenize U.S. Treasuries (e.g., BlackRock's BUIDL)

Use as collateral to borrow USDC/GHO

Permissionless side lends stablecoins to institutions

Brings "repo market" on-chain

Strategic Positioning:

Aave as settlement layer for tokenized economy

Major partnerships with tokenization firms

Expected exponential growth with regulatory clarity

💰 The GHO Ecosystem

The Native Stablecoin

GHO Features:

Native Aave stablecoin

Backed by collateral on Aave

Cross-chain via CCIP

Revenue engine for DAO

The Merit Program:

Incentivizes GHO usage

Expansion across chains

Integration with DeFi ecosystem

The "Chainsaw Arc": Financial Optimization

What Happened:

Aave DAO shut down 50%+ of underperforming L2 instances

Focused liquidity on high-revenue chains (Ethereum, Arbitrum, Base)

Dramatically improved profitability

Results:

Annualized revenue: ~$130M

Exceeds cash reserves of many competitors

Funds AAVE buybacks

Bolsters GHO stability

⚙️ Advanced Features and Modes

Isolation Mode Deep-Dive

When Assets Are Isolated:

Newer, volatile tokens

Lower liquidity assets

Experimental listings

Restrictions:

Can only borrow stablecoins

Cannot combine with other collateral

Limited flexibility during downturns

Why Avoid as Beginner:

If isolated asset crashes, you can't add ETH to shore up HF

Must repay debt or deposit more of falling asset

Higher risk concentration

E-Mode Deep-Dive

High Leverage, High Risk:

Up to 97% LTV for correlated assets

Designed for looping strategies

Example: Supply USDC → Borrow USDT → Swap → Repeat

The Danger:

USDC/USDT correlation is high but not 100%

Depeg events can trigger instant liquidations

Small 2-3% deviation = total loss at 97% LTV

For Beginners: Avoid E-Mode until you understand correlation risk and depeg scenarios.

📊 Operational Best Practices

For Supply-Only Positions

Choose stablecoins (USDC, USDT, DAI)

Toggle collateral OFF (zero liquidation risk)

Monitor APY (it fluctuates with utilization)

Use L2 (Arbitrum/Base for lower gas)

Start with Aave App (insurance coverage)

For Borrowing Positions

Maintain HF > 2.0 (absolute minimum: 1.5)

Use blue-chip collateral (ETH, WBTC, stablecoins)

Avoid Isolation Mode (unless you understand risks)

Monitor daily (prices and interest change)

Have exit plan (know how to add collateral/repay)

Network Selection

Beginners: Arbitrum or Base

Low gas costs ($0.20-1.00)

High liquidity

Same security as mainnet

Better for learning

Advanced: Ethereum Mainnet

Maximum liquidity

Highest security

Best for large positions ($50k+)

Higher gas costs ($20-100+)

🎓 Beginner's Corner: Getting Started with Aave

Step 1: Choose Your Path

Simple savings: Use Aave App (insurance, simple)

Full features: Use Aave V3 dApp (borrowing, advanced)

Step 2: Network Selection

Start on Arbitrum or Base (low gas)

Bridge funds from mainnet or withdraw from CEX

Step 3: First Position

Supply USDC only (stable, no volatility risk)

Toggle collateral OFF (zero liquidation risk)

Monitor for a week to understand system

Step 4: Graduation

Once comfortable, explore borrowing

Start with conservative HF (>2.0)

Use blue-chip collateral only

🔬 Advanced Deep-Dive: V4 Architecture Details

Dynamic Risk Configuration

Real-Time Adjustments:

LTV ratios adjust based on volatility

Liquidation thresholds adjust automatically

No governance vote needed

Responds to market conditions instantly

Example: If ETH volatility spikes, LTV automatically decreases to protect protocol and users.

Soft Liquidations

Traditional (Hard):

Liquidate entire position

Sell all collateral

Large penalty

V4 (Soft):

Liquidate only minimum needed

Partial collateral sale

Smaller penalty

User keeps remaining position

Benefit: Reduces punitive losses and improves user experience.

📈 Real-World Example: Aave Supply Position

Setup:

Supply: $10,000 USDC

Network: Arbitrum

APY: 5%

Collateral: OFF

After 1 Year:

aUSDC balance: ~10,500

Value: $10,500

Earnings: $500

Gas costs: ~$0.50 (on Arbitrum)

If APY Changes to 7%:

Your position automatically earns new rate

No action needed

Compound effect continues

Withdrawal:

Burn 10,500 aUSDC

Receive 10,500 USDC

Total cost: ~$0.50 gas

Net profit: ~$499.50

Interactive Protocol Comparison Tool

Compare Aave, Morpho, and Euler features side by side:

Launch Protocol Comparison Tool →

🔑 Key Takeaways

Aave is the market leader with $70B+ TVL and 60% market share

Two entry paths: Aave App (insurance, simple) or V3 dApp (full features)

V4 introduces Hub/Spoke architecture solving fragmentation

Umbrella Safety Module provides automated, granular protection

Start on L2 (Arbitrum/Base) for low gas costs

Supply stablecoins first with collateral OFF for zero risk

Horizon bridges RWA opening institutional access

Avoid E-Mode/Isolation until you understand risks

🚀 Next Steps

Lesson 6 explores Morpho's modular infrastructure—the efficient challenger to Aave's monolithic model. You'll learn about Morpho Blue, MetaMorpho vaults, and the curator economy.

Complete Exercise 5 to practice Aave position setup and optimization strategies.

Remember: Aave represents the safest, most established entry point. Master its interface and features before exploring more complex protocols.

← Back to Summary | Next: Exercise 5 → | Previous: Lesson 4 ←

Last updated