Lesson 9: Yield Optimization Strategies

🎧 Lesson Podcast

🎬 Video Overview

Lesson 9: Yield Optimization Strategies

🎯 Core Concept: Maximizing Returns While Managing Risk

📊 Supply Rate Maximization

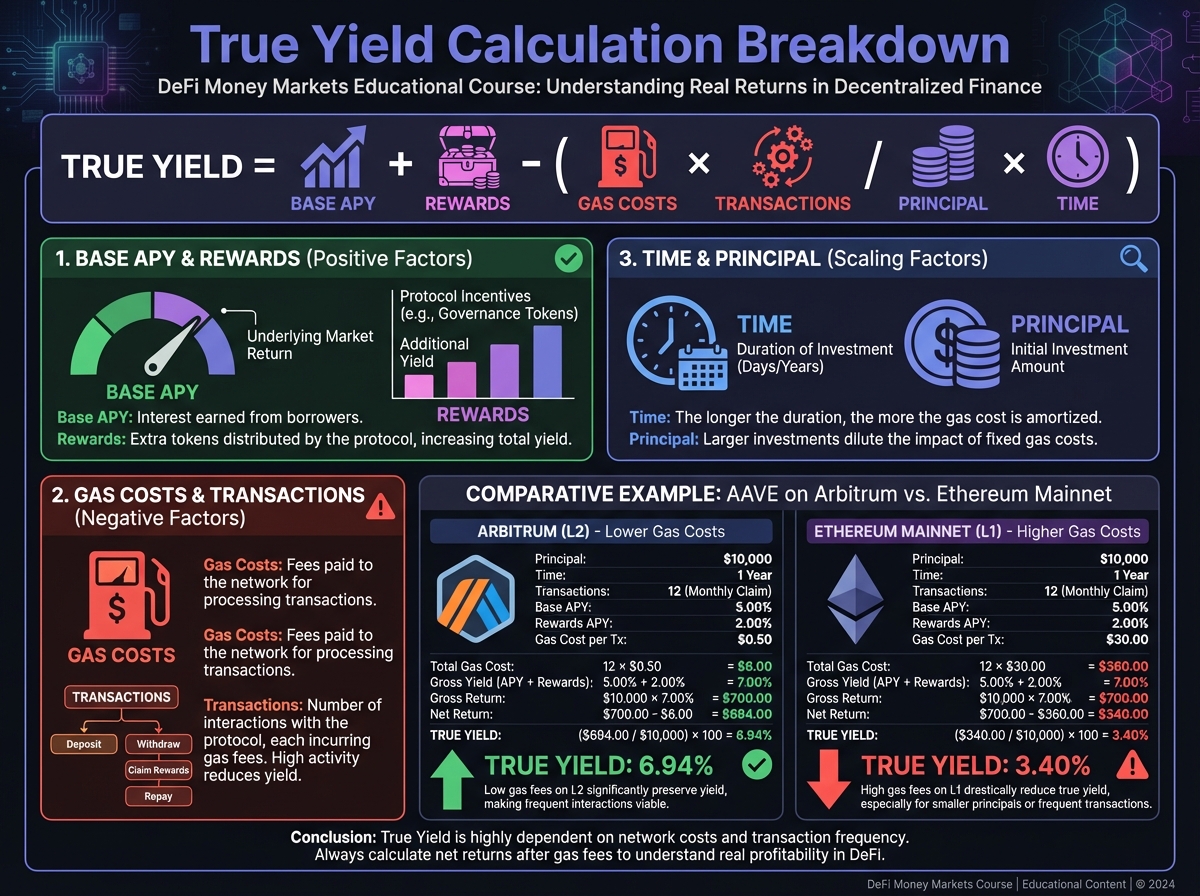

Understanding True Yield

Supply Rate Factors

💰 Borrow Rate Optimization

When Borrowing Makes Sense

Calculating Borrow Profitability

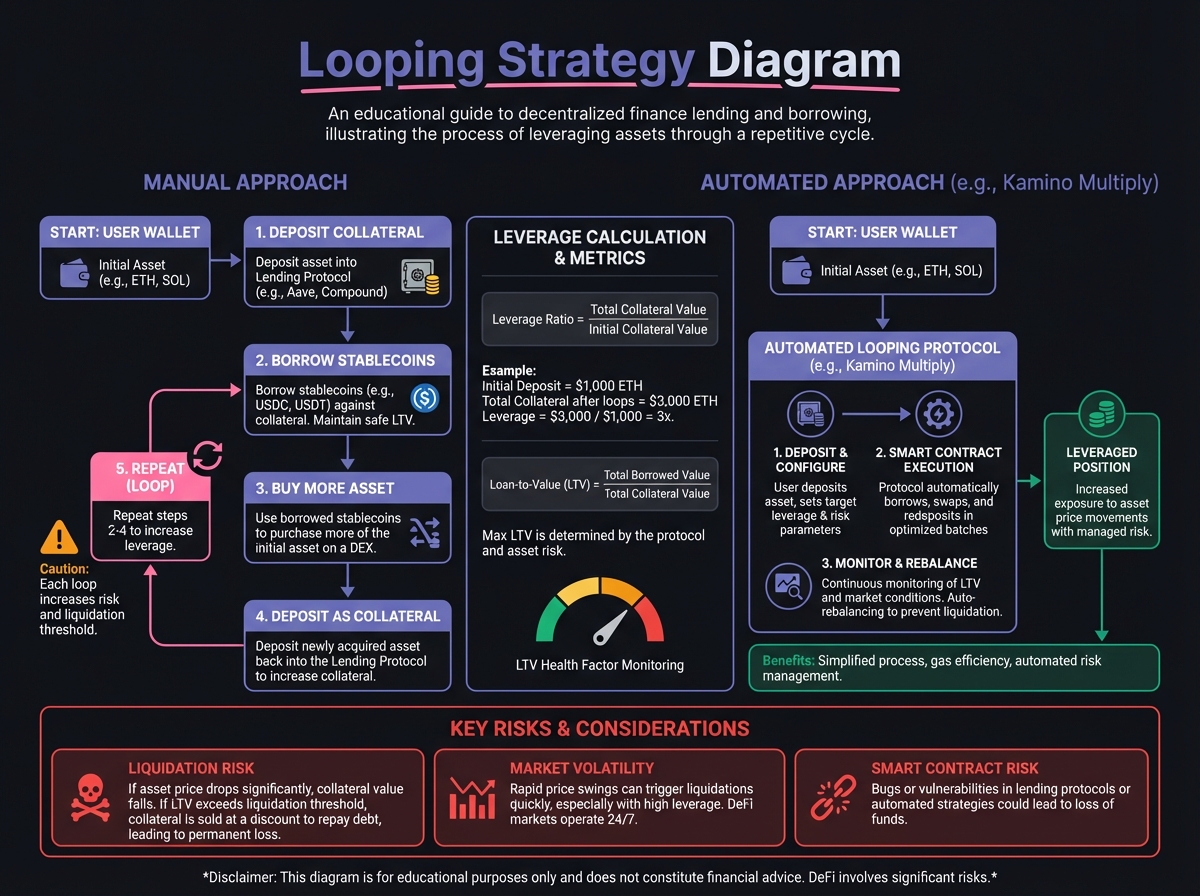

🔄 Looping Strategies

What is Looping?

Manual Looping (Step-by-Step)

Automated Looping (Kamino Multiply)

