Lesson 6: Morpho - Modular Lending Infrastructure

🎧 Lesson Podcast

🎬 Video Overview

Lesson 6: Morpho - Modular Lending Infrastructure

🎯 Core Concept: From Optimizer to Infrastructure

📈 Evolution: Optimizer to Blue

Phase I: The Morpho Optimizer

Phase II: Morpho Blue (V2)

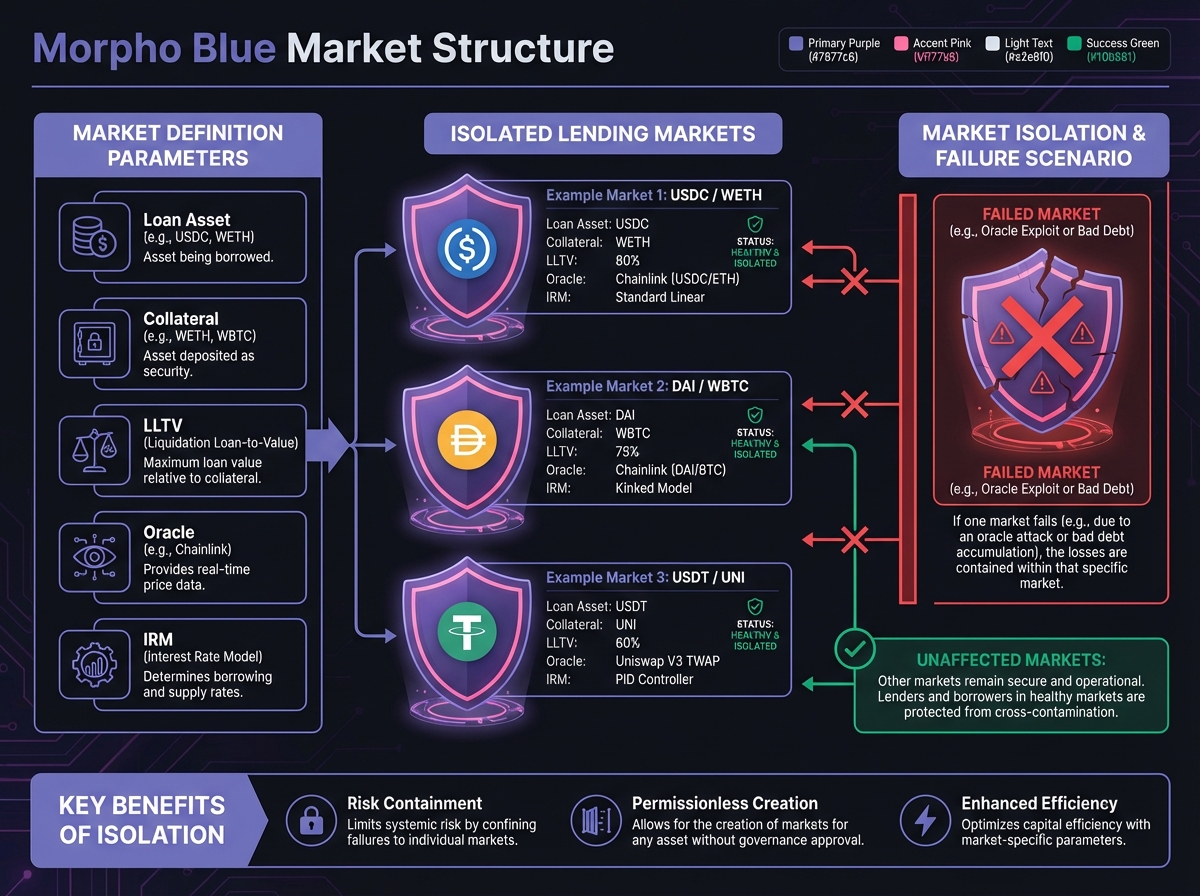

🏗️ Morpho Blue Architecture

The Singleton Contract

Isolated Lending Markets

Oracle Agnosticism

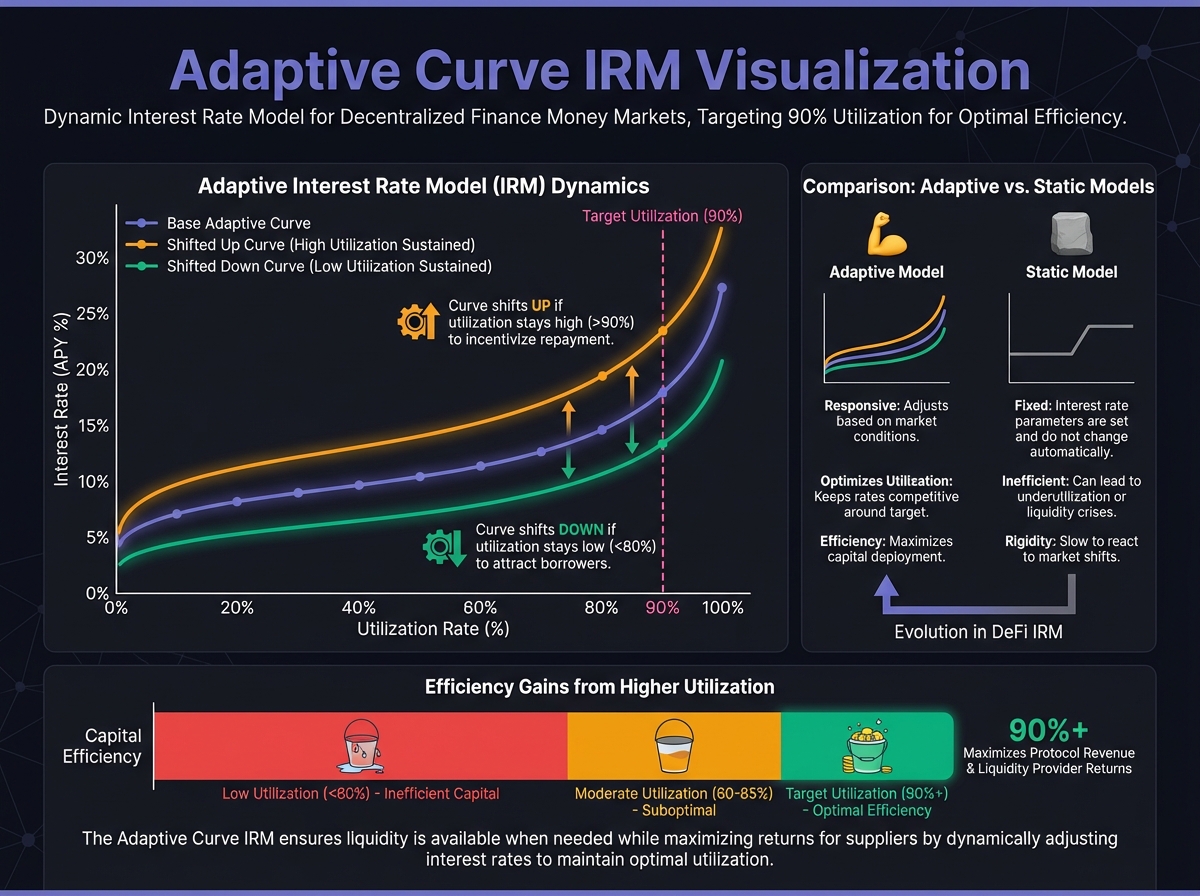

