Lesson 8: Alternative Chain Protocols

🎧 Lesson Podcast

🎬 Video Overview

Lesson 8: Alternative Chain Protocols

🎯 Core Concept: High-Performance Chain Money Markets

🪐 Kamino Finance (Solana)

The Hybrid Primitive

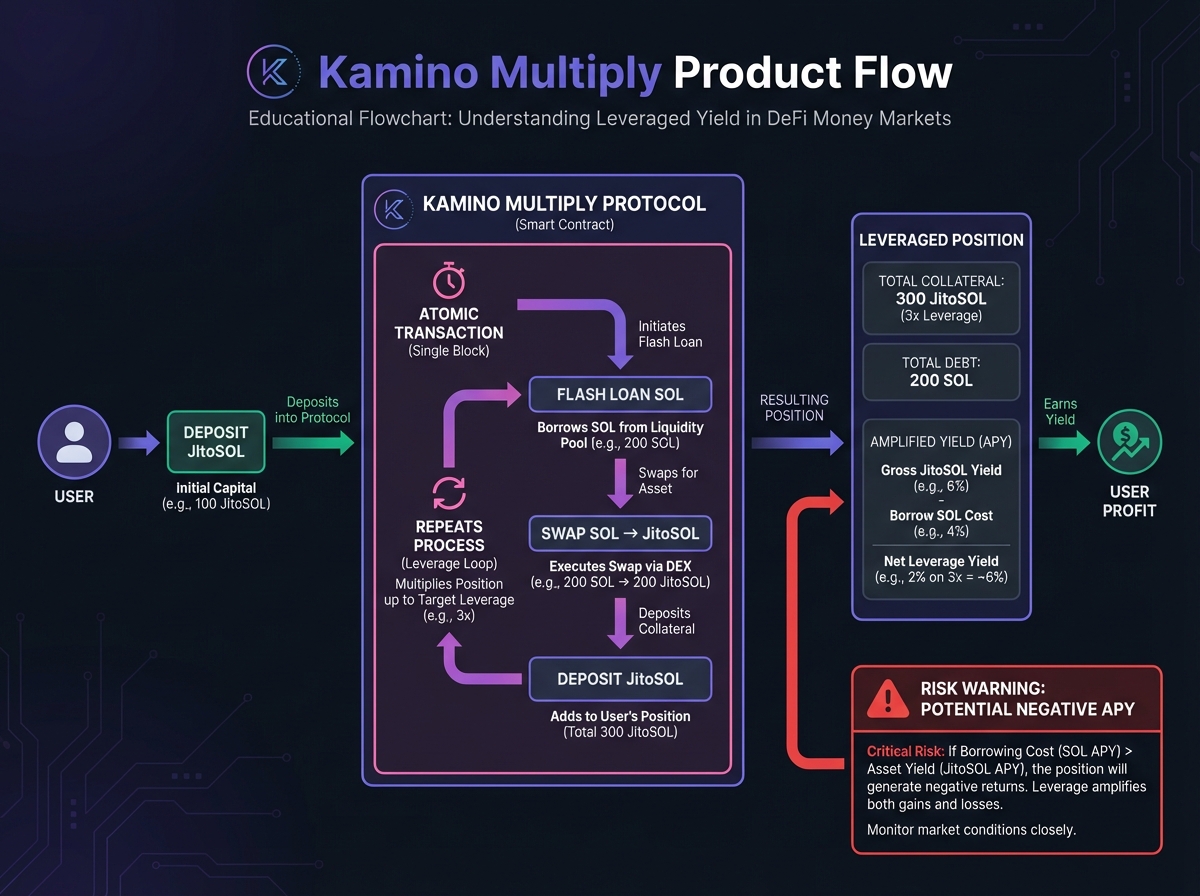

The Multiply Product

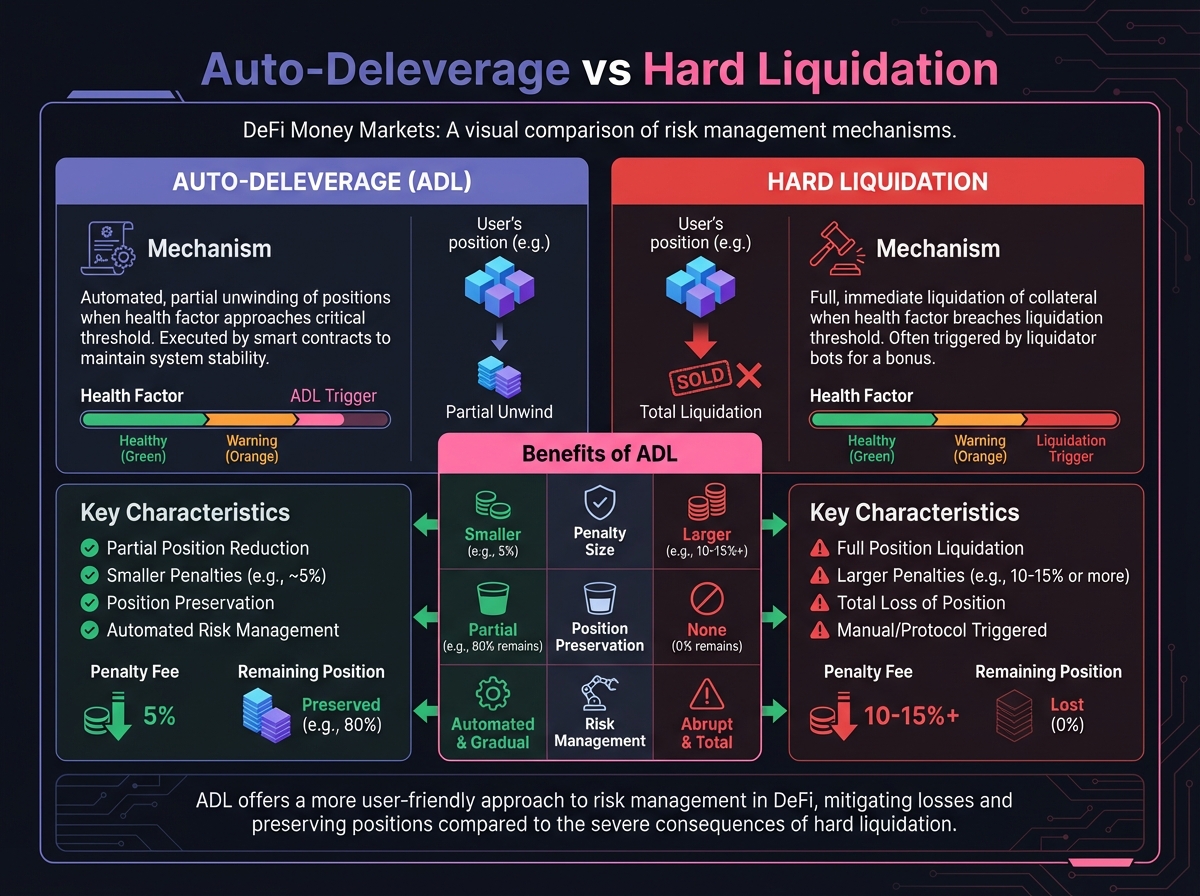

Auto-Deleverage (ADL)

V2 Modular Design

🌊 Suilend (Sui)

The Move-Based Architecture

Operational Considerations

Security History

🌐 JustLend (Tron)