Loop Risk Management

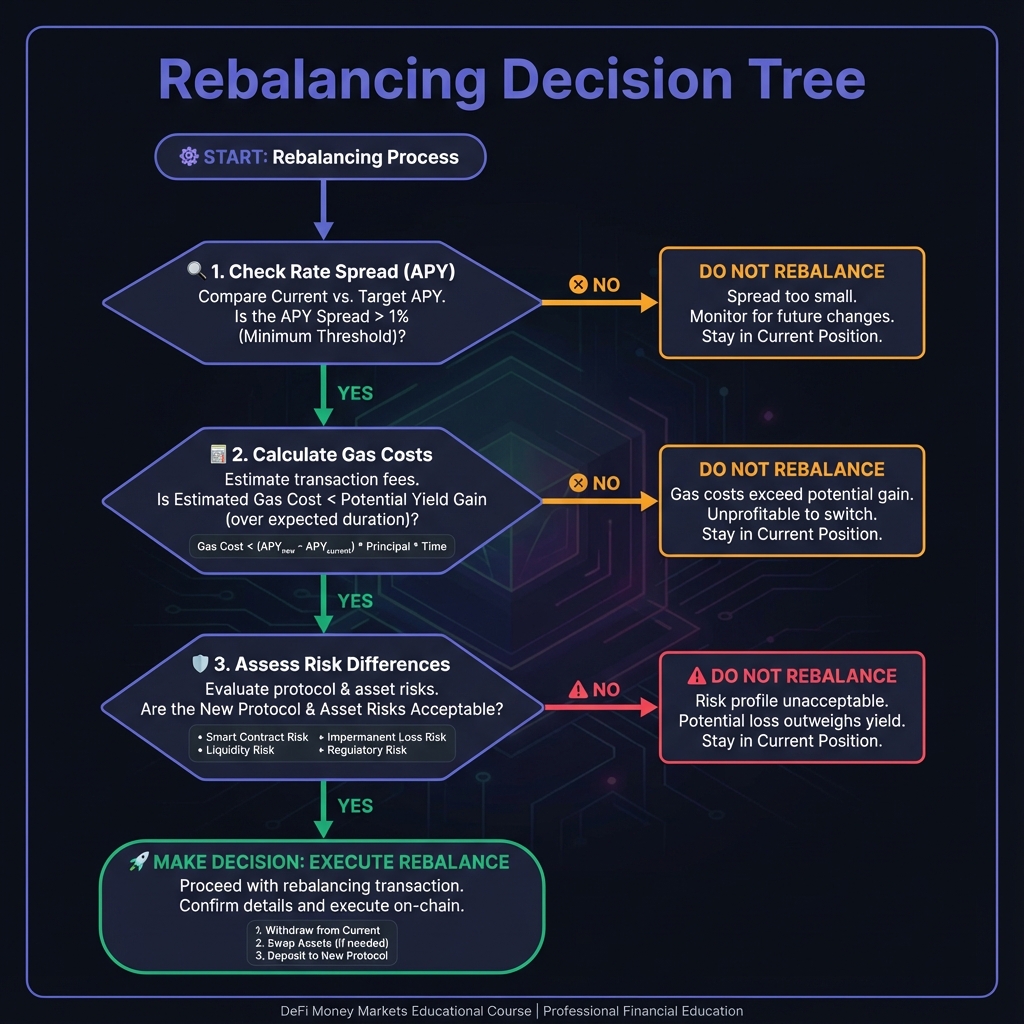

🌐 Cross-Protocol Arbitrage

Identifying Opportunities

Execution Considerations

📈 Advanced Optimization Techniques

Compound Frequency Optimization

Multi-Protocol Diversification

Yield Aggregators

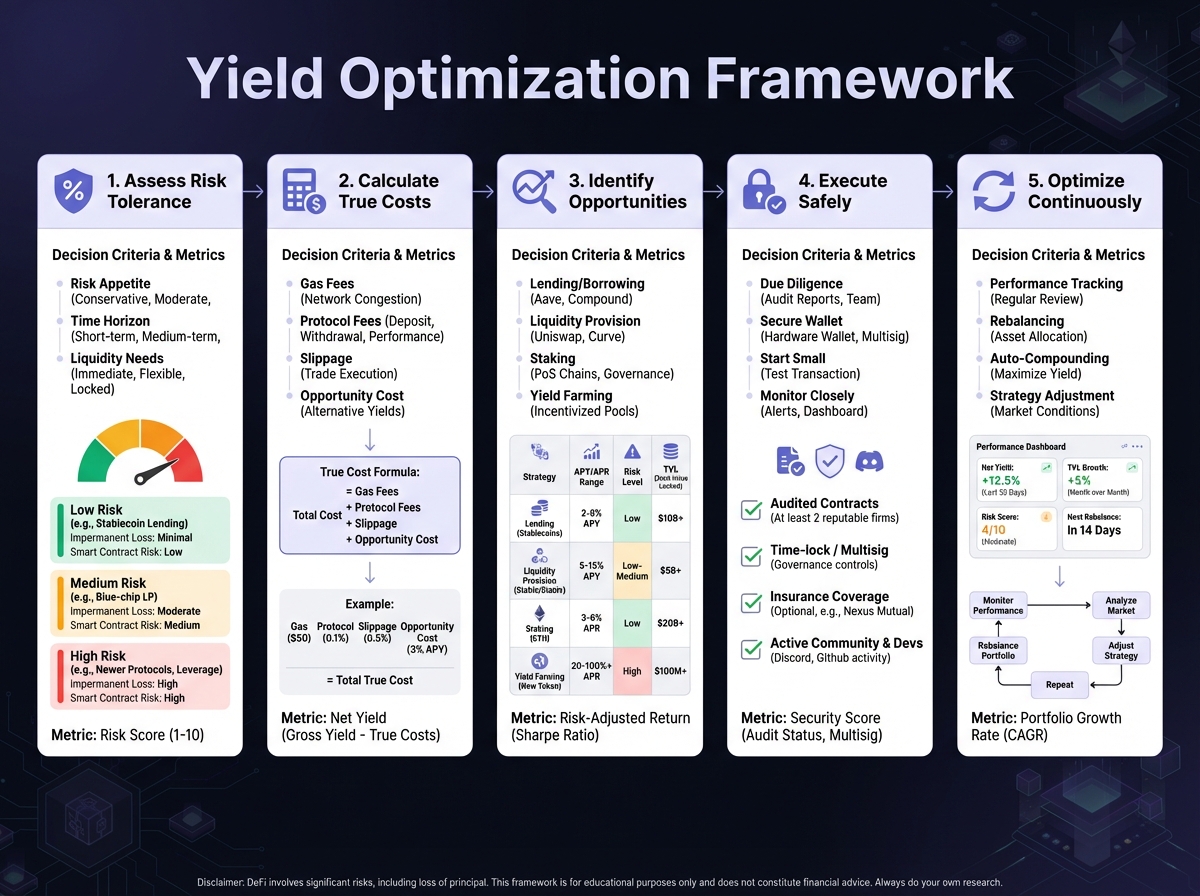

🎯 Yield Optimization Framework

Step 1: Assess Risk Tolerance

Step 2: Calculate True Costs

Step 3: Identify Opportunities

Step 4: Execute Safely

Step 5: Optimize Continuously

⚠️ Common Optimization Mistakes

📊 Real-World Optimization Example

🔧 Interactive Tools

Interactive Looping Calculator

🔑 Key Takeaways

🚀 Next Steps

Last updated