Lesson 4: Your First Money Market Position

🎧 Lesson Podcast

🎬 Video Overview

Lesson 4: Your First Money Market Position

🎯 Core Concept: Start Simple, Start Safe

Your first money market position should be a learning experience, not a high-stakes gamble. This lesson walks you through setting up your first safe deposit, understanding the interface, and monitoring your position correctly.

The First-Time Participant Checklist

Before you deposit a single token, ensure you:

✅ Understand the basics (Lessons 1-3)

✅ Have calculated your risk tolerance

✅ Chosen a beginner-friendly protocol (Aave recommended)

✅ Have funds on Layer 2 (for lower gas costs)

✅ Know how to monitor your position

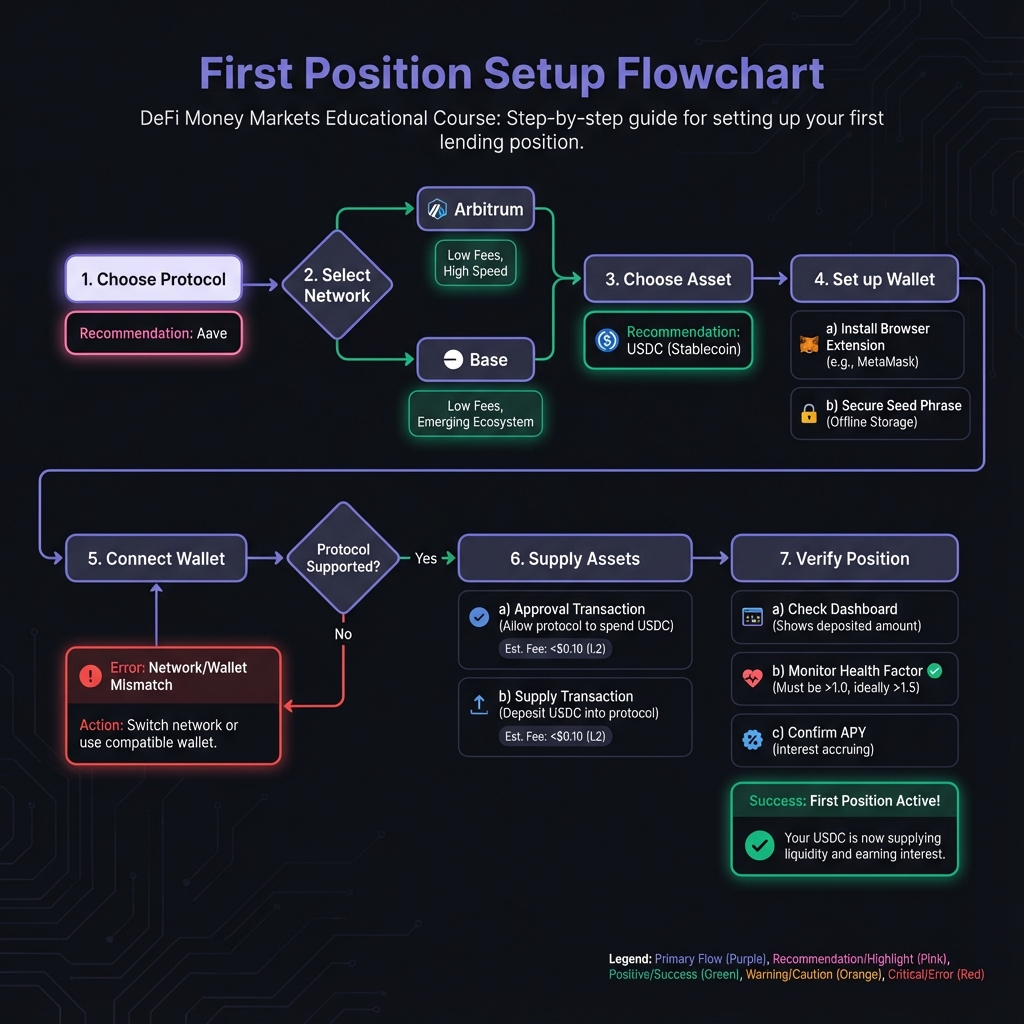

🏁 Step 1: Choose Your First Protocol

For Absolute Beginners: Start with Aave

Why Aave?

