Exercise 8: Advanced Risk Management Framework

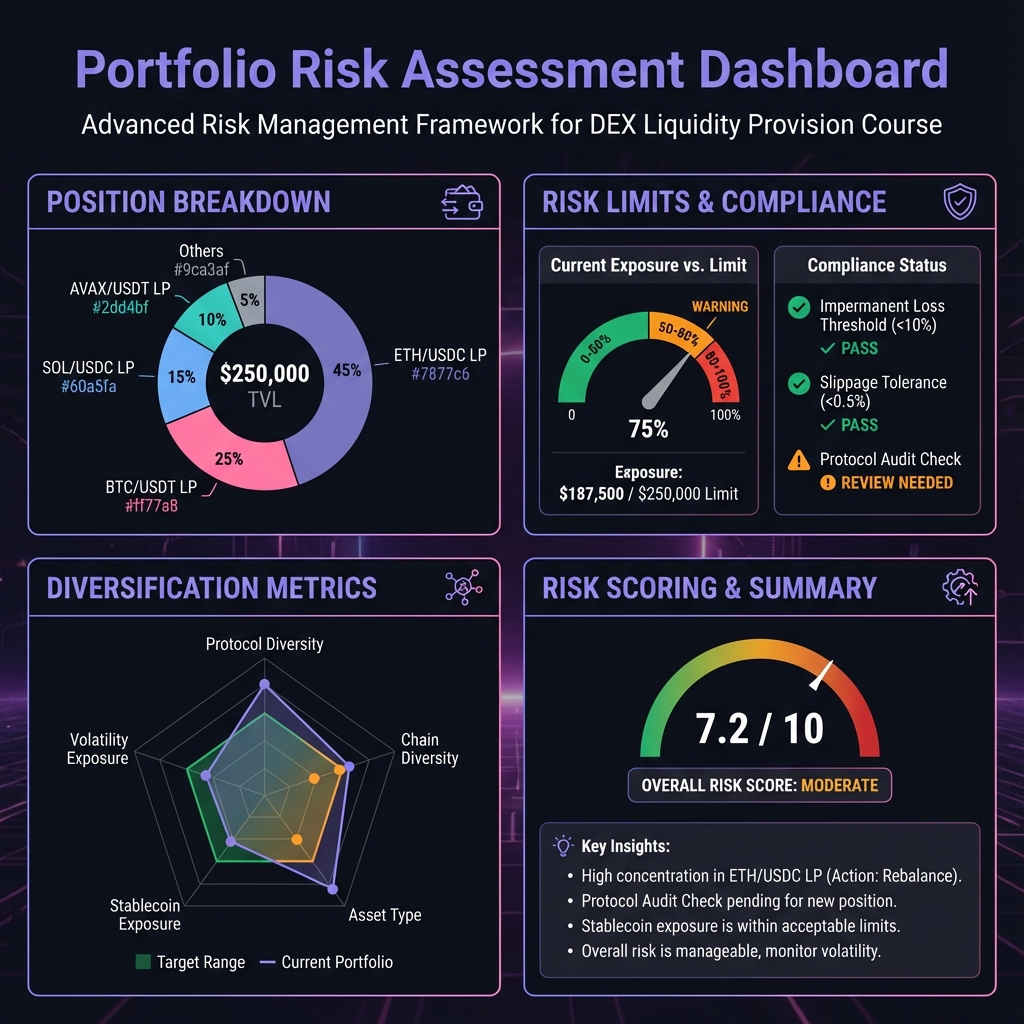

🛡️ Phase 1: Risk Assessment (20 minutes)

Portfolio Risk Analysis

Position

Capital

% of Portfolio

Pair

Volatility

IL Risk

Status

Risk Limit Framework

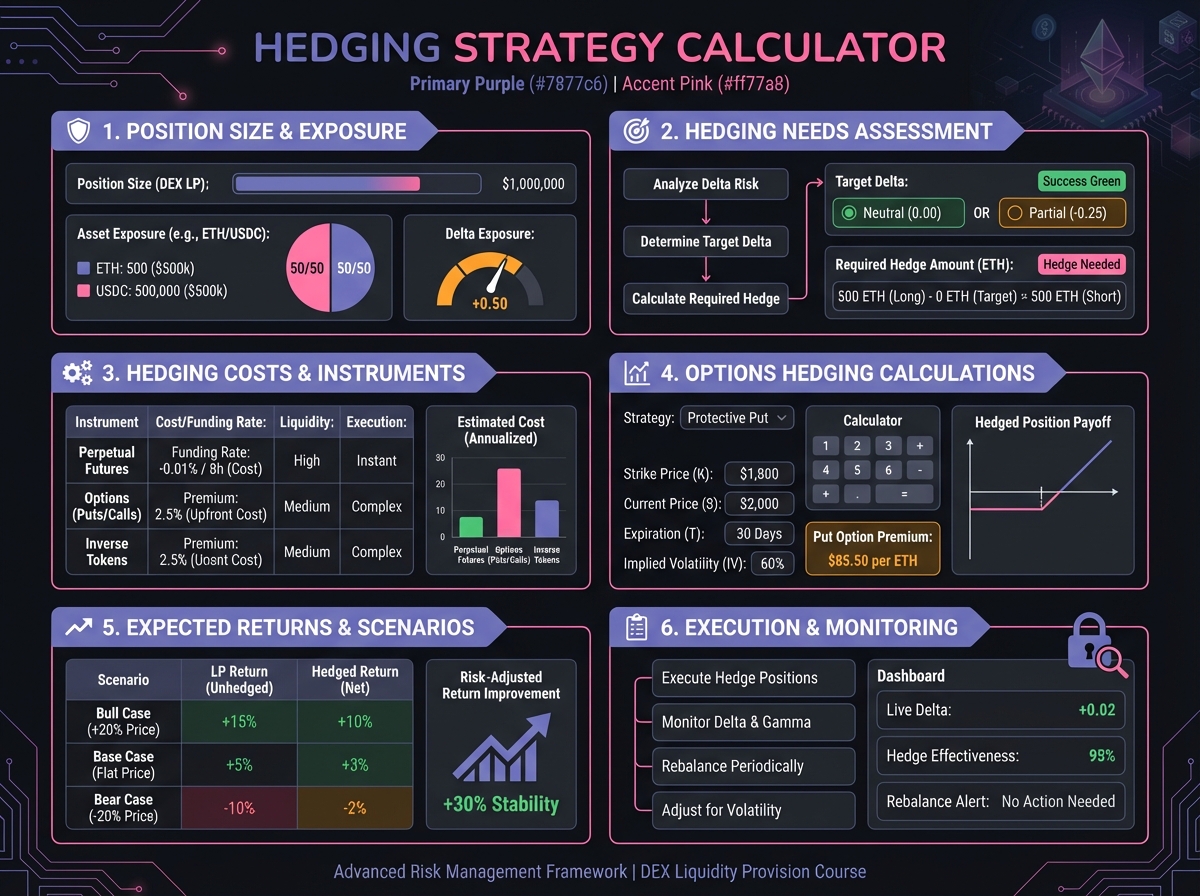

🔄 Phase 2: Hedging Strategy Design (20 minutes)

Delta Hedging Analysis

Options Hedging Strategy

📊 Phase 3: Risk Monitoring System (15 minutes)

Monitoring Dashboard Setup

Alert System

🎯 Phase 4: Risk Management Protocol (15 minutes)

Decision Framework

Emergency Protocol

📚 Next Steps

Last updated