Lesson 1: Understanding DeFi Money Markets Fundamentals

🎧 Lesson Podcast

🎬 Video Overview

Lesson 1: Understanding DeFi Money Markets Fundamentals

🎯 Core Concept: What is a DeFi Money Market?

A DeFi money market is a decentralized protocol that enables users to lend and borrow cryptocurrency assets without intermediaries. Think of it as a peer-to-peer bank that runs 24/7 on blockchain, where you can earn yield on deposits or borrow against your assets using smart contracts instead of traditional banking infrastructure.

Why Money Markets Matter

Before DeFi money markets, if you wanted to:

Earn interest on crypto assets, you needed centralized exchanges (limited options, custodial risk)

Borrow against crypto, you needed centralized lenders (high fees, KYC requirements, geographic restrictions)

DeFi money markets changed everything by:

Eliminating intermediaries: No banks or centralized lenders needed

Enabling permissionless lending: Lend or borrow from anyone, anywhere, anytime

Creating composability: Money markets integrate with other DeFi protocols

Offering transparency: All transactions and rates are on-chain, publicly verifiable

📚 The Evolution: From Traditional Finance to DeFi

Traditional Finance Model

In traditional finance, lending requires:

Credit checks and income verification

Bank intermediaries

Geographic restrictions

High fees and slow processes

Example: To borrow $10,000 against $20,000 of stocks:

Apply at a bank (days/weeks for approval)

Pay origination fees (2-5%)

Subject to credit score requirements

Interest rates: 5-10% annually

The DeFi Revolution

DeFi money markets replace traditional lending with over-collateralized lending:

No credit checks needed

Instant access via smart contracts

Global availability

Transparent, algorithmic interest rates

Key Innovation: Instead of trusting a bank, you trust code. Instead of underwriting credit risk, the protocol uses over-collateralization—you must deposit more value than you borrow.

