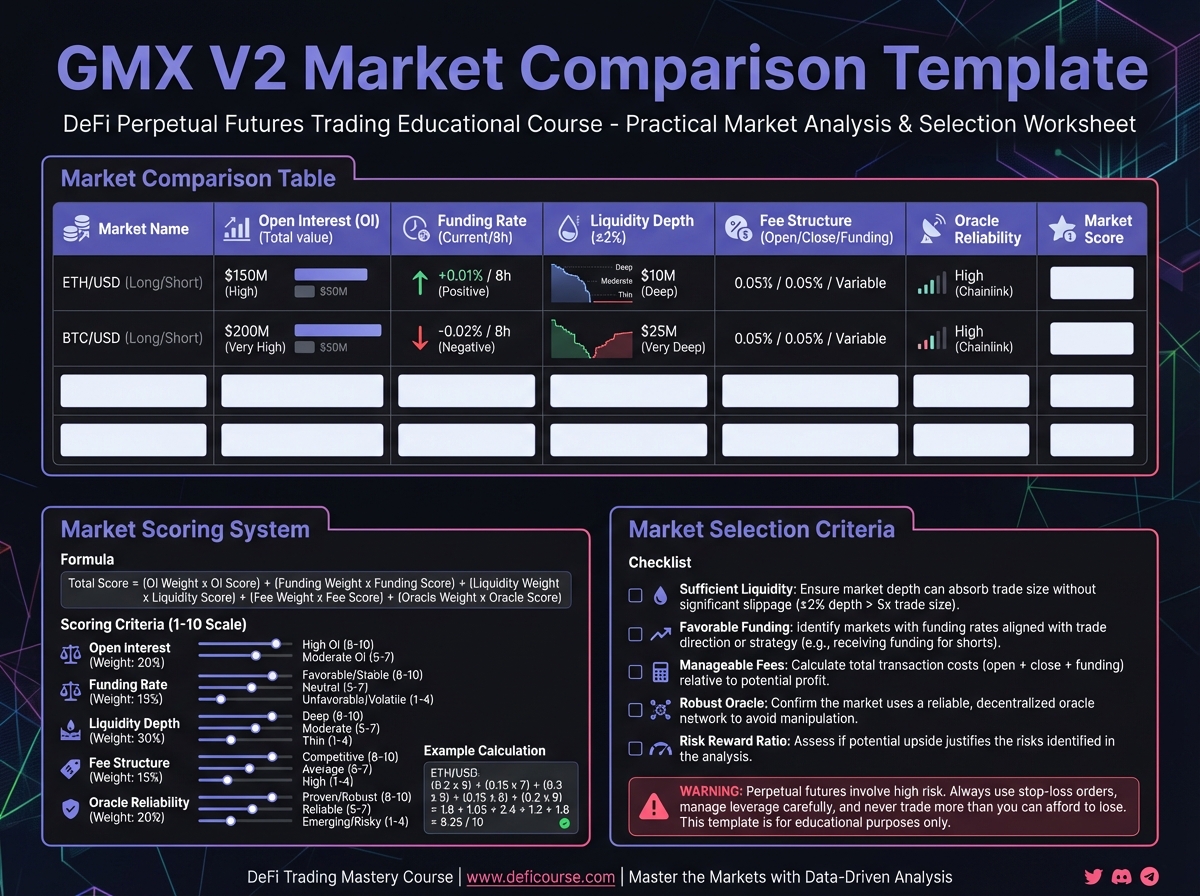

Exercise 6: GMX V2 Market Analysis and Selection

🔍 Phase 1: Pool Analysis (20 minutes)

Exercise 1: Standard vs. Synthetic Market Identification

Market

Backing Assets

Type

Risk Level

Exercise 2: Pool Health Assessment

Exercise 3: GM Token Valuation

📊 Phase 2: Fee Structure Analysis (15 minutes)

Exercise 4: Trading Fee Calculation

Exercise 5: Price Impact Fee Estimation

Exercise 6: Funding Rate Analysis

💰 Phase 3: LP Strategy Development (15 minutes)

Exercise 7: Pool Selection for LP

Pool

TVL

OI Balance

Utilization

APY

Your Choice

Exercise 8: Delta-Neutral Strategy Design

🎯 Phase 4: Trader vs. LP Perspective (10 minutes)

Exercise 9: Trader Analysis

Exercise 10: LP Analysis

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 6: GMX V2 - Oracle-Based Liquidity PoolsNextLesson 7: Drift Protocol - Solana's Hybrid Architecture

Last updated