Exercise 7: Drift Market Creation and Strategy Analysis

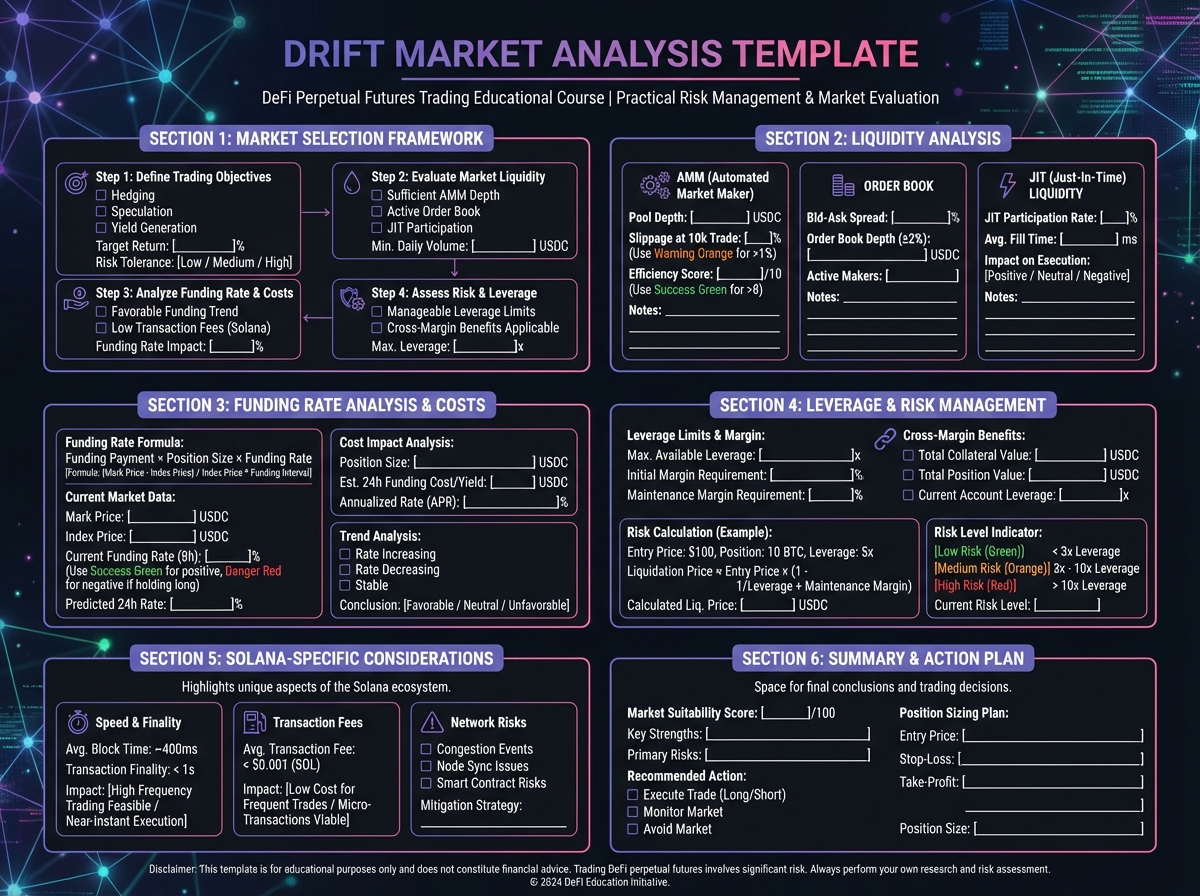

🔍 Phase 1: Liquidity Trifecta Understanding (15 minutes)