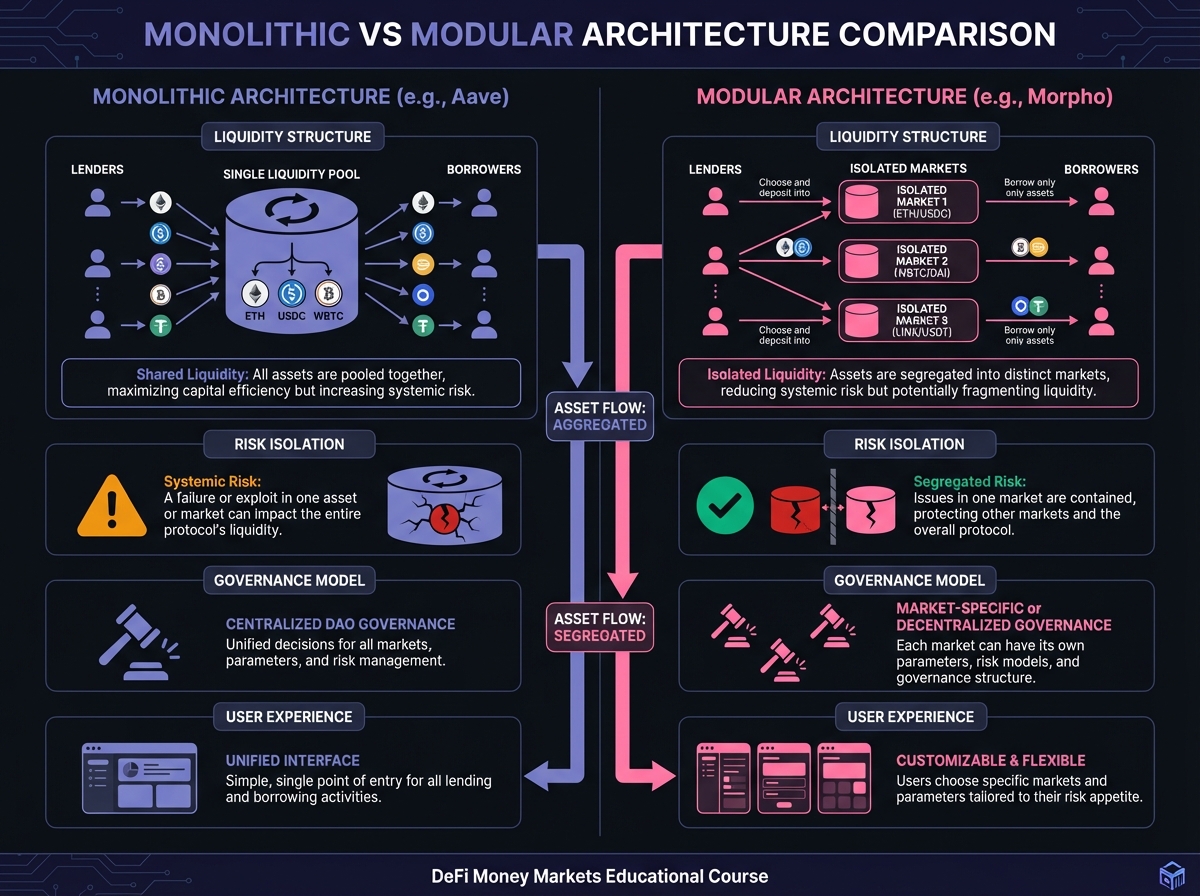

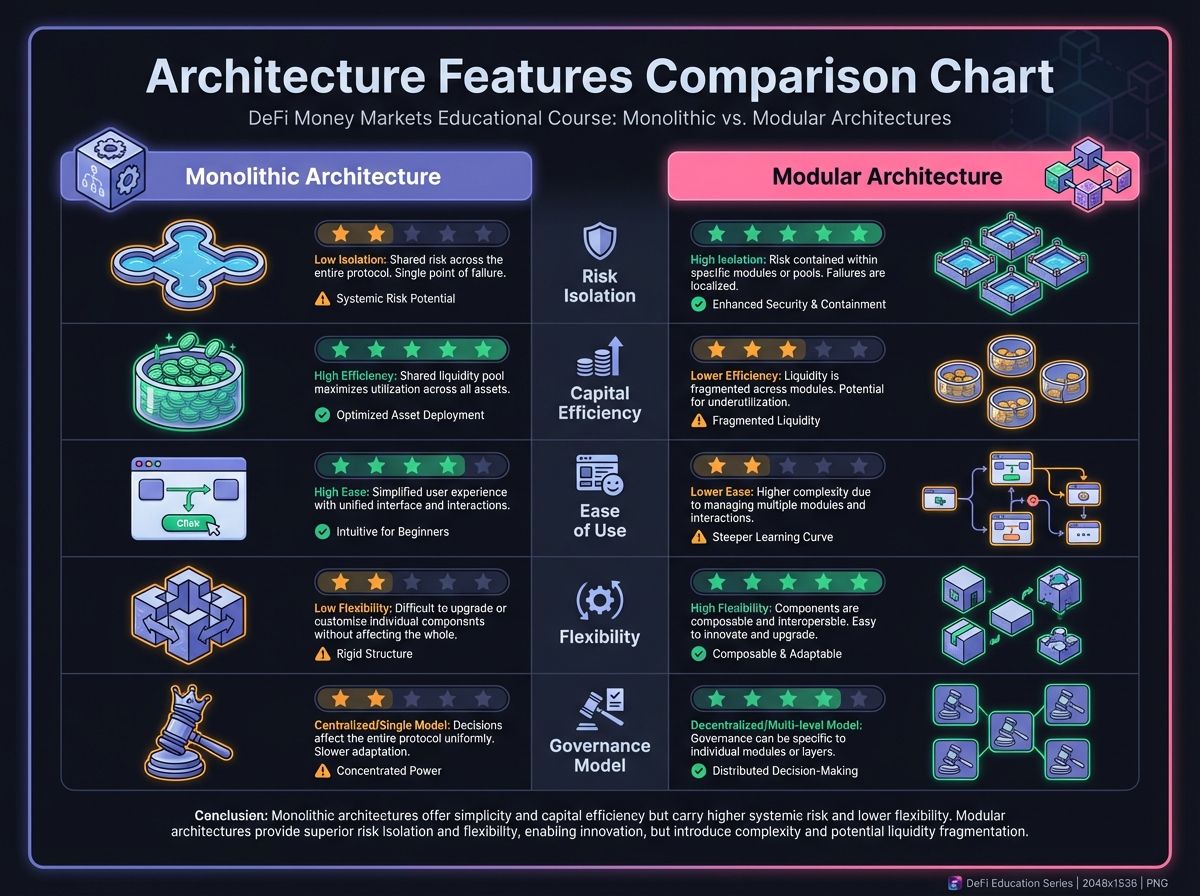

🏗️ The Two Architectural Philosophies

Understanding this distinction is the single most critical factor in assessing risk when choosing a money market protocol.

Monolithic Peer-to-Pool Model

In this traditional model, all deposited assets are pooled together into a single, massive liquidity reserve.

How It Works:

You supply USDC → it's commingled with USDC from thousands of other users

Borrowers can collateralize any whitelisted asset (ETH, WBTC, etc.) to borrow from this shared pool

All lenders share the same pool of liquidity

Examples: Aave V3, JustLend, Suilend

The Benefits:

✅ Immediate liquidity: Deep, fragmented pools mean instant deposits/withdrawals

✅ Simple UX: Deposit Asset A, Borrow Asset B—straightforward

✅ Diversified risk: Large pools can absorb individual defaults

The Systemic Risk:

❌ Weakest link problem: If governance votes to accept a risky asset as collateral and that asset crashes faster than liquidators can sell it, the entire protocol can suffer bad debt

❌ Socialized losses: All depositors are at risk, even those who never interacted with the risky asset

❌ Governance dependency: Centralized risk decisions affect everyone

Real-World Example: If Aave governance lists a volatile meme coin as collateral and it crashes 90% before liquidations occur, all USDC lenders could face losses, even if they never touched the meme coin.

Modular/Isolated Market Model

This paradigm separates lending markets into isolated pairs or independent vaults.

How It Works:

Instead of one giant pool, there's a specific market for "Lending USDC against Wrapped Bitcoin collateral only"

