Lesson 3: Risk Management Fundamentals

🎧 Lesson Podcast

🎬 Video Overview

Lesson 3: Risk Management Fundamentals

🎯 Core Concept: Understanding and Mitigating Risk

Risk management is the difference between sustainable DeFi participation and catastrophic losses. This lesson teaches you to identify, assess, and mitigate the risks inherent in money markets, focusing on practical strategies that protect your capital.

The Brutal Truth

Many participants lose money in money markets not because the protocols fail, but because they misunderstand risk. Understanding liquidation mechanics, recognizing danger signals, and knowing what to avoid are essential skills for safe participation.

💸 Understanding Liquidation

What is Liquidation?

Liquidation is the forced sale of your collateral to repay your debt when your position becomes unsafe. It's triggered automatically when your Health Factor drops below 1.0.

Why Liquidations Happen

Liquidations occur when:

Collateral price drops: Your ETH collateral loses value

Debt grows: Accrued interest increases your debt

Both happen: The double whammy of falling prices and growing debt

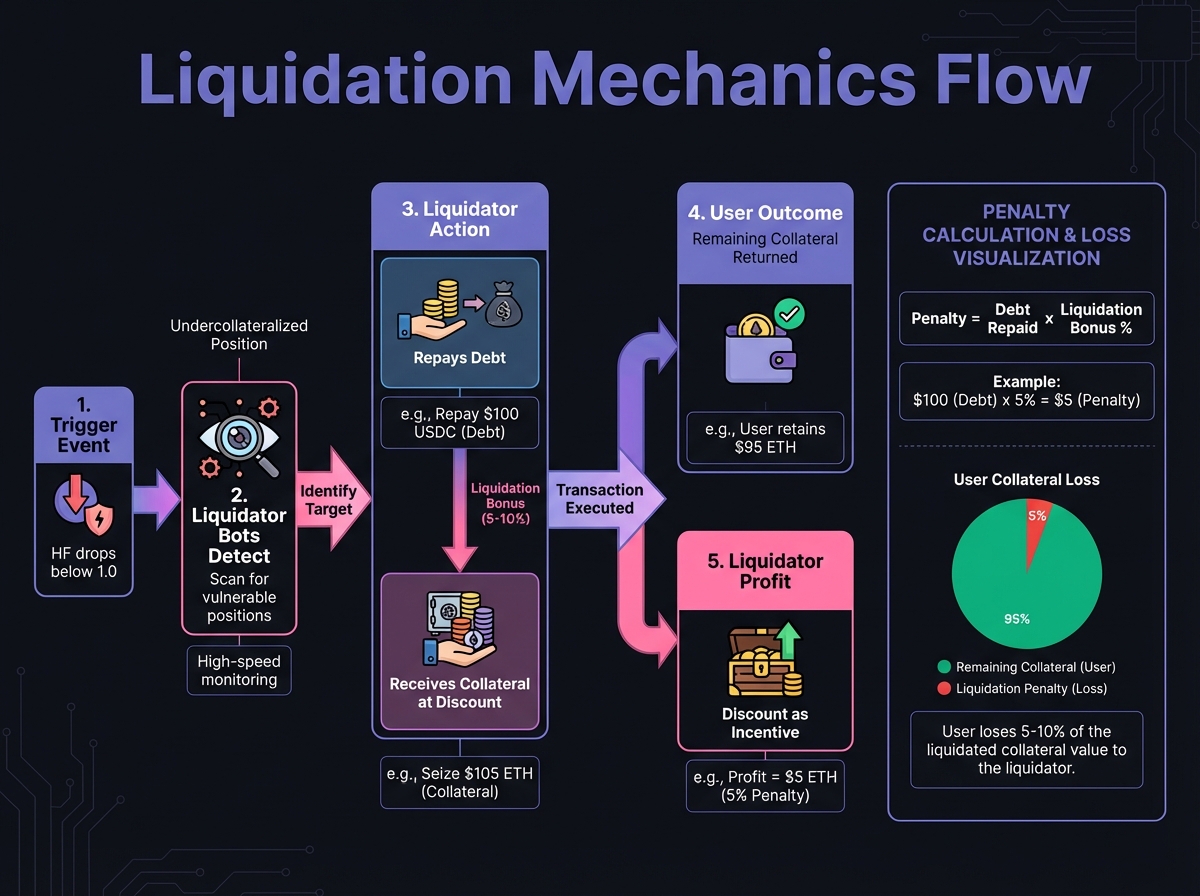

How Liquidation Works

The Process:

