Exercise 2: Calculation Practice and Risk Metrics

🔢 Phase 1: Funding Rate Calculations (15 minutes)

Exercise 1: Basic Funding Payment

Exercise 2: Funding Cost Comparison

Funding Rate

Hourly

Daily (24h)

Weekly

Annualized

Exercise 3: Break-Even Analysis

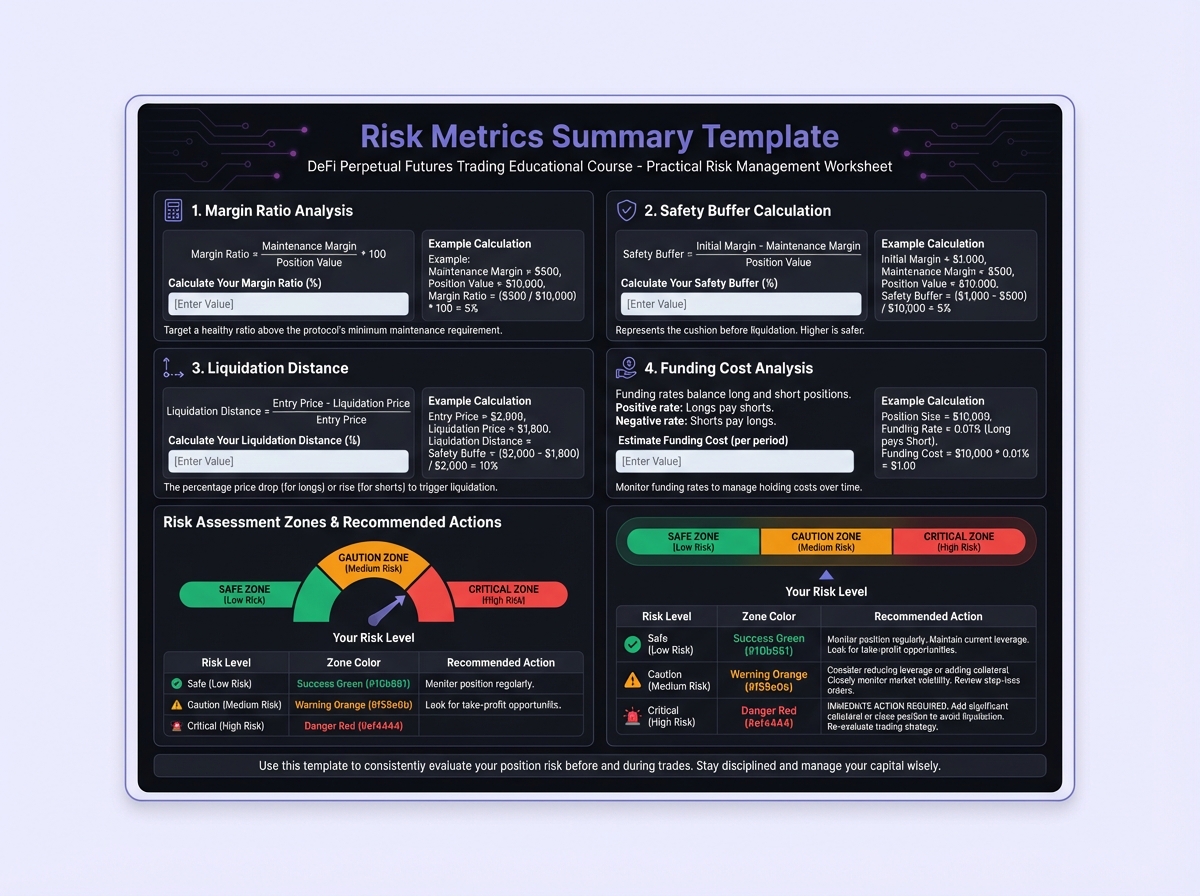

📊 Phase 2: Margin and Leverage Calculations (15 minutes)