Each market operates independently with its own risk parameters

Risk is isolated—if one market fails, others remain unaffected

Examples: Morpho Blue, Euler v2

The Benefits:

✅ Risk isolation: If a niche collateral asset fails in one vault, only lenders in that vault are affected

✅ Granular control: Each market can have different LTVs, oracles, and risk parameters

✅ Permissionless innovation: Anyone can create new markets without governance approval

The Complexity:

❌ Burden of choice: You can't simply "lend USDC"—you must choose which USDC vault to lend to

❌ Due diligence required: You must assess the collateral quality and curator reputation

❌ Fragmented liquidity: Smaller pools may have lower utilization rates

Real-World Example: On Morpho, you might choose between:

"Gauntlet USDC Prime" vault (ETH/WBTC collateral, conservative LTVs)

"Steakhouse USDC Aggressive" vault (more volatile collaterals, higher LTVs)

Each has different risk profiles and yields.

Which Architecture Should You Choose?

For Beginners:

Start with Monolithic (Aave) for simplicity and safety

Understand the governance track record and safety modules

Stick to established protocols with long audit histories

For Advanced Users:

Modular offers higher yields and customization

Requires understanding curators, market parameters, and risk isolation

Better for sophisticated strategies and risk tolerance

💰 Core Concepts: The Foundation

Over-Collateralization

Definition: You must deposit collateral worth MORE than the amount you borrow.

Example:

You deposit $1,000 worth of ETH

Maximum LTV (Loan-to-Value) = 80%

You can borrow up to $800 of USDC

The $200 difference is your safety buffer

Why Over-Collateralization?