Your Health Factor drops below 1.0

Liquidator bots detect the unsafe position

Liquidator repays your debt (or part of it)

Liquidator receives your collateral at a discount (e.g., 5-10% bonus)

Remaining collateral (if any) returns to you

Example:

You borrowed $8,000 USDC against $10,000 ETH

ETH crashes to $8,500, HF drops below 1.0

Liquidator repays $8,000 USDC

Receives ~$8,400 worth of ETH (includes liquidation bonus)

You lose ~$1,600 (from $10,000 to $8,400)

Liquidation penalty: ~5-10% of collateral value

The Liquidation Penalty

Standard Penalties:

Most protocols: 5-10% of liquidated collateral

Some protocols: Fixed percentage (e.g., 8%)

Advanced protocols: Variable penalties based on risk

Why Penalties Exist:

Incentivize liquidators to act quickly

Cover gas costs for liquidation

Deter reckless borrowing

Protect protocol solvency

Real Impact: A 10% liquidation penalty on $10,000 collateral = $1,000 loss, even if you intended to repay the loan.

📊 Health Factor Monitoring

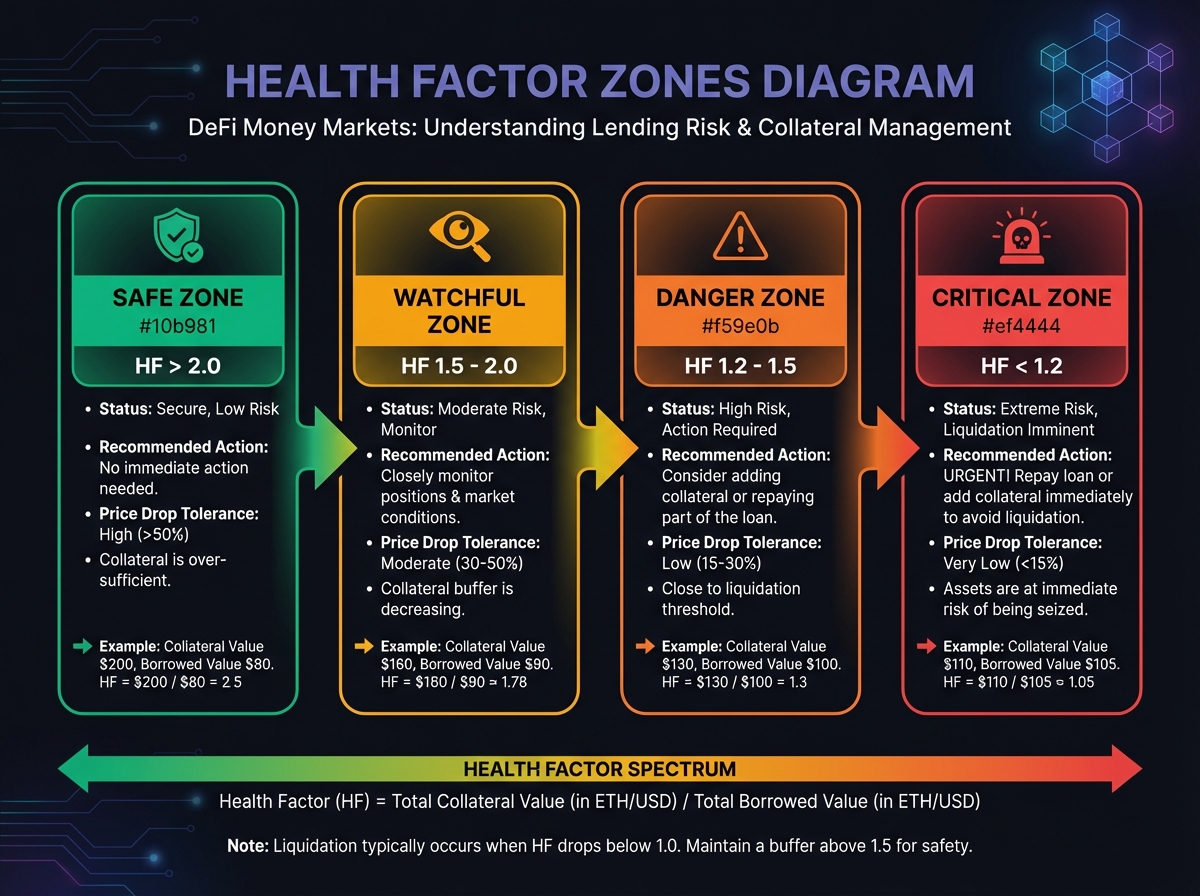

The Critical Thresholds

HF > 2.0: Safe Zone

Comfortable buffer

Can withstand significant volatility

Recommended for beginners

HF = 1.5 - 2.0: Watchful Zone

Adequate but requires monitoring

Monitor daily

Set up alerts

HF = 1.2 - 1.5: Danger Zone

High risk of liquidation

Monitor hourly

Take action immediately

HF < 1.2: Critical Zone

Liquidation likely

Emergency action required

Add collateral or repay immediately

Setting Up Monitoring

Daily Checklist:

Check Health Factor on all borrowing positions

Review collateral prices (are they dropping?)

Calculate interest accrued

Assess if action is needed

Tools:

Protocol dashboards (Aave, Morpho, etc.)

DeFi portfolio trackers (Zapper, DeBank)

Price alerts (set on CoinGecko, CoinMarketCap)

Health Factor alerts (some protocols offer this)

Automatic Protection Strategies

1. Collateral Addition

Add more collateral when HF drops

Increases buffer without repaying debt

Useful if you believe collateral will recover

2. Debt Repayment

Repay part of your loan

Reduces debt, increases HF

Permanent solution (but requires capital)

