Exercise 1: Perpetual Futures Knowledge Assessment

⏰ Time Investment: 30-45 minutes 🎯 Goal: Test your understanding of perpetual futures fundamentals and identify knowledge gaps

📚 Required Reading Integration 📖 Primary: Lesson 1: Understanding Perpetual Futures Fundamentals 📖 Supporting: Lesson 2: The Mathematics of Perpetual Trading

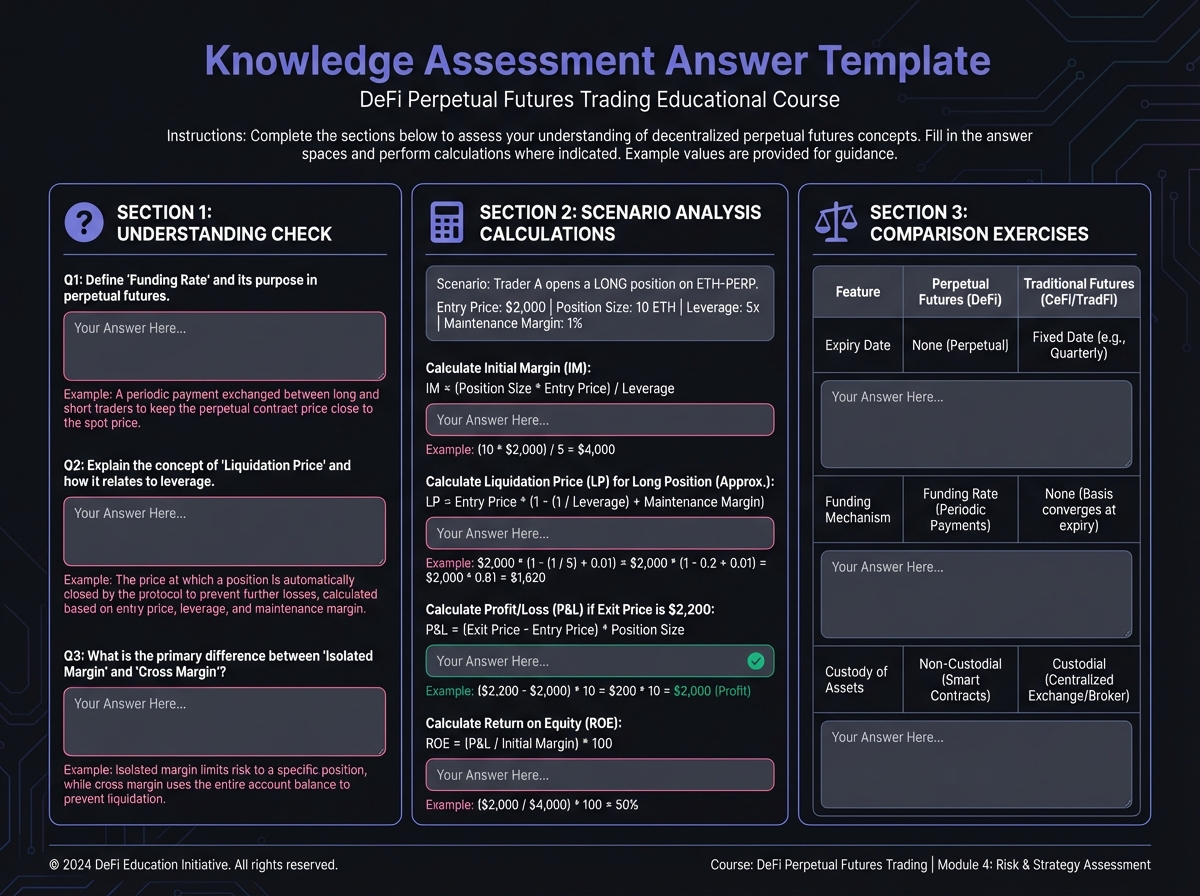

🔍 Phase 1: Knowledge Check (10 minutes)

Understanding Check

Answer these questions to assess your comprehension:

1. What is the fundamental difference between perpetual futures and traditional futures?

Your answer: _________________________________

2. How do funding rates keep perpetual prices aligned with spot prices?

Your answer: _________________________________

3. What happens when funding rate is positive and you're holding a long position?

Your answer: _________________________________

4. What is the difference between isolated margin and cross margin?

Your answer: _________________________________

5. Why can perpetual futures exist without expiration dates?

Your answer: _________________________________

📊 Phase 2: Scenario Analysis (15 minutes)

