Lesson 12: Building Your Professional Money Market System

🎧 Lesson Podcast

🎬 Video Overview

Lesson 12: Building Your Professional Money Market System

🎯 Core Concept: Operational Excellence

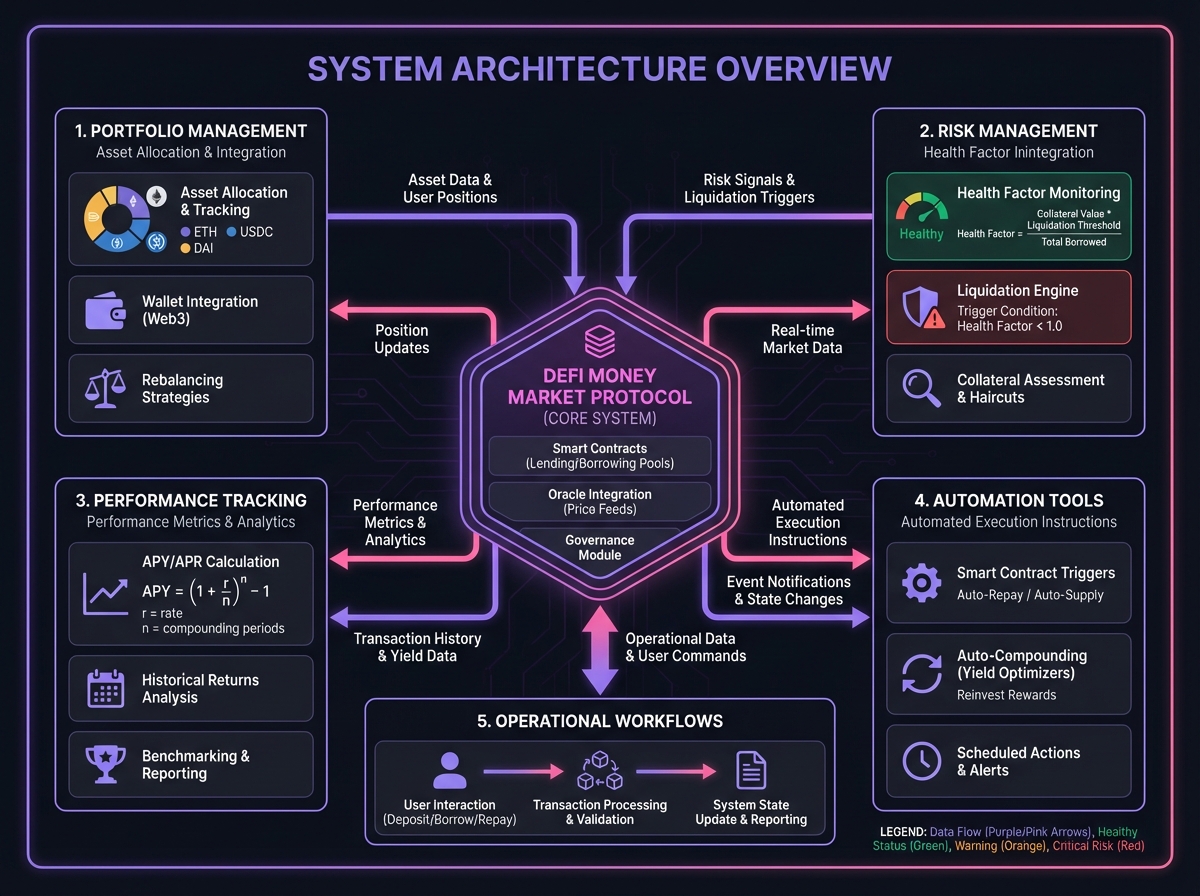

🏗️ System Architecture

Core Components

📊 Multi-Protocol Portfolio Management

Portfolio Structure