3. Emergency Exit

Repay entire loan if HF critical

Exit position completely

Locks in losses but prevents liquidation

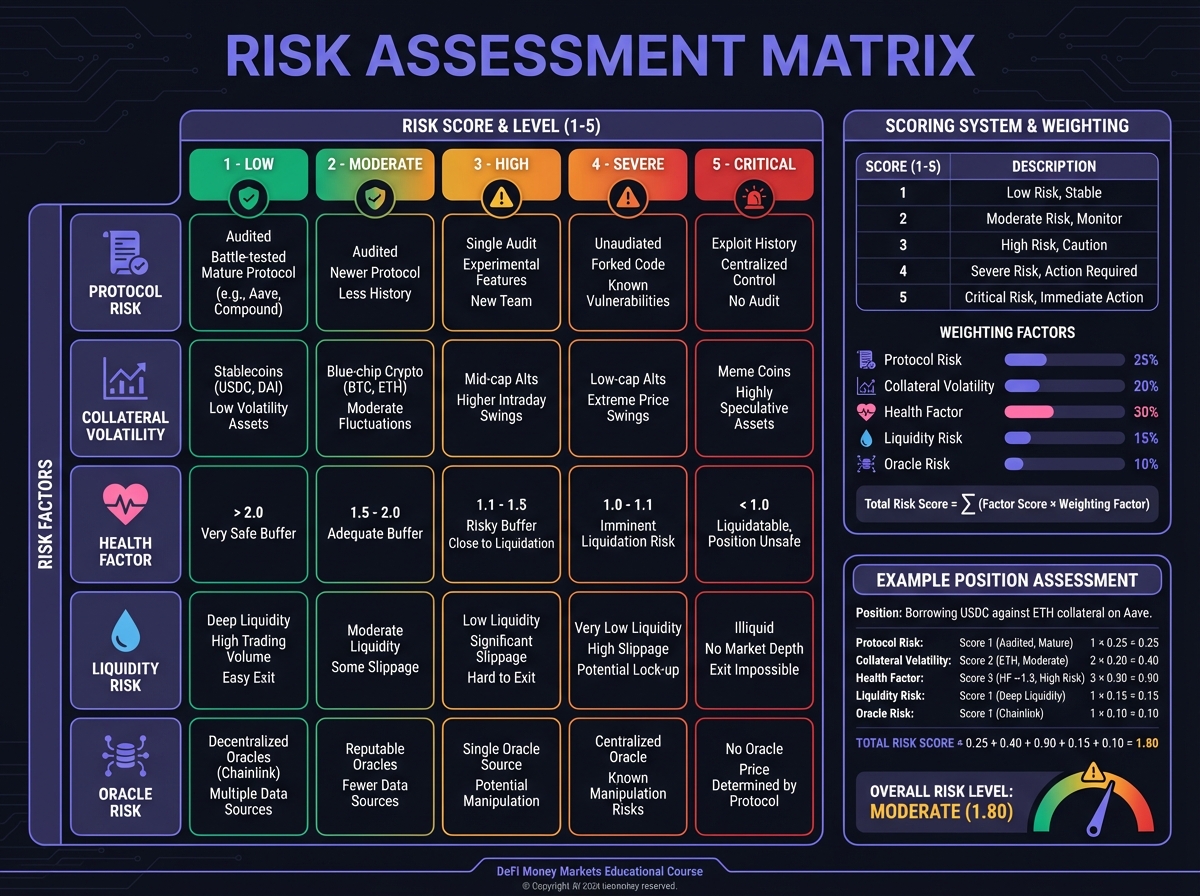

🎯 Collateral Volatility Considerations

Understanding Volatility Risk

High Volatility Assets:

Meme coins, altcoins

Volatility: 50-200%+ daily swings possible

Risk: Can crash faster than liquidators can act

Medium Volatility Assets:

Major cryptos (ETH, BTC)

Volatility: 5-20% daily swings common

Risk: Manageable with proper HF buffer

Low Volatility Assets:

Stablecoins, LSTs (staked ETH)

Volatility: 1-5% daily swings

Risk: Lowest, but still non-zero

Choosing Collateral Wisely

For Beginners: Use low-volatility collateral

Stablecoins (if protocol allows)

Liquid staking tokens (wstETH, rETH)

Major blue-chip assets (ETH, BTC)

To Avoid (as beginner):

Meme coins

New tokens without price history

Low-liquidity assets

Experimental or isolated assets

The Correlation Risk

What is Correlation?

How closely two assets move together

High correlation = similar price movements

Low correlation = independent movements

Why It Matters:

If borrowing USDC against ETH, you're betting ETH won't crash

If borrowing ETH against BTC, both could crash together

High correlation = higher risk

Example:

Borrowing USDC against ETH: Low correlation (USDC stable, ETH volatile) → Higher risk