Exercise 1: Execution Flow Analysis

Exercise 2: JIT Auction Mechanics

Exercise 3: DLOB vs. DAMM Comparison

Feature

DLOB

DAMM

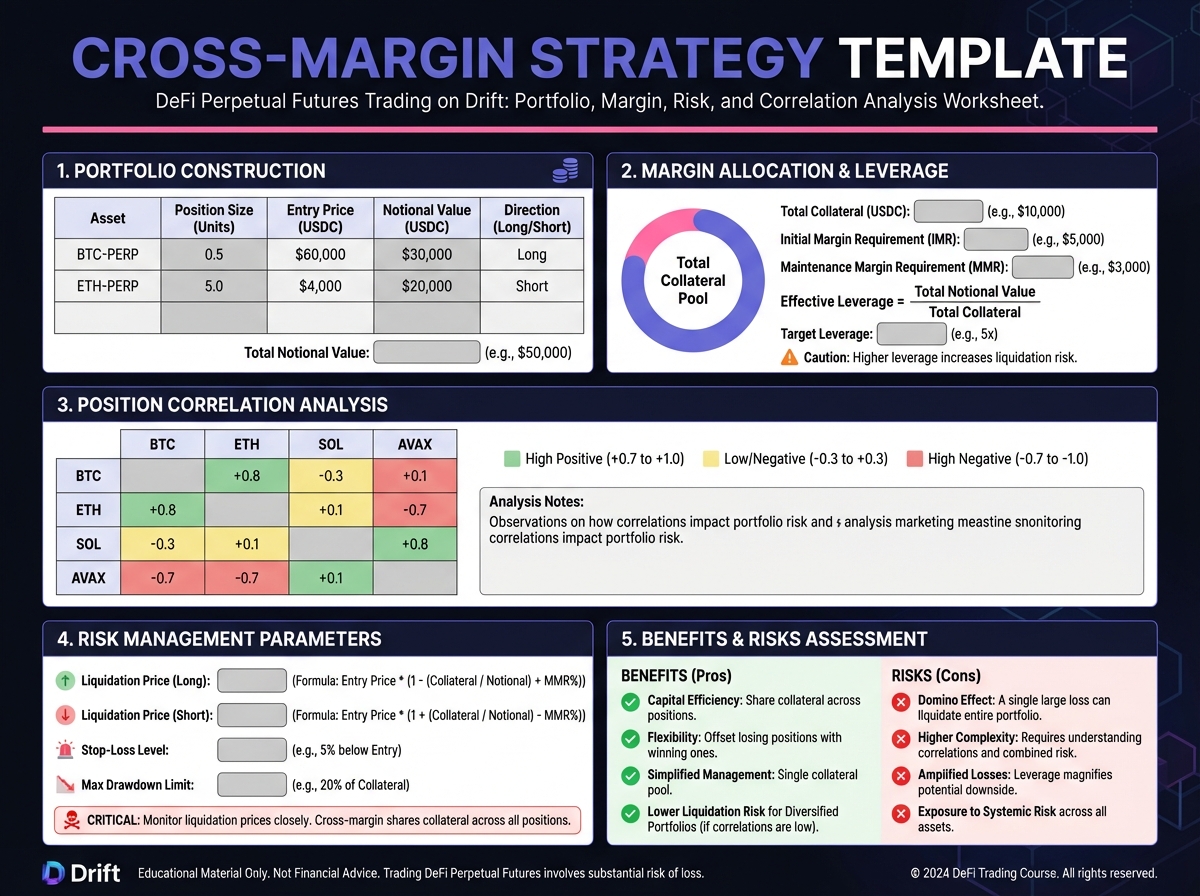

💰 Phase 2: Cross-Margin System (20 minutes)

Exercise 4: Unified Margin Calculation

Exercise 5: Cross-Margin Hedging Strategy

Exercise 6: Asset Weighting Impact

Asset

Amount

Weight

Buying Power

🎯 Phase 3: Advanced Order Types (15 minutes)

Exercise 7: Oracle-Pegged Orders

Exercise 8: Stop Loss Strategy

🔬 Phase 4: Strategy Design (15 minutes)

Exercise 9: Multi-Product Strategy

Exercise 10: JIT Participation Strategy

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 7: Drift Protocol - Solana's Hybrid ArchitectureNextLesson 8: Alternative Chain Protocols

Last updated