✅ Largest, most established protocol

✅ Extensive audits and safety track record

✅ Simple interface

✅ Insurance options available (Aave App)

✅ Largest liquidity pools

✅ Good documentation

Two Entry Paths:

Path A: Aave App (Recommended)

Mobile app (iOS, Android)

Insurance coverage up to $1M

Simplified interface

No gas management

Best for: Saving/earning yield only

Path B: Aave V3 dApp

Full-featured web interface

Direct protocol interaction

Can use crypto as collateral

Best for: Borrowing or advanced strategies

Alternative: Start on Layer 2

For your first position, use Arbitrum or Base:

Lower gas costs (practice without high fees)

Still large liquidity pools

Same security as mainnet

Better for learning and experimentation

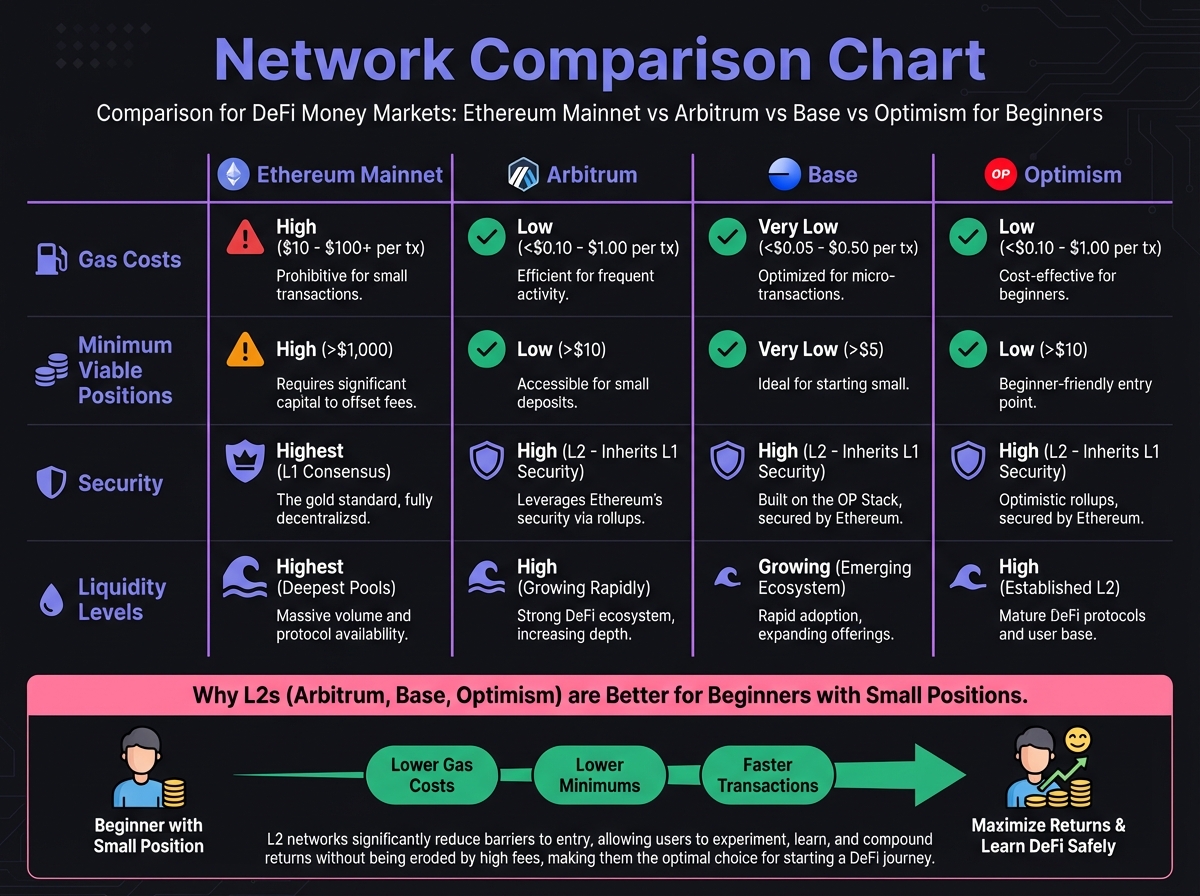

🌐 Step 2: Choose Your Network

Network Selection Guide

Ethereum Mainnet:

Gas costs: $20-100+ per transaction

Only viable for: Large positions ($10k+)

Best for: Maximum security, largest liquidity

Not recommended for first position

Arbitrum (Recommended for beginners):

Gas costs: $0.20-1.00 per transaction

Viable for: Small positions ($100+)

Security: Inherited from Ethereum

Liquidity: Very high

Best choice for learning

Base (Good alternative):