Crypto prices are volatile

The buffer protects against price drops

No credit checks needed—the math ensures solvency

Algorithmic Interest Rates

Unlike banks that set fixed rates, DeFi rates adjust automatically based on supply and demand.

Basic Mechanism:

High borrowing demand → Higher interest rates (encourages more deposits, discourages borrowing)

Low borrowing demand → Lower interest rates (discourages deposits, encourages borrowing)

Result: Rates balance automatically to maintain liquidity

Non-Custodial

Unlike banks or centralized exchanges, you maintain custody of your assets:

You control the keys: Assets stay in your wallet

No withdrawal restrictions: Exit anytime (if liquidity available)

Transparent: All transactions visible on-chain

No KYC: No identity verification required

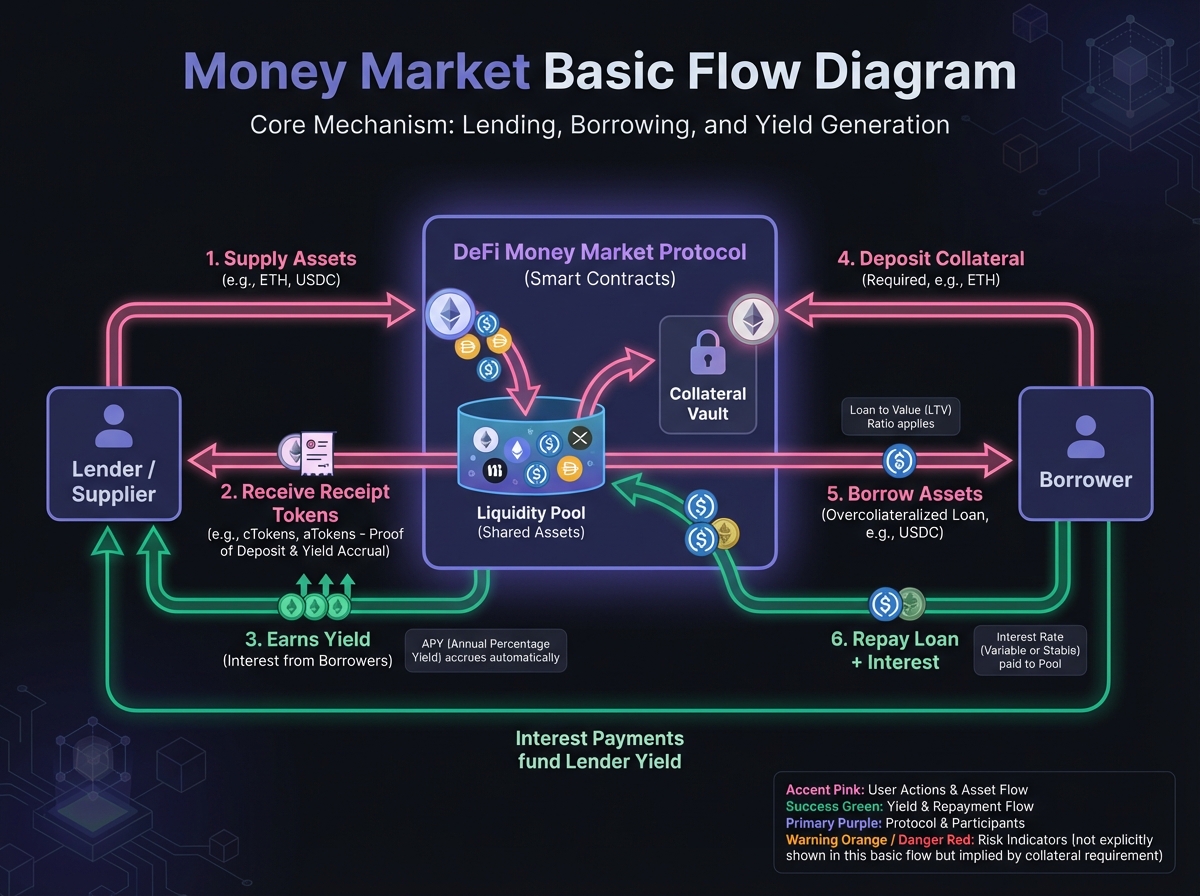

🔄 How Money Markets Work: The Basic Flow

Supplying Assets (Lending)