The Tron Ecosystem Leader

The USDD Factor

Energy and Bandwidth Model

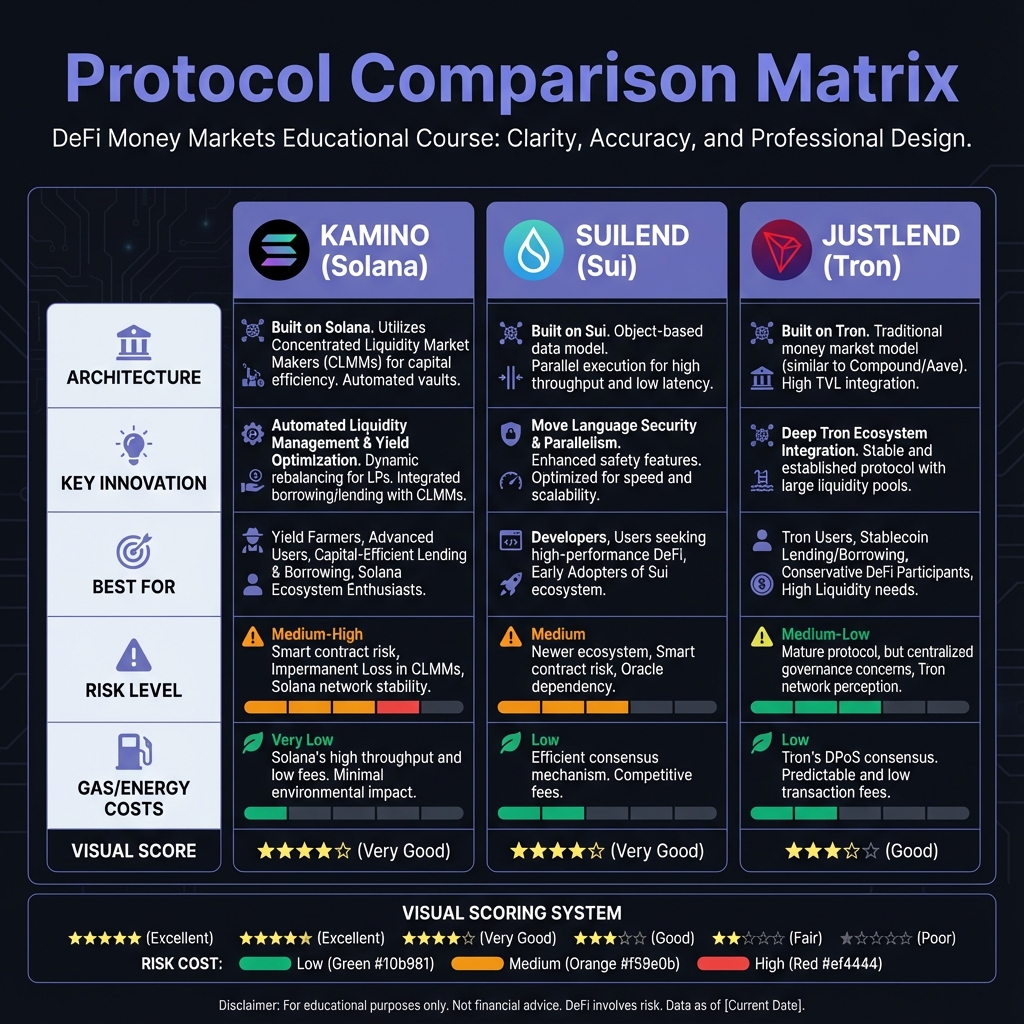

📊 Cross-Chain Comparison

Feature

Kamino (Solana)

Suilend (Sui)

JustLend (Tron)

⚠️ Cross-Chain Considerations

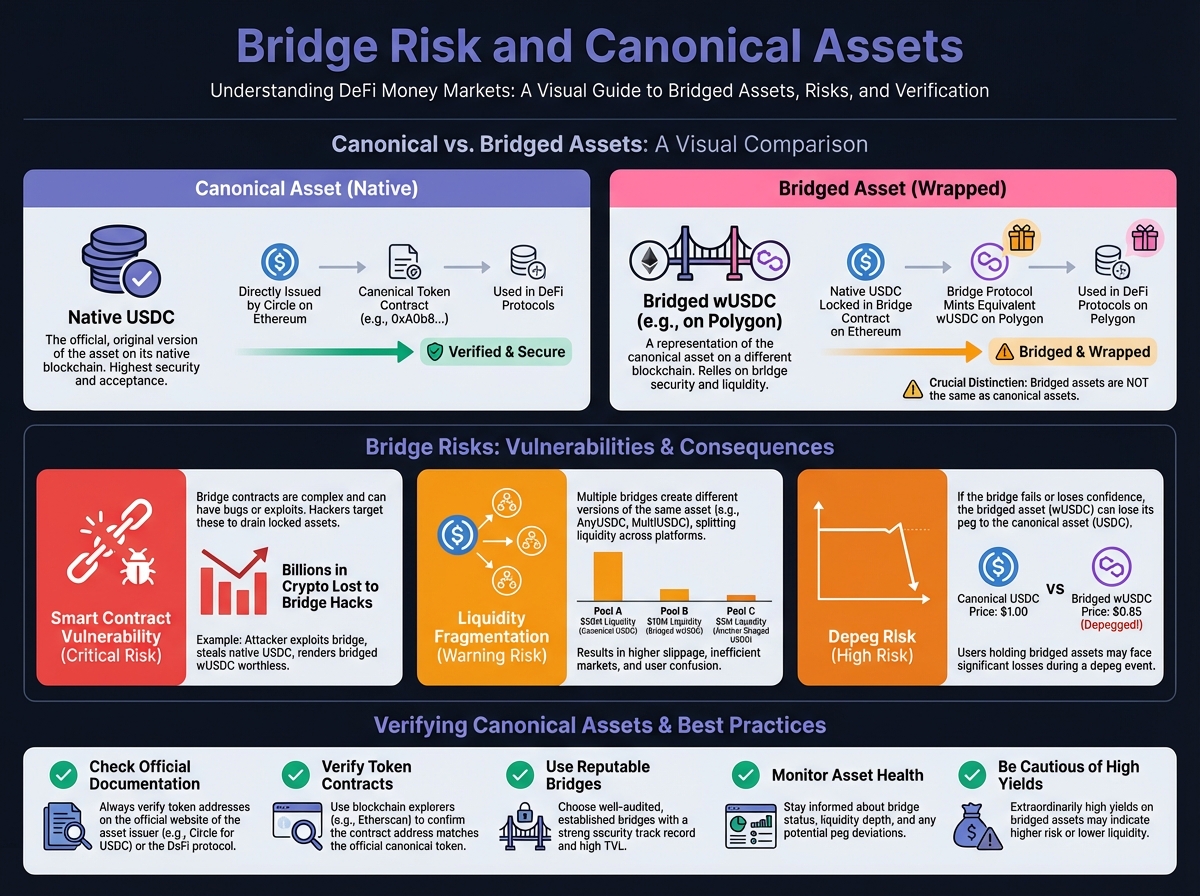

Bridge Risk

Canonical Assets

🎯 When to Use Alternative Chains

Use Solana (Kamino) For:

Use Sui (Suilend) For:

Use Tron (JustLend) For:

🚀 Getting Started on Alternative Chains

Step 1: Network Setup

Step 2: Choose Protocol

Step 3: Start Conservative

Step 4: Understand Risks

🎓 Beginner's Corner

🔬 Advanced Deep-Dive: Kamino's Efficiency

Why Hybrid Primitive Matters

📈 Real-World Example: Kamino Multiply

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 7: Euler Market Creation and Risk AnalysisNextExercise 8: Multi-Protocol Comparison and Selection

Last updated