Borrowing USDC against USDT: High correlation (both stablecoins) → Lower risk

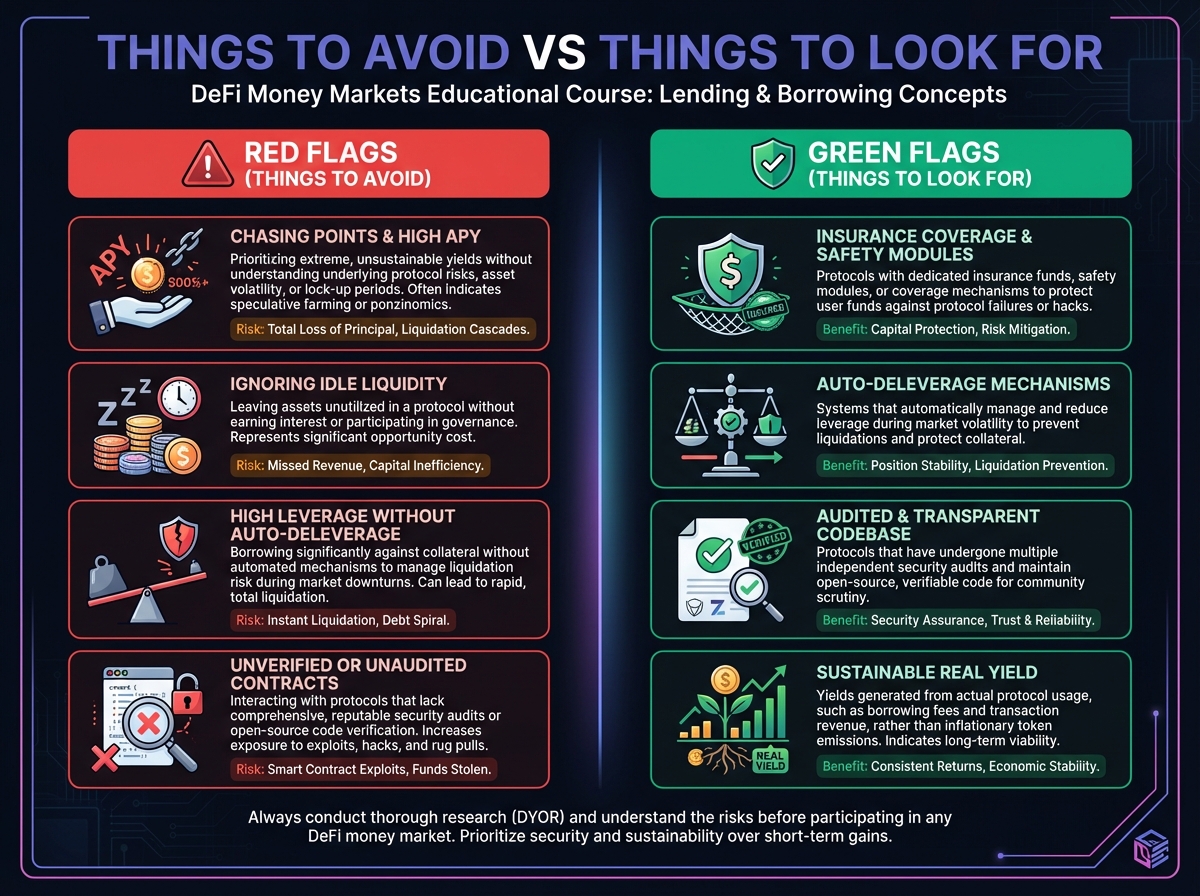

⚠️ Things to Avoid

1. Don't Chase Points into Insolvency

Many protocols use "Points" programs to incentivize liquidity. These programs reward deposits but don't protect against losses.

The Trap:

High-risk, low-liquidity vault offers 10,000 points

Points might be worth $100 (theoretical value)

If the underlying asset crashes 50%, you lose $5,000

Net result: Massive loss despite points

Rule: Never deposit into high-risk positions solely for points. Points are speculative; principal loss is real.

2. Don't Mistake "Isolated" for "Safe"

In Isolation Mode (Aave) or isolated vaults (Morpho), risk is isolated from the protocol, but not from you.

The Misconception:

"Isolated mode is safer" (for the protocol)

Reality: Your risk is actually more concentrated

Example:

You're the only lender in a niche Morpho vault

Borrower defaults on isolated market

You take the full loss—no shared insurance fund

Protocol is safe, but you're not

Lesson: Isolation protects the protocol, not individual users. Understand that isolated markets can fail completely.

3. Don't Bridge Without Gas

A classic operational error that traps assets.

The Mistake:

Bridge USDC to Sui or Solana

Forget to bridge native gas token (SUI or SOL)

Assets arrive but you can't move them

Solution: Always bridge a small amount of the native token first, or use bridges that include gas.

4. Don't Ignore "Dust" Approval Issues

When approving contracts, default wallet settings often request "Unlimited Approval."

The Risk:

Approve Aave to spend unlimited USDC

If Aave is upgraded maliciously or hacked

Attacker can drain your entire USDC balance

Solution: Use "Just-in-Time" approvals—approve only the exact amount you intend to deposit.

5. Don't Use E-Mode Without Understanding

E-Mode allows extremely high LTVs (up to 97%) for correlated assets.

