Lesson 11: Advanced Topics and Emerging Trends

🎧 Lesson Podcast

🎬 Video Overview

Lesson 11: Advanced Topics and Emerging Trends

🎯 Core Concept: The Future of Money Markets

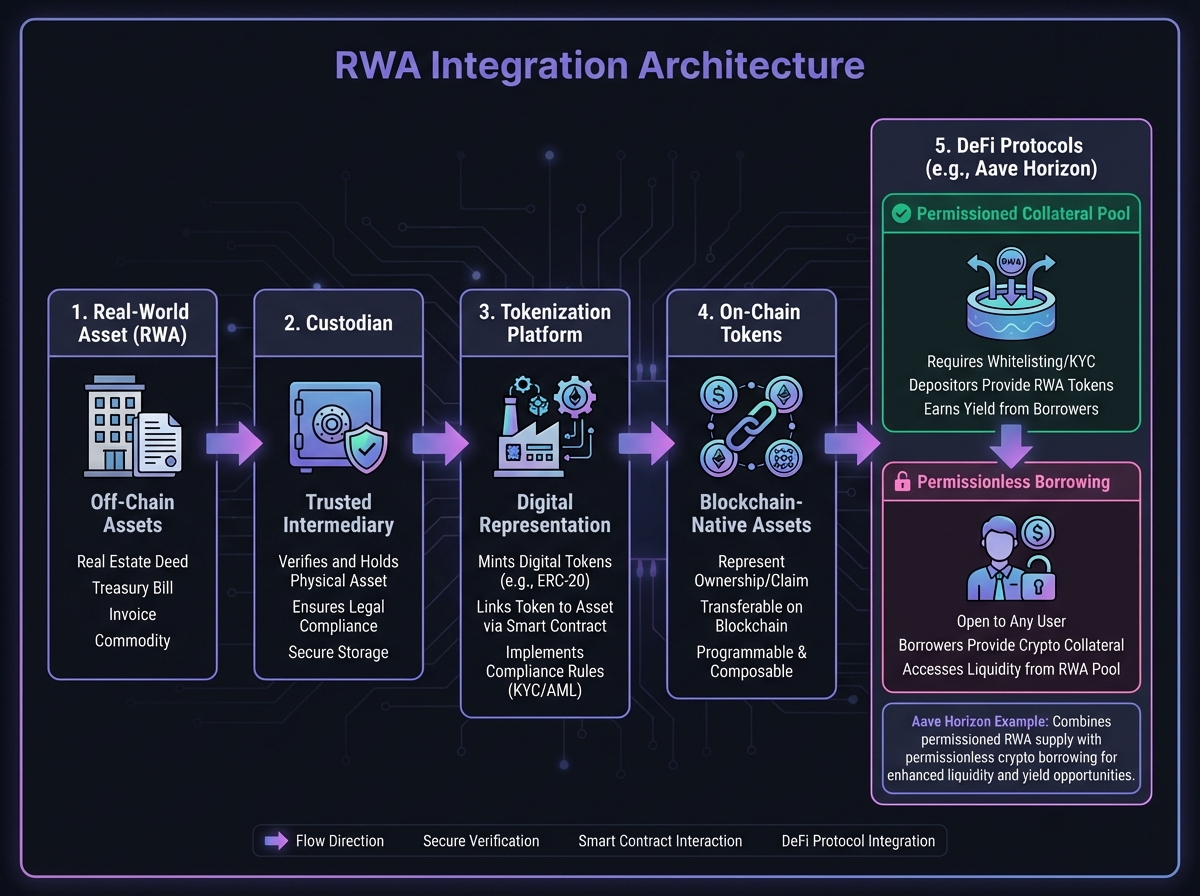

🏦 Real-World Assets (RWA) Integration

What Are RWAs?