Exercise 4: Position Sizing

Leverage

Position Size

Initial Margin Required

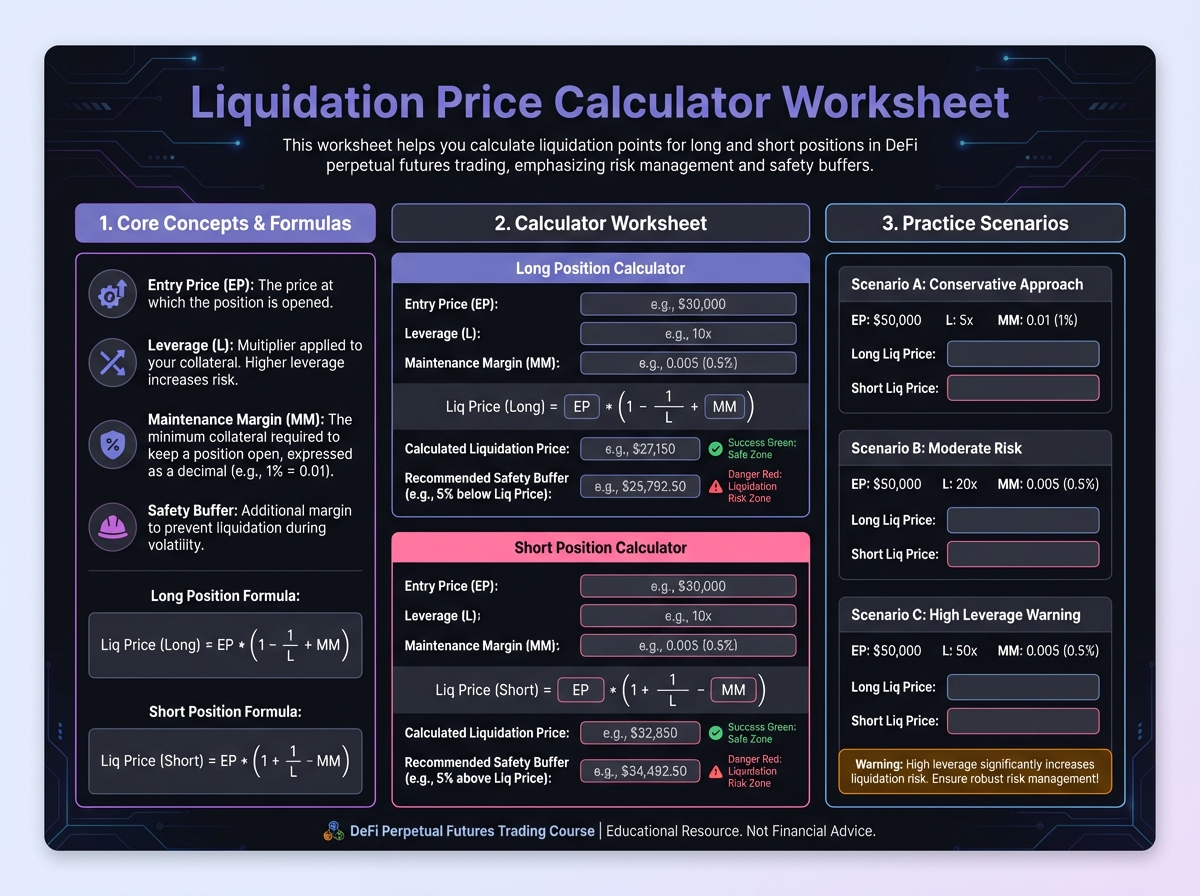

Exercise 5: Liquidation Price Calculations

Exercise 6: Margin Ratio Analysis

⚠️ Phase 3: Risk Assessment (15 minutes)