Adaptive Curve IRM

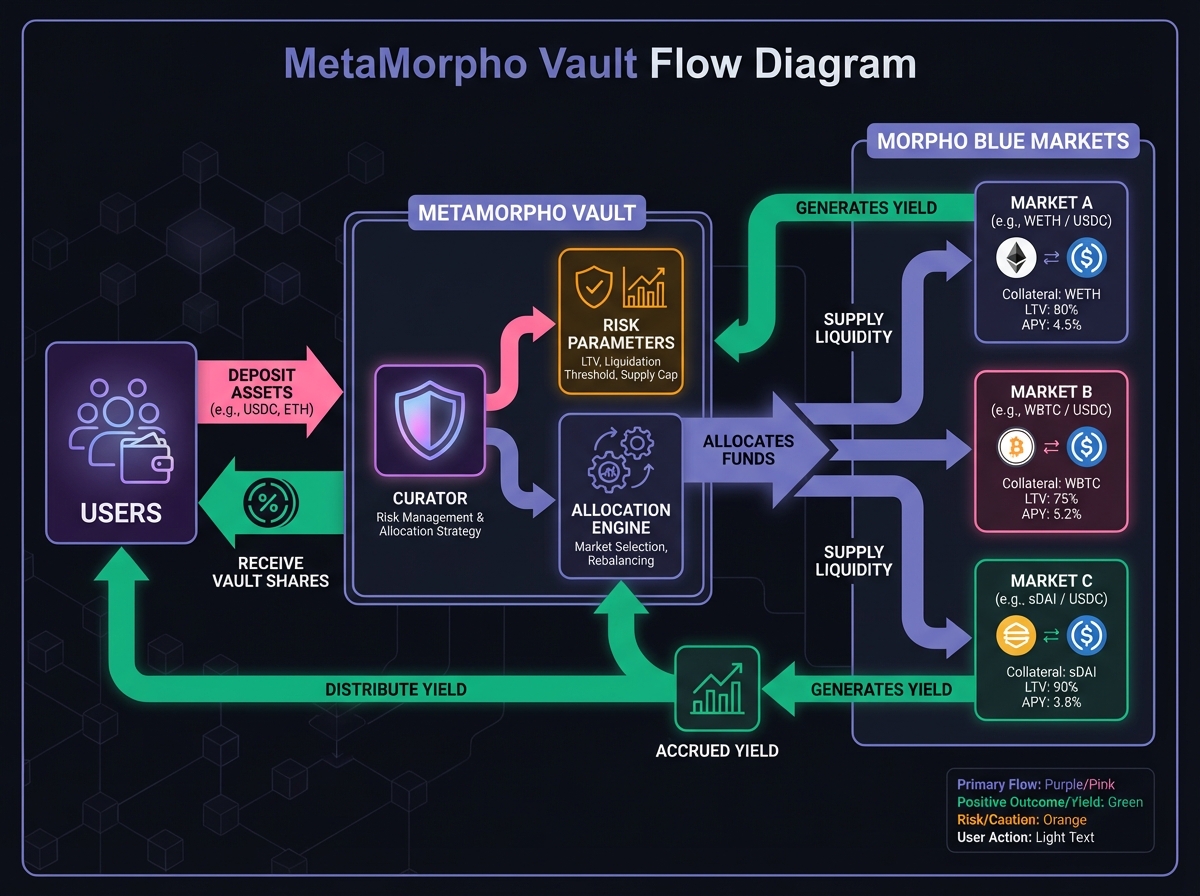

📦 MetaMorpho Vaults: The Curation Layer

The User Experience Problem

How Vaults Work

The Curator Economy

Vault Selection Criteria

💧 Risk Isolation & Bad Debt

Market-Level Isolation

Unrealized Bad Debt Tracking

⚠️ Operational Considerations

Idle Liquidity Risk

Curator Risk

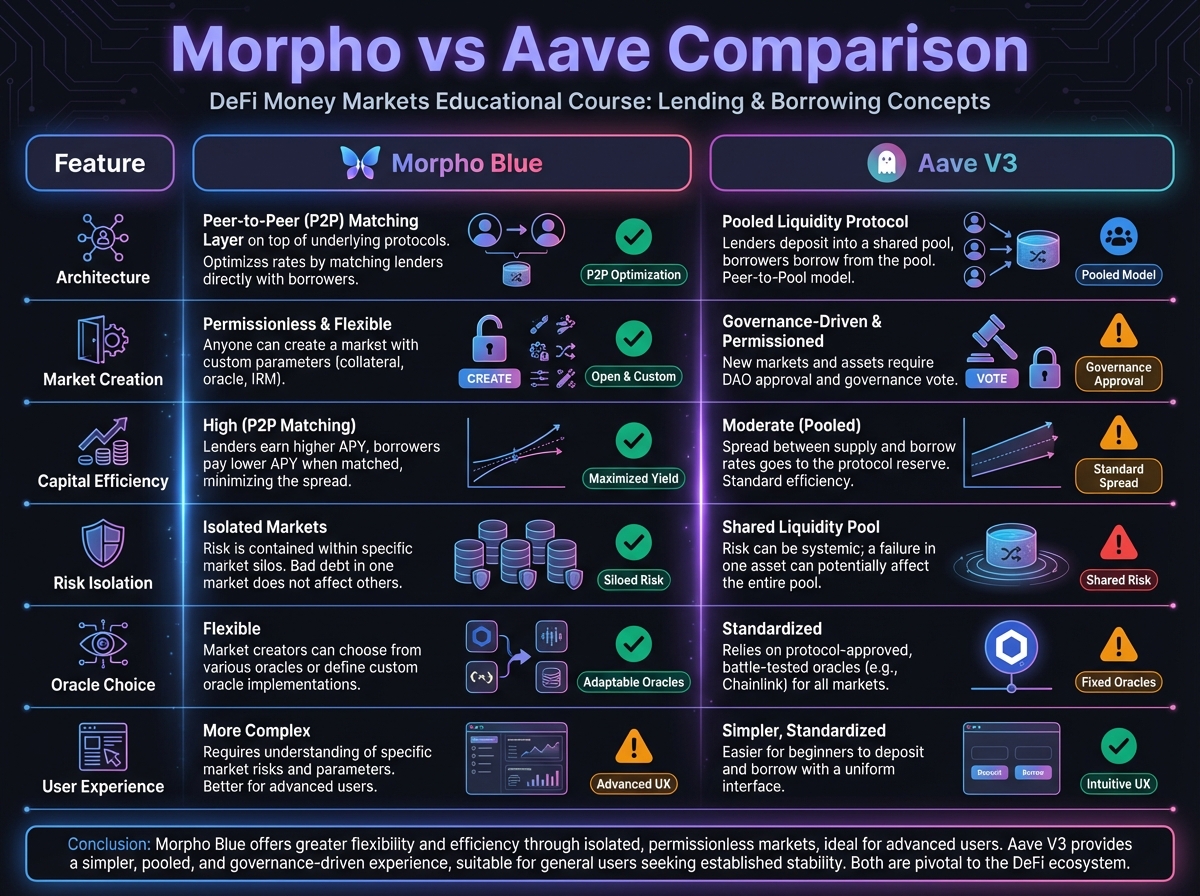

📊 Comparing Morpho vs Aave

Feature

Aave V3

Morpho Blue

🎯 When to Use Morpho

Best For:

Not Ideal For:

🚀 Getting Started with Morpho

Step 1: Choose a Vault

Step 2: Due Diligence

Step 3: Deposit

Step 4: Monitor

🎓 Beginner's Corner

🔬 Advanced Deep-Dive: Efficiency Gains

Why Morpho Achieves Higher Utilization

📈 Real-World Example

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 5: Aave Position Setup and OptimizationNextExercise 6: Morpho Market Analysis and Selection

Last updated