Rebalancing Framework

🔧 Automation Tools

Health Factor Monitoring

Automated Reporting

Rebalancing Automation

📈 Performance Tracking

Key Metrics

Benchmarking

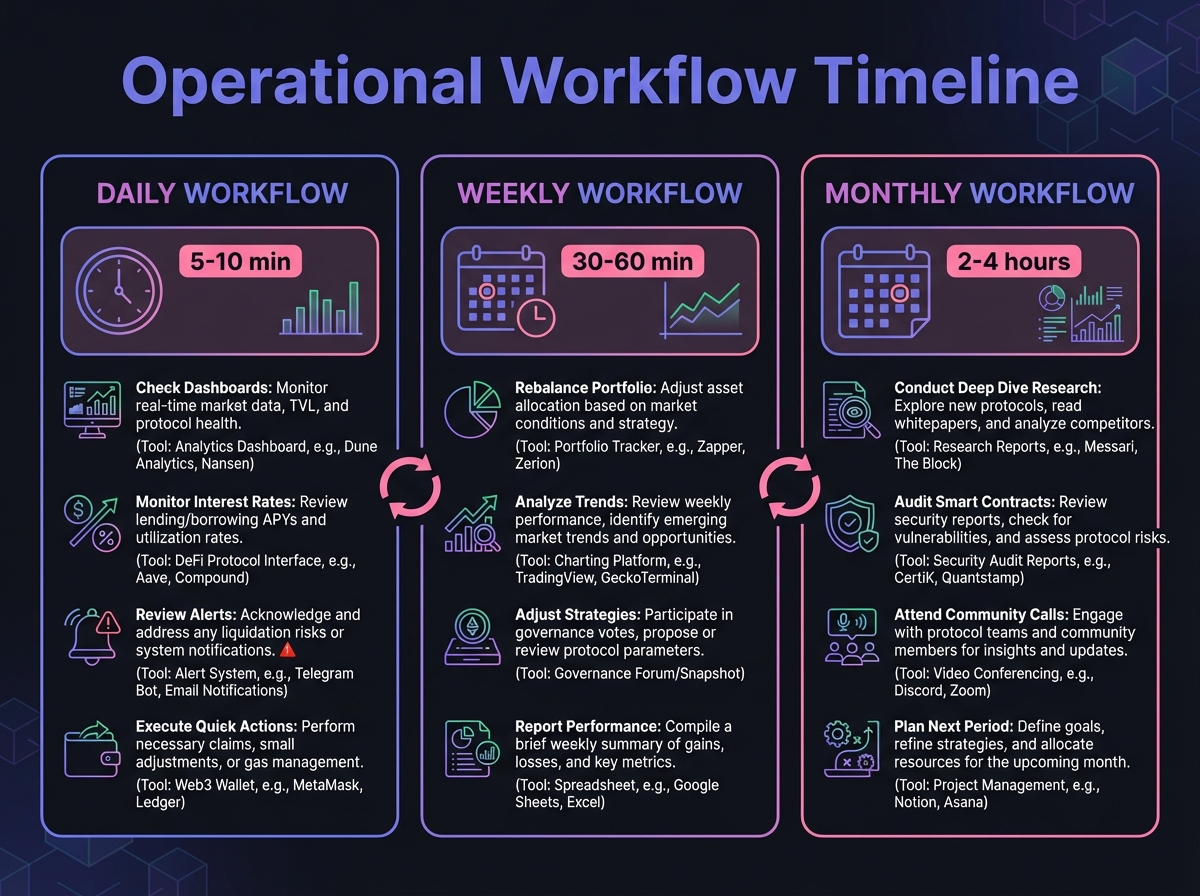

🔄 Operational Workflows

Daily Workflow (5-10 minutes)

Weekly Workflow (30-60 minutes)

Monthly Workflow (2-4 hours)

