Exercise 5: V3 Range Selection and Management

🎯 Phase 1: Range Selection Strategy (20 minutes)

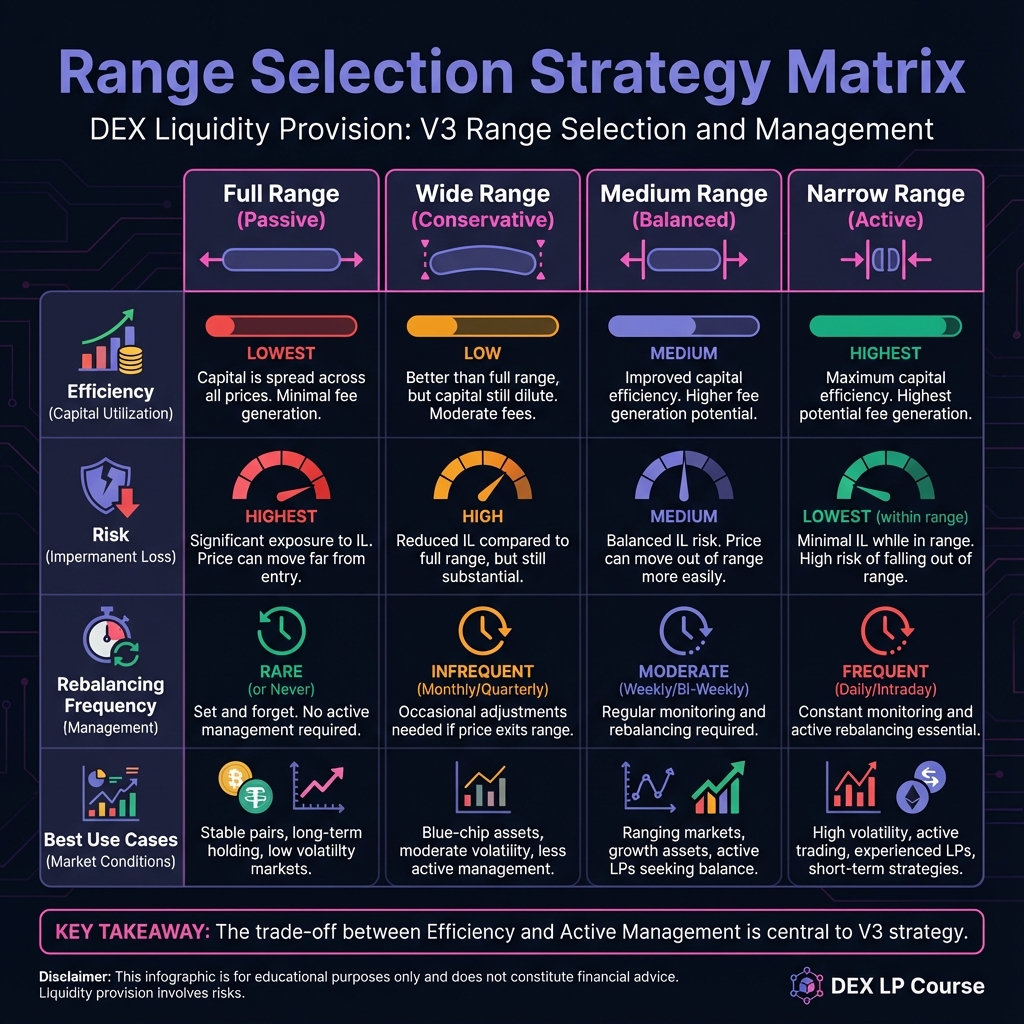

Range Width Decision Framework

Risk vs. Efficiency Analysis

Strategy

Efficiency

Risk Level

Rebalancing Frequency

Best For

📊 Phase 2: Tick Calculation Practice (15 minutes)

Understanding Ticks

Fee Tier Selection

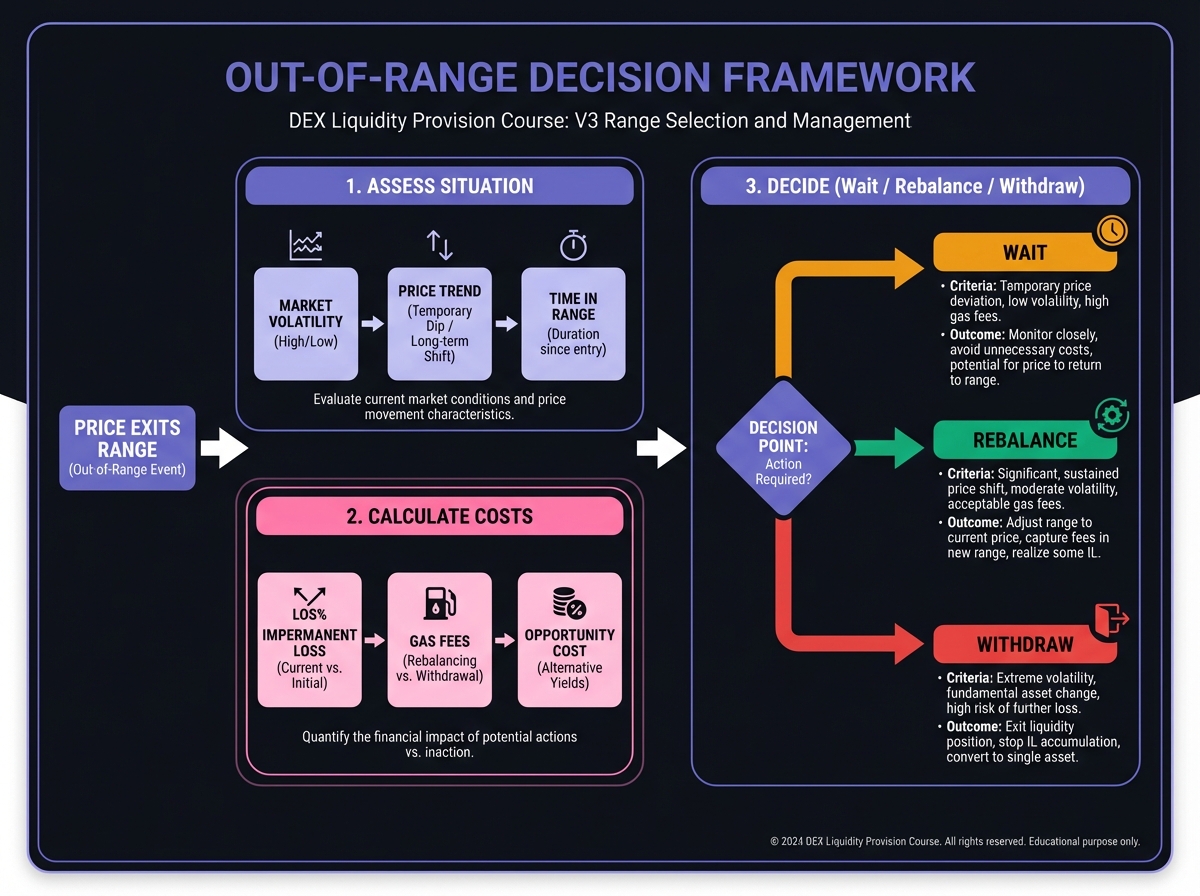

🔄 Phase 3: Position Management (15 minutes)

Out-of-Range Response Protocol

Rebalancing Calculation

📈 Phase 4: Fee Collection Strategy (10 minutes)

Fee Collection Timing

🎯 Phase 5: Complete V3 Position Plan (10 minutes)

Your V3 Position Design

📚 Next Steps

Last updated