Exercise 3: Architecture Analysis and Selection

🔍 Phase 1: Architecture Identification (10 minutes)

Exercise 1: Protocol Classification

Protocol

Architecture Type

Reasoning

Exercise 2: Architecture Characteristics

Feature

CLOB

Oracle Pools

vAMM

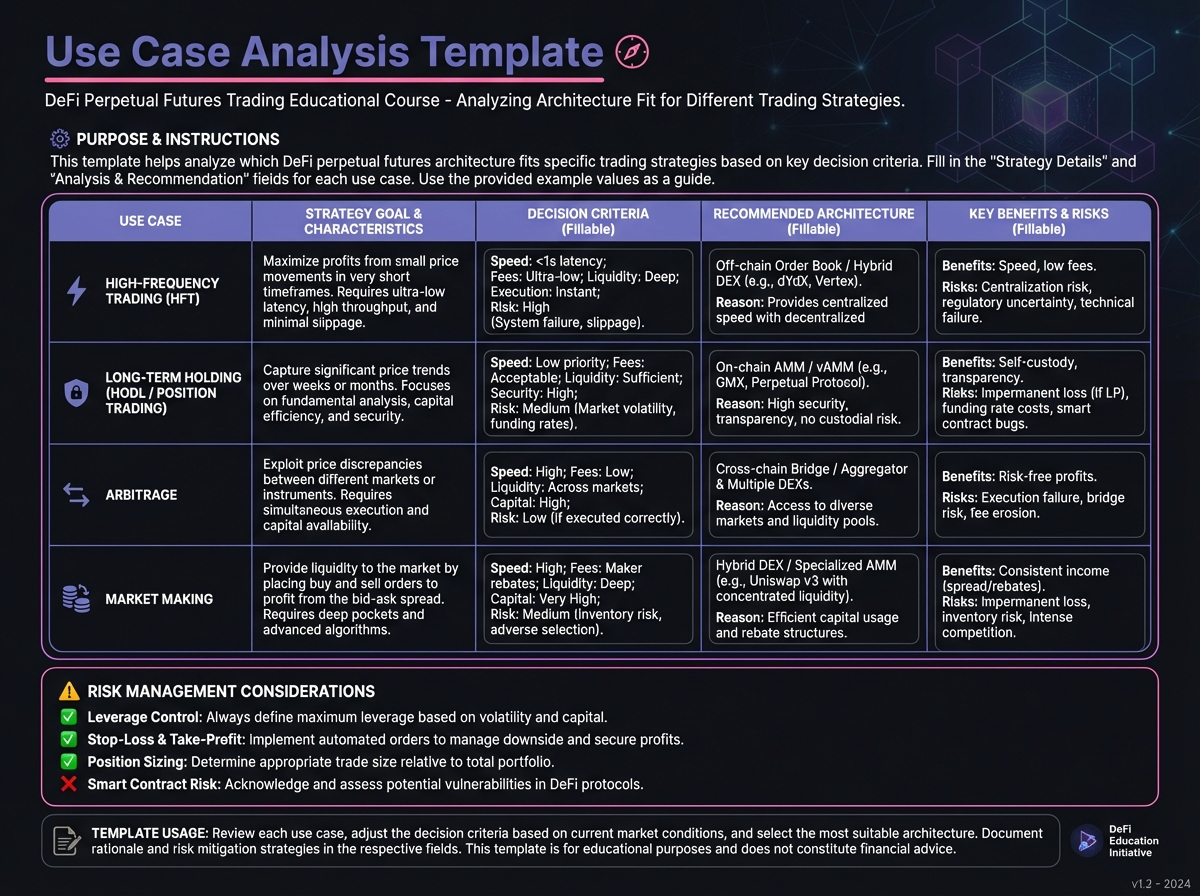

📊 Phase 2: Use Case Matching (15 minutes)

Exercise 3: Strategy to Architecture Matching

Strategy

Best Architecture

Reasoning

Exercise 4: Risk Assessment by Architecture

💡 Phase 3: Real-World Scenario Analysis (15 minutes)