Gas costs: $0.10-0.50 per transaction

Viable for: Small positions

Security: Inherited from Ethereum

Liquidity: Growing rapidly

Good for cost-sensitive beginners

Optimism:

Gas costs: $0.15-0.80 per transaction

Viable for: Small positions

Similar to Arbitrum

Getting Funds on Layer 2

From Ethereum Mainnet:

Use official bridge: Arbitrum Bridge or Base Bridge

Bridge USDC or ETH

Wait for confirmation (usually 10-15 minutes)

Funds appear in your wallet on L2

From Centralized Exchange:

Many exchanges support direct L2 withdrawals

Withdraw USDC directly to Arbitrum/Base address

Saves bridging step

💰 Step 3: Choose Your Asset

Start with Stablecoins

For your first position, only supply stablecoins (USDC, USDT, DAI).

Why Stablecoins First?

✅ No price volatility risk

✅ Can't get liquidated (you're not borrowing)

✅ Simple: deposit and earn yield

✅ Low risk learning experience

Recommended Stablecoins:

USDC (USD Coin) - Most widely accepted

USDT (Tether) - High liquidity

DAI (Dai Stablecoin) - Decentralized alternative

What About Crypto Collateral?

Don't use crypto as collateral on your first position!

Wait until:

You understand Health Factor monitoring

You have experience monitoring positions

You understand liquidation risks

You're comfortable with volatility

Start simple: Supply USDC → Earn yield → Understand the system → Then explore borrowing later.

🔧 Step 4: Set Up Your Wallet

Wallet Options

MetaMask (Most Popular):

Browser extension

Mobile app available

Supports all networks

Good for beginners

WalletConnect-Compatible Wallets:

Rainbow

Coinbase Wallet

Trust Wallet

Works with many DeFi interfaces

Wallet Setup Checklist

Create or import wallet

Write down seed phrase (store securely!)

Never share seed phrase

Consider hardware wallet for larger amounts

Add network

Add Arbitrum network (if using Arbitrum)

Add Base network (if using Base)

Use chainlist.org for verified RPCs

Fund wallet

Send small amount of ETH for gas

Send USDC for your first deposit

Keep extra ETH for gas fees

Verify security

Check you're on correct network

Bookmark official Aave website

Be cautious of phishing sites

📱 Step 5: Make Your First Supply

Using Aave V3 dApp (Step-by-Step)

1. Connect Wallet

Go to app.aave.com

Click "Connect Wallet"

Select your wallet (MetaMask, etc.)

Approve connection

2. Select Network

Switch to Arbitrum (or your chosen L2)

Confirm network switch in wallet

Wait for interface to load

3. Navigate to Supply

Click "Supply" tab in interface

Browse available assets

Select USDC (or your chosen stablecoin)

4. Enter Amount

Enter amount you want to supply

Interface shows:

APY (annual percentage yield)

Collateral status (toggle OFF for first position)

Transaction details

5. Review Details

Check APY rate

Verify network (should be Arbitrum/Base, not Mainnet)

Ensure "Use as Collateral" is OFF (for first position)

Review gas estimate

6. Approve Token (First Time Only)

Click "Approve" button

Confirm transaction in wallet

Wait for approval confirmation

This allows Aave to access your USDC

7. Supply

Click "Supply" button

Review transaction details

Confirm in wallet

Wait for confirmation

8. Verify

Check your wallet balance (should show aUSDC tokens)