The Danger:

USDC and USDT seem identical (both $1.00)

But they can depeg (e.g., USDC depegged to $0.87 in March 2023)

At 97% LTV, a 3% depeg = instant liquidation

For Beginners: Avoid E-Mode until you fully understand correlation risk and depeg scenarios.

6. Don't Ignore Idle Liquidity

On Morpho/Euler vaults, check "Idle Liquidity" before depositing.

The Problem:

Vault has 0% idle liquidity (all funds lent out)

You try to withdraw

Transaction fails—no liquidity available

Solution: Only deposit in vaults with >10% idle liquidity for instant withdrawals.

✅ Things to Look Out For (Green Flags)

1. Consumer Protection Wrappers

The Aave App's $1M insurance policy is a game-changer.

Why It Matters:

Protects against smart contract failures

Protects against technical exploits

Provides peace of mind for retail users

Prioritize interfaces offering insurance

For Beginners: Start with insured interfaces when available.

2. Auto-Deleverage (ADL)

Protocols like Kamino and Suilend offer Auto-Deleverage mechanisms.

How It Works:

As position approaches liquidation, ADL partially unwinds

Sells just enough collateral to restore health

Avoids catastrophic total loss

Benefit: Acts as automated risk manager, preventing sudden liquidations.

3. High Idle Liquidity

Healthy vaults maintain reserves for withdrawals.

Target: >10% idle liquidity

Ensures instant withdrawals

Shows good risk management

Indicates sustainable operations

4. Canonical Assets

On L2s and alt-L1s, use canonical (official) versions of assets.

Why It Matters:

Bridge wrappers can depeg (e.g., wUSDC vs native USDC)

Fragmented liquidity reduces efficiency

Official assets are more trusted

Check: Verify you're using the official, canonical version (often listed on protocol documentation).

5. Transparent Curator Track Records

For modular protocols (Morpho, Euler), research curators before depositing.

What to Check:

Historical performance

Risk management practices

Transparency in reporting

Response to past incidents

🛡️ Safety Buffers and Position Sizing

Calculating Safety Buffers

Minimum Buffer: 20-30% above liquidation threshold

Example:

Liquidation Threshold: 85%

You borrow at 65% (20% buffer)

Collateral can drop 20% before liquidation risk

Formula for Buffer: Buffer%=CollateralValueCollateralValue−(Debt/LT)×100%

Example Calculation:

Collateral: $10,000 ETH

Debt: $6,000 USDC

LT: 85%

Buffer=$10,000$10,000−($6,000/0.85)=$10,000$10,000−$7,059=29.4%

Position Sizing Guidelines

Conservative (Beginners):

Borrow 40-50% of maximum LTV

Maintain HF > 2.0

Use stable collateral (ETH, BTC, stablecoins)

Moderate (Experienced):

Borrow 60-70% of maximum LTV

Maintain HF > 1.5

Monitor weekly

Aggressive (Advanced):

Borrow 75-80% of maximum LTV

Maintain HF > 1.3

Monitor daily or use automation

Never:

Borrow at maximum LTV

Let HF drop below 1.2

Use highly volatile collateral without extreme caution

🔄 Emergency Exit Procedures

When to Exit

Exit Immediately If:

HF drops below 1.2

Oracle failure detected

Protocol pause announced

Major exploit reported

Critical collateral depegging (e.g., stablecoin breaks peg)

How to Exit

Option 1: Repay Debt

Calculate total debt (principal + accrued interest)

Ensure you have funds available

Repay via protocol interface

Withdraw collateral

Time: Can take minutes depending on network congestion

Option 2: Add Collateral

Calculate how much collateral needed

Transfer additional collateral

Deposit to increase HF

Time: Fastest option if you have collateral available

Option 3: Partial Repayment

Repay portion of debt to restore HF > 1.5

Buy time to evaluate situation

Decide on final strategy later

Gas Considerations

During High Volatility:

Network congestion increases

Gas fees spike

Transactions may take longer

Have ETH/gas tokens ready

On Layer 2:

Lower gas costs

Faster transactions

Better for active management

Still have gas ready

🎓 Beginner's Corner: Risk Assessment Checklist

Before Opening a Position, Ask:

What's my Health Factor target?