Exercise 5: Protocol Selection Scenario

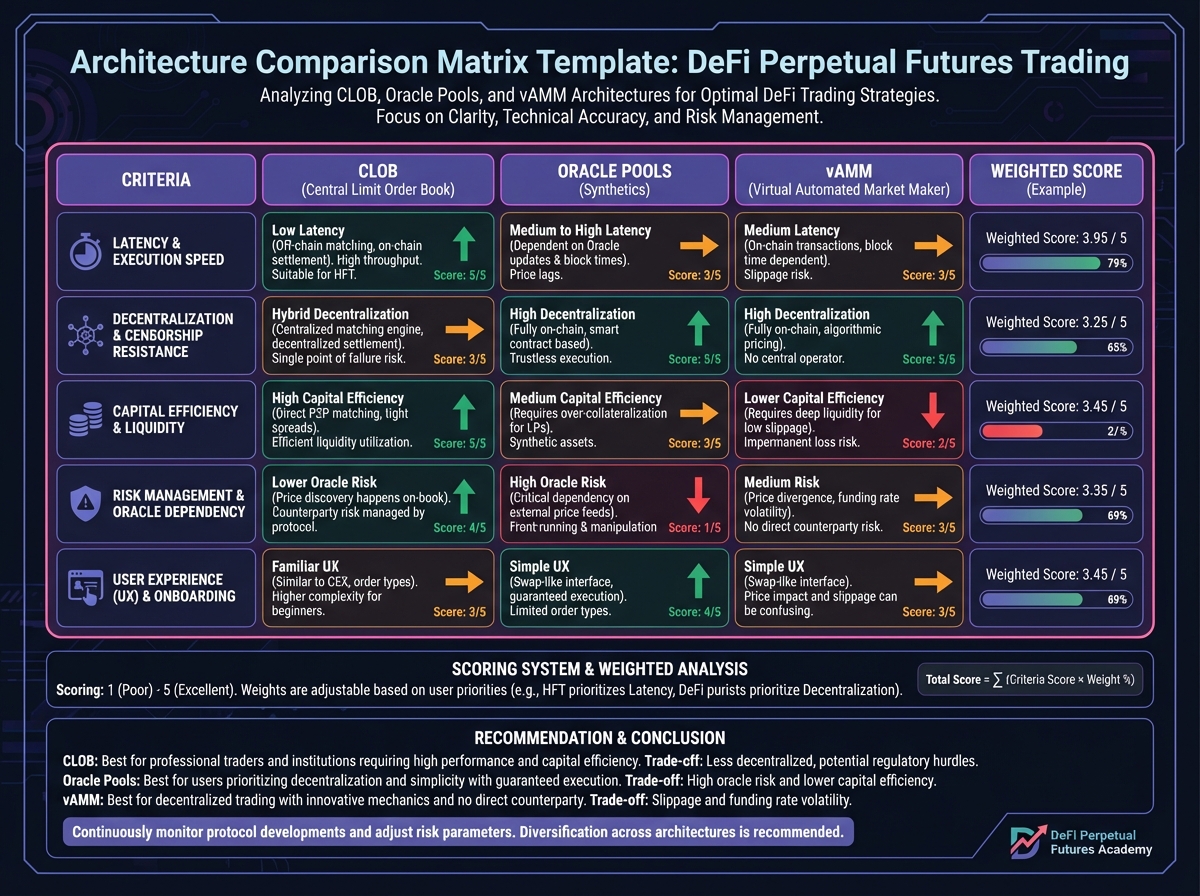

Exercise 6: Architecture Comparison Matrix

Factor

CLOB

Oracle Pool

vAMM

Your Priority

📝 Phase 4: Hybrid Architecture Understanding (10 minutes)

Exercise 7: Drift's Liquidity Trifecta

Exercise 8: GMX V2 Evolution

Benefit

Drawback

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 3: Architecture Types and Market StructureNextLesson 4: Your First Perpetual Position

Last updated