📋 Documentation System

Essential Documents

Documentation Best Practices

🎯 The Professional System Checklist

Setup Phase

Operation Phase

Optimization Phase

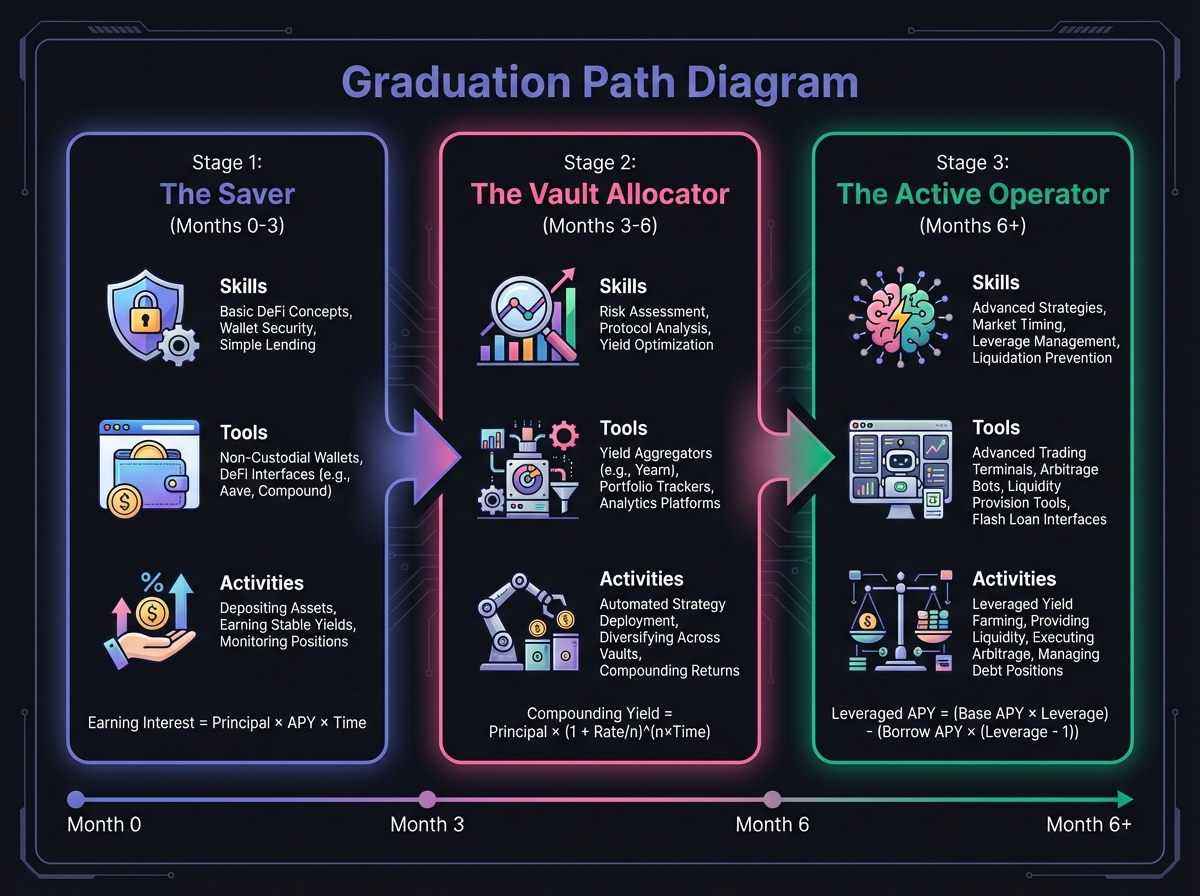

🚀 The Graduation Path

Stage 1: The Saver (Months 0-3)

Stage 2: The Vault Allocator (Months 3-6)

Stage 3: The Active Operator (Months 6+)

🎓 Final Best Practices

Do's

Don'ts

🔬 Advanced: Custom Automation Example

Python Monitoring Script (Concept)

📊 Real-World System Example

🔑 Key Takeaways

🎓 Course Completion

🚀 Final Exercise

Last updated