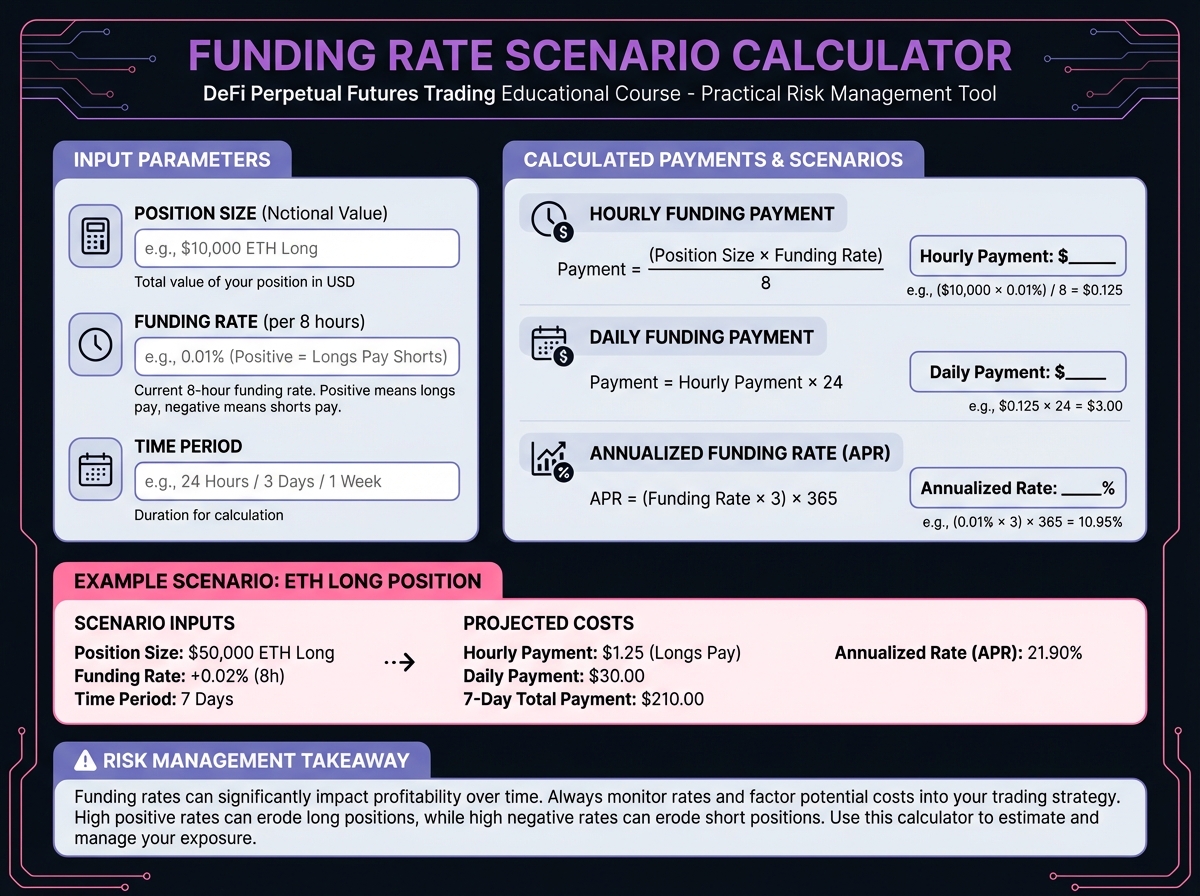

Funding Rate Scenario

Scenario: You're considering a long ETH perpetual position.

Market Conditions:

ETH Spot Price: $2,500

ETH Perpetual Price: $2,550

Funding Rate: 0.02% per hour (positive)

Your Position: $10,000 notional (5x leverage on $2,000 margin)

Exercise 1: Calculate the funding cost:

Hourly payment: $_______

Daily payment (24 hours): $_______

Annualized rate: _______%

Exercise 2: If ETH price stays flat at $2,500 for 7 days, what is your net P&L?

Funding paid over 7 days: $_______

Price movement: $_______

Net P&L: $_______

ROI: _______%

Exercise 3: What does this tell you about the importance of funding rates?

Your answer: _________________________________

Leverage Scenario

Scenario: You want to open a position with different leverage levels.

Setup:

Available Margin: $1,000

Entry Price: $2,500

Maintenance Margin: 0.5%

Exercise 4: Calculate position size and liquidation price for each leverage:

2x

$_______

$_______

_______%

5x

$_______

$_______

_______%

10x

$_______

$_______

_______%

Exercise 5: Which leverage would you choose for your first trade and why?

Your choice: _______

Reasoning: _________________________________

💡 Phase 3: Risk Identification (10 minutes)

Common Mistakes Exercise

Identify the mistake in each scenario:

Scenario 1: Trader opens 20x long position on ETH, thinking "I'm safe until price drops 5%."

The Mistake: _________________________________

Why It's Wrong: _________________________________

Scenario 2: Trader holds long position for 30 days, pays 0.01% per hour funding, says "funding is negligible."

The Mistake: _________________________________

Why It's Wrong: _________________________________

Scenario 3: Trader uses cross margin for first trade, opens long BTC and long ETH, both get liquidated when market crashes.

The Mistake: _________________________________

Why It's Wrong: _________________________________

📝 Phase 4: Key Concepts Review (10 minutes)

Fill in the Blanks

1. Perpetual futures use _______________ to keep prices aligned with spot, instead of expiration dates.

2. When perpetual price is above spot price, _______________ positions pay _______________ positions.

3. With _______________ margin, your maximum loss is limited to the margin you allocate to that position.

4. _______________ amplifies both profits and losses, making liquidation risk higher.

5. The _______________ is the price at which your position will be automatically closed by the protocol.

True or False

1. Perpetual futures never expire. (True / False)

2. Funding rates are always paid by long positions. (True / False)

3. Higher leverage always means higher profits. (True / False)

4. Isolated margin is safer than cross margin for beginners. (True / False)

5. You can lose more than your margin with isolated margin. (True / False)

✅ Self-Assessment

Rate your understanding (1 = Need more review, 5 = Fully understand):

Areas needing more review: _________________________________

🎯 Next Steps

If you scored < 4 on any topic:

Review Lesson 1 material on that topic

Re-read the Beginner's Corner sections

Practice calculations from Lesson 2

Look up additional resources on unclear concepts

If all topics ≥ 4:

Proceed to Exercise 2 (Calculation Practice)

Move forward with confidence!

Last updated