Return to Aave dashboard

See your supplied balance

Check your APY earnings

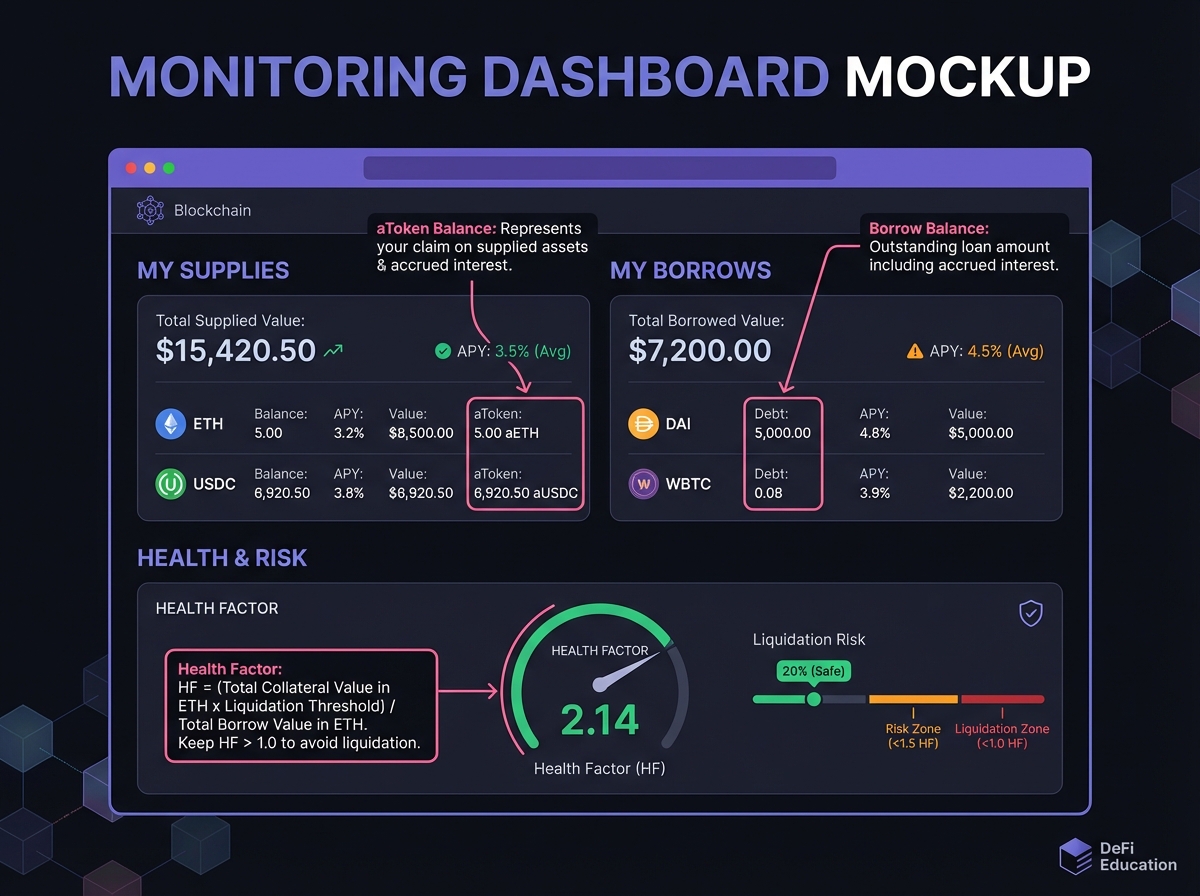

Understanding Receipt Tokens

When you supply assets, you receive receipt tokens:

Supply USDC → Receive aUSDC (aToken USDC)

These tokens represent your deposit + accrued interest

Value increases over time as interest accrues

Burn to withdraw: Burn aUSDC → Receive USDC + interest

Example:

Supply 10,000 USDC

Receive 10,000 aUSDC

After 1 year at 5% APY

aUSDC balance: ~10,500 (representing $10,500 value)

Withdraw: Burn 10,500 aUSDC → Receive 10,500 USDC

📊 Step 6: Understanding Your Dashboard

Key Metrics to Monitor

Supply Balance:

Your deposited amount

Grows over time (interest accrues)

Shows in both USDC and aUSDC terms

APY (Annual Percentage Yield):

Current yield rate

Changes based on utilization

Can fluctuate daily

Total Value:

Your position value

Includes accrued interest

Updates in real-time

Health Factor (if borrowing):

Only relevant if you have loans

For supply-only positions: N/A

Monitor if you start borrowing later

Collateral Toggle: Critical Setting

"Use as Collateral" Toggle:

OFF (Recommended for First Position):

✅ Earn yield only

✅ Zero liquidation risk

✅ Cannot borrow (which is good for beginners)

✅ Position is 100% safe from liquidation

ON (Advanced):

✅ Can borrow against collateral

❌ Exposed to liquidation risk

❌ Requires active monitoring

❌ Not recommended for first position

For Your First Position: Keep this OFF. You're just learning to earn yield. Borrowing comes later.

💡 Monitoring Your Position

Daily Checklist

Check your balance

Has your aToken balance increased?

This confirms interest is accruing

Check APY

Has the rate changed?

Understand why (utilization changes)

Review dashboard

Are there any warnings or alerts?

Is everything functioning normally?

Weekly Review

Calculate returns

Compare actual earnings to expected

Understand compounding effect

Review protocol health

Check utilization rates

Monitor for any protocol updates

Assess strategy

Are you comfortable with the risk?

Ready to explore borrowing?

Consider adding more funds?