Why RWAs Matter

RWA Integration Models

Risks and Considerations

🏛️ Institutional Adoption

The Institutional Wave

Institutional Products

Impact on Retail Users

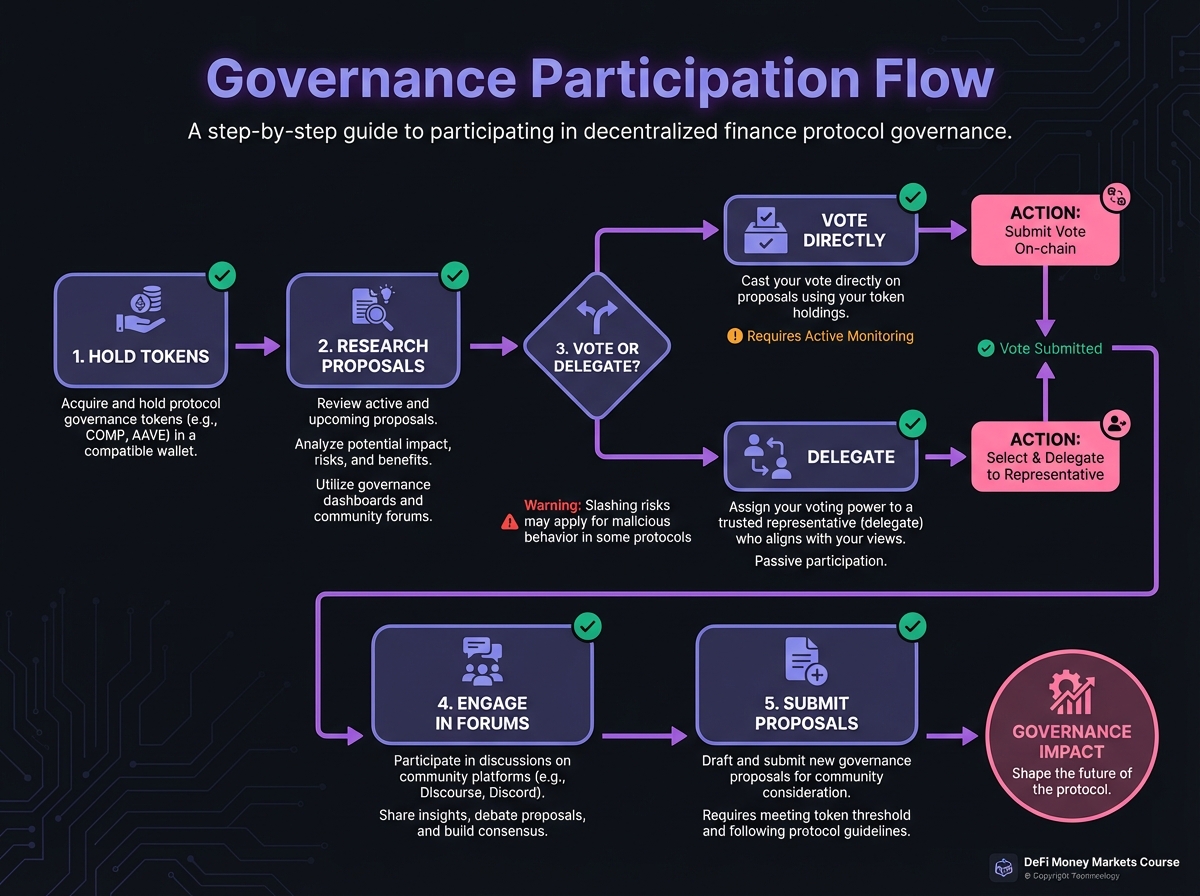

🗳️ Governance Participation

Why Governance Matters

Governance Models

Participating in Governance

Governance Risks

💰 Protocol Token Economics

Token Utility Models

Token Value Drivers

Evaluating Token Investments

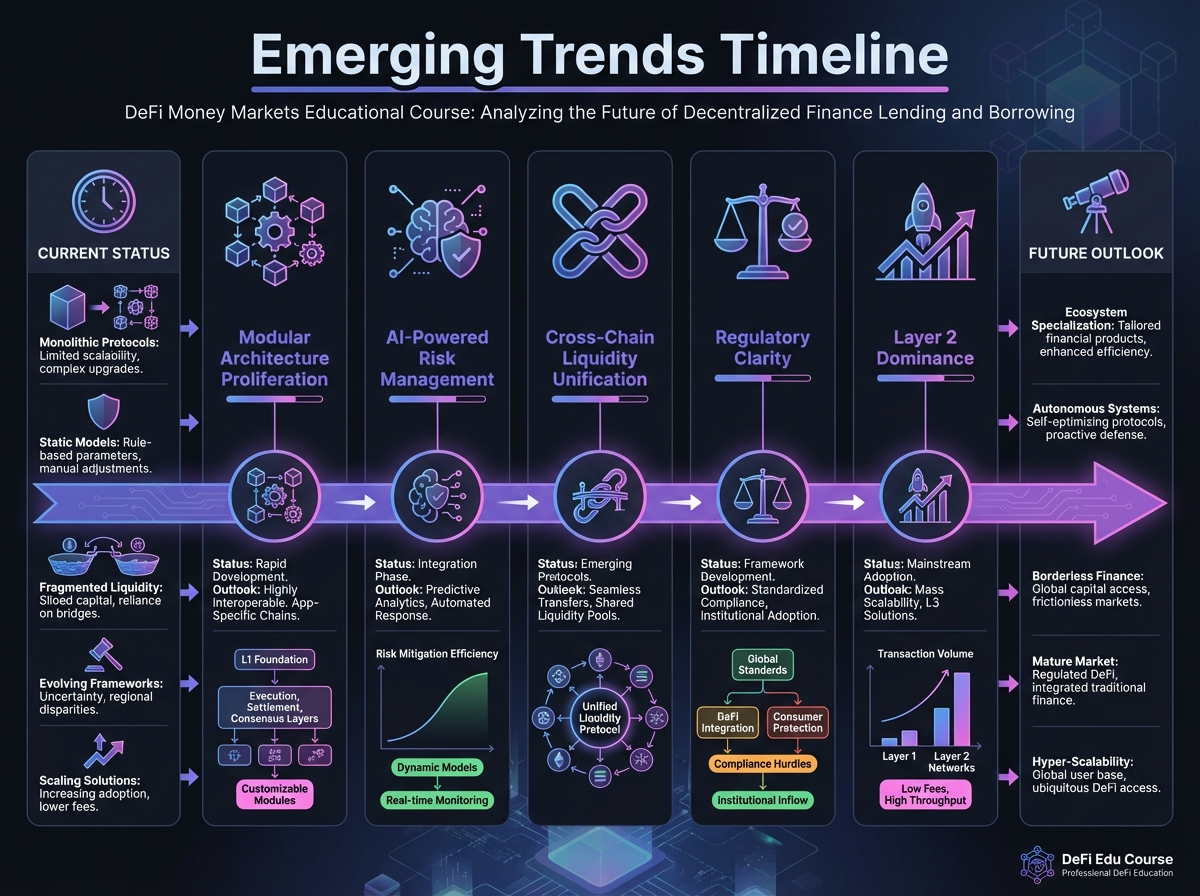

🔮 Emerging Trends

1. Modular Architecture Proliferation

2. AI-Powered Risk Management

3. Cross-Chain Liquidity Unification

4. Regulatory Clarity

5. Layer 2 Dominance

📊 Future Outlook

Short-Term (1-2 Years)

Medium-Term (3-5 Years)

Long-Term (5+ Years)

⚠️ Risks and Challenges

Technical Risks

Economic Risks

Regulatory Risks

Systemic Risks

🎯 Strategic Positioning

For Retail Users

For Institutional Users

🎓 Beginner's Corner

🔬 Advanced Deep-Dive: RWA Tokenization

Technical Architecture

Risk Layers

📈 Real-World Example: RWA Impact

🔑 Key Takeaways

🚀 Next Steps

Last updated