Exercise 4: First Position Setup and Management

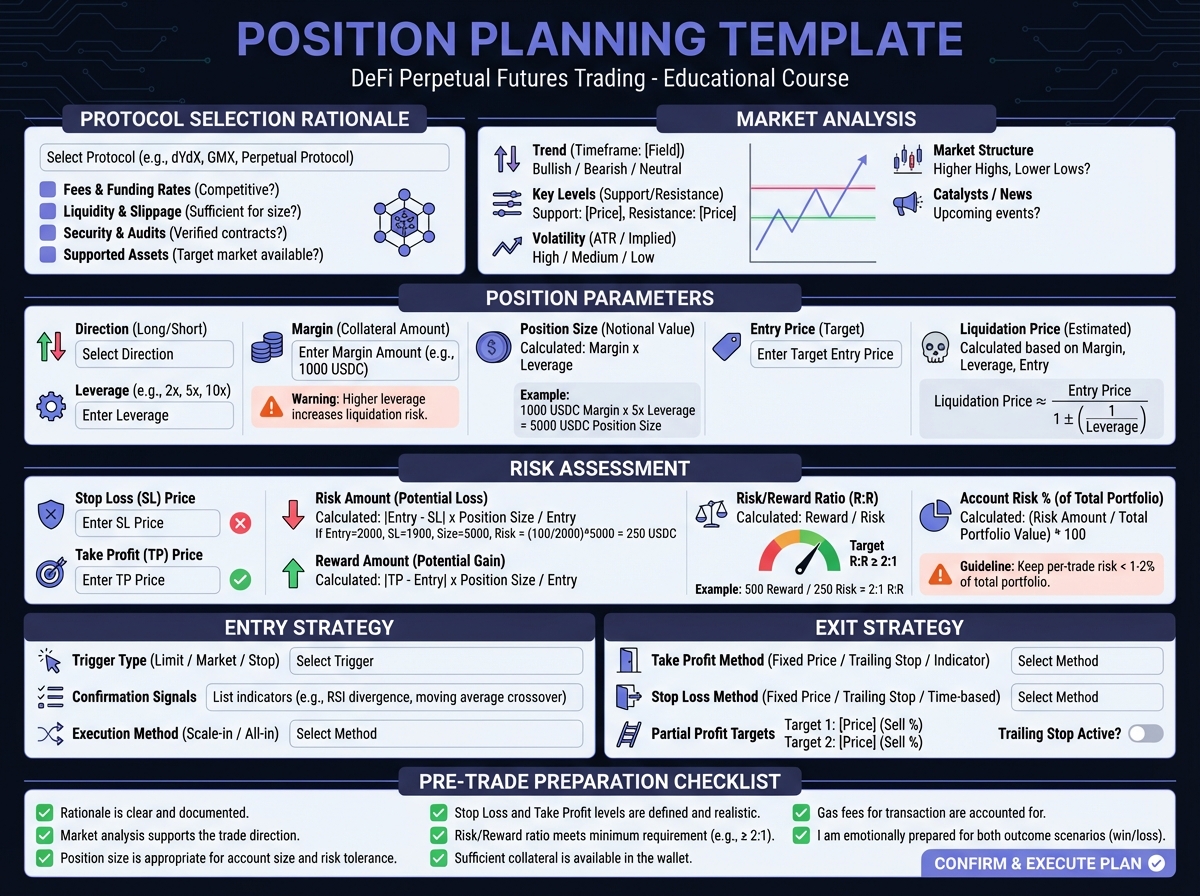

📋 Phase 1: Pre-Trade Planning (15 minutes)

Exercise 1: Position Planning Worksheet

Exercise 2: Pre-Trade Checklist

📊 Phase 2: Position Setup Calculations (15 minutes)

Exercise 3: Complete Position Math

Exercise 4: Risk Scenario Planning

Price Movement

Unrealized P&L

Funding Cost (7 days)

Net P&L

Action Plan

💡 Phase 3: Execution Plan (10 minutes)