Setting Up Alerts (Optional but Recommended)

Price Alerts:

Set on CoinGecko or CoinMarketCap

Alert if stablecoin depegs significantly

Monitor for protocol issues

Protocol Alerts:

Follow protocol Twitter/Discord

Subscribe to governance updates

Monitor security news

🎓 Beginner's Corner: Common First-Time Mistakes

Mistake 1: Supplying on Ethereum Mainnet

Why it's wrong: Gas fees can be $50-100

Fix: Use Arbitrum or Base for first positions

Mistake 2: Leaving "Use as Collateral" ON without understanding

Why it's wrong: Creates liquidation risk

Fix: Turn OFF for first position, learn borrowing later

Mistake 3: Not checking network

Why it's wrong: Might supply on wrong network

Fix: Always verify network in interface and wallet

Mistake 4: Supplying volatile crypto instead of stablecoins

Why it's wrong: Unnecessary risk for first position

Fix: Start with USDC only, learn the basics first

Mistake 5: Not monitoring position

Why it's wrong: Need to verify everything works

Fix: Check daily for first week, then weekly

Mistake 6: Approving unlimited token amounts

Why it's wrong: Security risk if protocol compromised

Fix: Approve only what you need (or use revoke.cash later)

🔬 Advanced Deep-Dive: Understanding aTokens

How aTokens Work

The Mechanism:

When you supply USDC, Aave mints aUSDC tokens

Your aUSDC balance = your deposit + interest

Interest accrues continuously (every block)

Value increases over time

The Formula: aTokenBalance=DepositAmount×(1+APY×Time)

Example:

Deposit: 10,000 USDC

APY: 5%

After 6 months: 10,000 × (1 + 0.05 × 0.5) = 10,250 aUSDC

Key Insight: You don't receive separate interest payments. The aToken itself increases in value.

Withdrawal Process

How to Withdraw:

Navigate to "Withdraw" tab

Select amount to withdraw

Click "Withdraw"

Confirm transaction

aTokens are burned, USDC returned

Important: You can withdraw anytime (if liquidity available). No lockup periods.

📈 Real-World Example: Your First $1,000 Deposit

Setup:

Deposit: $1,000 USDC

Protocol: Aave V3 on Arbitrum

APY: 5%

Position: Supply only (collateral OFF)

Month 1:

Starting balance: 1,000 aUSDC

Interest earned: ~$4.17 (5% ÷ 12 months)

Ending balance: ~1,004.17 aUSDC

Value: $1,004.17

Month 6:

Balance: ~1,025 aUSDC

Total interest: ~$25

Value: $1,025

Year 1:

Balance: ~1,050 aUSDC

Total interest: $50

Value: $1,050

Return: 5% APY

If APY Changes to 6% (utilization increases):

Your position continues earning

Rate updates automatically

No action needed

New earnings at 6% APY

Withdrawal (after 1 year):

Burn 1,050 aUSDC

Receive ~1,050 USDC

Gas cost: ~$0.50 on Arbitrum

Net profit: ~$49.50

⚠️ Important Safety Reminders

Before Your First Deposit

Verify website

Always use official Aave site

Check URL carefully

Bookmark official site

Check network

Confirm you're on correct network

Don't mix mainnet and L2 addresses

Start small

First deposit: $100-500

Test the process

Verify everything works

Then scale up

Keep records

Screenshot transaction hashes

Record your aToken balance

Track your earnings

After Your First Deposit

Verify in wallet

Check you received aTokens

Verify balance is correct

Check dashboard

Position appears correctly

APY is as expected

No error messages

Test withdrawal (after a few days)

Withdraw small amount

Verify process works

Confirm funds return correctly

🔑 Key Takeaways

Start with Aave on Arbitrum/Base for lowest risk and gas costs

Supply stablecoins only (USDC) for your first position

Keep collateral OFF to avoid any liquidation risk

Start small ($100-500) to learn the process

Monitor daily for first week to ensure everything works

Understand aTokens - they represent your deposit + interest

Test withdrawal after a few days to verify the process

🚀 Next Steps

Now that you've set up your first position, Lesson 5 will dive deep into Aave's architecture, helping you understand the protocol you're using and prepare for more advanced strategies.

Complete Exercise 4 to track your first position and build your monitoring system.

Remember: Your first position is a learning experience. Start simple, start safe, and build your knowledge gradually. Once you're comfortable with supplying, you can explore borrowing and other protocols.

← Back to Summary | Next: Exercise 4 → | Previous: Lesson 3 ←

Last updated