Exercise 7: Liquidation Risk Analysis

Price Movement

Unrealized P&L

Remaining Margin

Margin Ratio

Status

Exercise 8: Funding Rate Impact

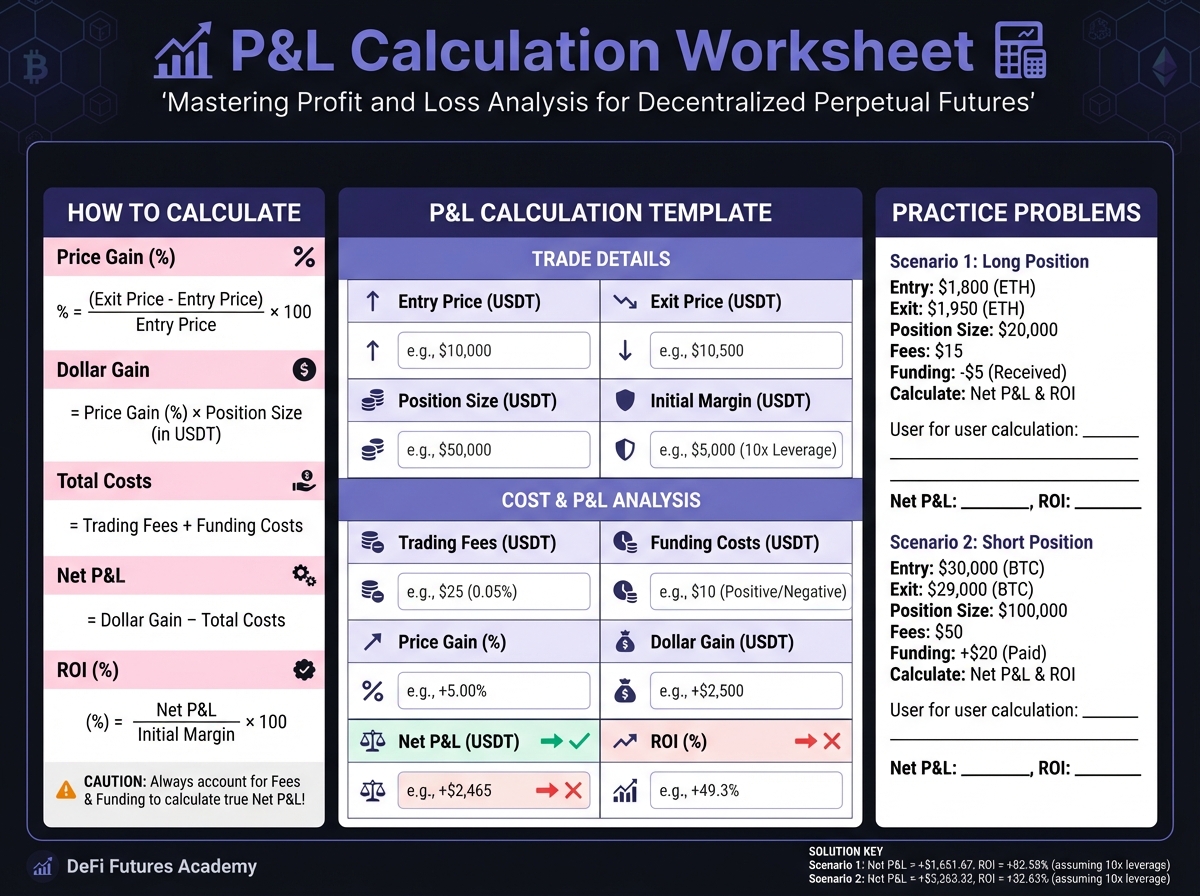

💰 Phase 4: Profit and Loss Calculations (15 minutes)

Exercise 9: Complete P&L Analysis

Exercise 10: Short Position P&L

Exercise 11: Break-Even Price

📈 Phase 5: Position Management Scenarios (15 minutes)

Exercise 12: Adding Margin

Exercise 13: Partial Close

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 2: The Mathematics of Perpetual TradingNextLesson 3: Architecture Types and Market Structure

Last updated