Exercise 5: Step-by-Step Execution

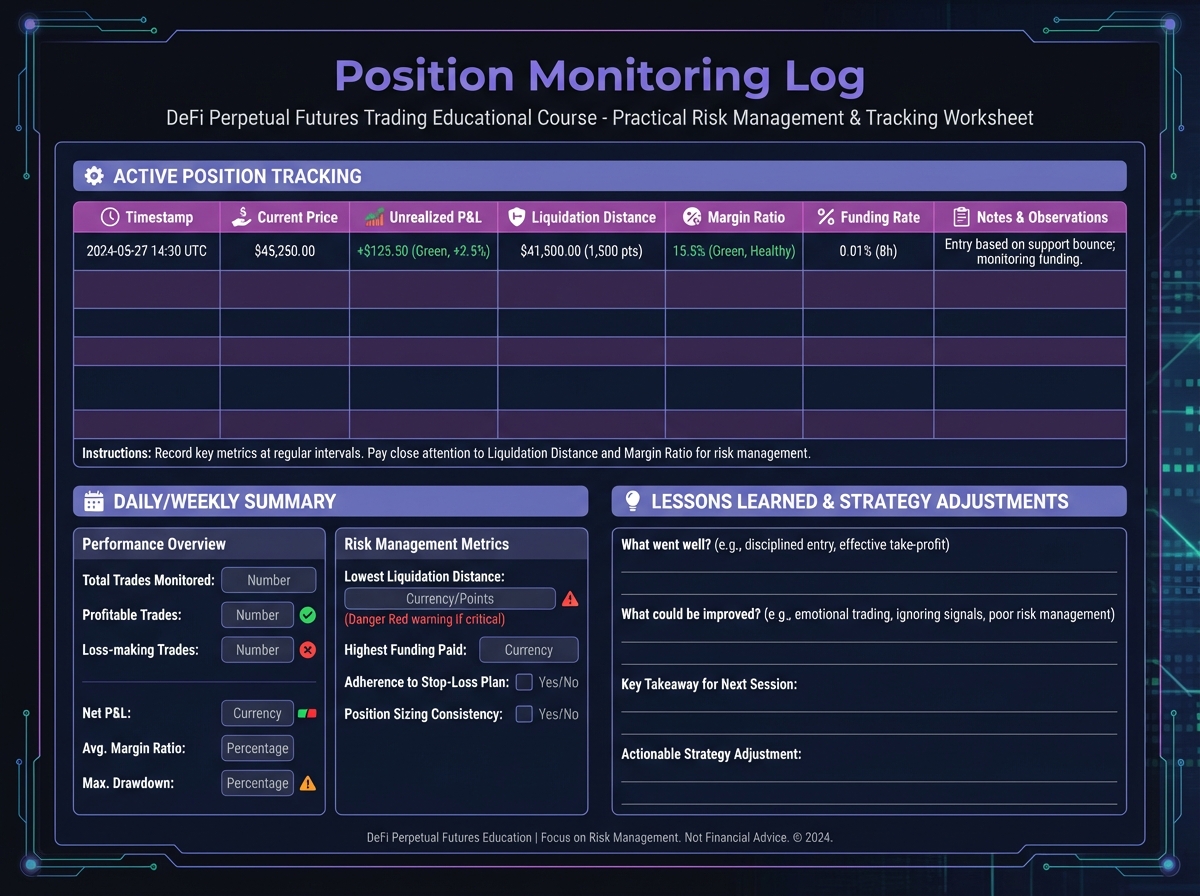

Exercise 6: Monitoring Plan

🎯 Phase 4: Position Management Scenarios (15 minutes)

Exercise 7: Scenario Response Planning

Exercise 8: Exit Strategy Planning

✅ Phase 5: Post-Trade Reflection (10 minutes)

Exercise 9: Trade Journal Entry

Exercise 10: Risk Management Review

🎯 Self-Assessment

🚀 Next Steps

Last updated