✅ Answer: > 2.0 for beginners

What's the volatility of my collateral?

✅ Check: Historical price movements

✅ Avoid: Assets with >50% daily swings

What happens if price drops 30%?

✅ Calculate: New HF after price drop

✅ Ensure: Still above 1.5

Do I understand liquidation mechanics?

✅ Know: Penalty percentage

✅ Know: What triggers liquidation

Can I monitor this position regularly?

✅ Set up: Alerts and monitoring tools

✅ Commit: Daily/weekly checks

Do I have an exit plan?

✅ Know: How to add collateral

✅ Know: How to repay debt

✅ Have: Funds available for emergency

🔬 Advanced Deep-Dive: Liquidation Mechanics

Hard vs Soft Liquidations

Hard Liquidations (Traditional):

Liquidate entire position

Sell all collateral

Pay liquidation penalty

User loses everything

Soft Liquidations (Advanced Protocols):

Liquidate only enough to restore HF

Partial collateral sale

Smaller penalty

User keeps remaining position

Example:

Position: $10,000 collateral, $8,000 debt, HF = 1.06

Hard liquidation: Sell all $10,000, penalty $500, receive $9,500

Soft liquidation: Sell $1,000, penalty $50, keep $9,000 position with restored HF

Liquidation Incentives

Why Liquidators Exist:

Liquidators are bots/traders who monitor positions

They're incentivized by liquidation bonuses (5-10%)

They pay gas to execute liquidation

They keep the bonus as profit

The Market:

Competitive—multiple liquidators compete

Fast—liquidations happen within seconds

Automated—no human intervention needed

For You: This means you can't "beat the system." If your HF drops below 1.0, liquidation is almost instant.

📊 Real-World Risk Scenario Analysis

Scenario 1: Gradual Price Decline

Setup:

Collateral: 10 ETH @ $2,000 = $20,000

Debt: $12,000 USDC

LT: 85%

Initial HF: 1.42

ETH Drops 10% Each Week:

Week 1: ETH = $1,800

Collateral: $18,000

Debt: $12,000 + interest ≈ $12,050

HF: ($18,000 × 0.85) ÷ $12,050 = 1.27 ⚠️

Week 2: ETH = $1,620

Collateral: $16,200

Debt: $12,050 + interest ≈ $12,100

HF: ($16,200 × 0.85) ÷ $12,100 = 1.14 🚨 CRITICAL

Action Required: Must add collateral or repay debt immediately.

Scenario 2: Flash Crash

Setup: Same as Scenario 1

Flash Crash: ETH drops 40% in 1 hour

Immediate Impact:

ETH = $1,200

Collateral: $12,000

Debt: $12,000

HF: ($12,000 × 0.85) ÷ $12,000 = 0.85 💥 LIQUIDATED

Result: Position liquidated immediately. No time to react.

Lesson: Always maintain HF > 1.5 to withstand sudden moves.

Interactive Health Factor Calculator

Practice calculating your position's Health Factor and see how price drops affect your safety:

Launch Collateral Ratio Calculator →

Launch Liquidation Price Calculator →

🔑 Key Takeaways

Liquidation is real and costly—penalties are 5-10% of collateral

Health Factor is your lifeline—monitor it constantly, keep it > 2.0

Avoid dangerous practices—don't chase points, don't ignore isolated risks

Look for safety features—insurance, ADL, idle liquidity

Have an exit plan—know how to add collateral or repay debt quickly

Position size conservatively—borrow 40-50% of max, not 80%

Monitor regularly—daily checks prevent surprises

🚀 Next Steps

Now that you understand risk management, Lesson 4 will walk you through setting up your first actual position. You'll learn to choose a protocol, set up your wallet, make your first deposit, and monitor your position safely.

Complete Exercise 3 to practice risk assessment and build your risk management framework.

Remember: Risk management is not optional. Understanding liquidation, monitoring Health Factor, and avoiding dangerous practices will protect your capital. Ignore these fundamentals, and you will lose money.

← Back to Summary | Next: Exercise 3 → | Previous: Lesson 2 ←

Last updated