Deposit: You supply assets (e.g., USDC) to the protocol

Receive tokens: You get receipt tokens (e.g., aUSDC on Aave) representing your share

Earn yield: Borrowers pay interest, which you earn proportionally

Withdraw: Redeem your receipt tokens anytime (if liquidity available)

Example:

Supply $10,000 USDC to Aave

Receive 10,000 aUSDC tokens

Earn 5% APY

After 1 year: aUSDC tokens worth ~$10,500

Withdraw: Burn aUSDC, receive $10,500 USDC

Borrowing Assets

Deposit collateral: Supply assets (e.g., ETH) as collateral

Borrow: Take out a loan of different assets (e.g., USDC)

Pay interest: Accrue interest on the borrowed amount

Repay: Return borrowed assets plus interest to unlock collateral

Example:

Deposit $10,000 worth of ETH as collateral

Borrow $6,000 USDC (60% LTV)

Pay 4% APY on the loan

Use USDC for trading or other investments

Repay $6,000 + interest to unlock ETH

The Interest Rate Mechanism

Interest rates are determined by utilization rate—the percentage of the pool currently lent out.

Simple Example:

Pool has 100 USDC total

50 USDC is borrowed

Utilization = 50%

Supply rate: 3% APY (what lenders earn)

Borrow rate: 5% APY (what borrowers pay)

The 2% spread goes to the protocol or liquidity reserves

🎓 Beginner's Corner: Common Questions

Q: Is my money safe? A: No investment is 100% safe. Risks include: smart contract bugs, liquidation if borrowing, oracle failures, and protocol insolvency. However, over-collateralization and established protocols reduce risk significantly.

Q: Can I lose my deposited funds? A: If you're only supplying (lending) stablecoins on a reputable protocol like Aave, risk is relatively low. If you're borrowing, you face liquidation risk if your collateral value drops.

Q: What's the difference between lending and borrowing? A: Lending = you supply assets and earn interest (lower risk). Borrowing = you deposit collateral and take out a loan (higher risk due to liquidation possibility).

Q: Why would I borrow if I already have crypto? A: Common reasons: (1) Get liquidity without selling assets (tax efficiency), (2) Leverage your position, (3) Fund other investments, (4) Short-term liquidity needs.

Q: Which protocol should I start with? A: For absolute beginners: Start with Aave on Arbitrum or Base (low gas costs). Supply stablecoins only initially. Once comfortable, explore other protocols.

Q: Can I get liquidated if I'm only lending? A: No. If you're only supplying assets (not borrowing), you cannot be liquidated. You only face liquidation if you have an active loan.

⚠️ Critical Differences from Traditional Finance

Credit Check

Required

None (over-collateralization)

Collateral Ratio

50-80% typical

110-150%+ required

Interest Rates

Set by banks

Algorithmic (supply/demand)

Access

Geographic restrictions

Global, 24/7

Custody

Bank holds funds

You hold keys

Withdrawal

Days/weeks

Instant (if liquidity)

Transparency

Limited

Fully on-chain

🔬 Advanced Deep-Dive: The Economics of Money Markets

The Interest Rate Spread

Money markets make money (or maintain solvency) through the spread between borrow and supply rates.

Typical Spread Structure:

Borrow rate: 6% APY

Supply rate: 4% APY

Spread: 2% APY

Where the Spread Goes:

Protocol reserves (for bad debt coverage)

Governance token holders

Insurance funds

Sometimes: back to suppliers as rewards

The Utilization Curve

Most protocols use a "kinked" interest rate model:

Below the Kink (e.g., <90% utilization):

Rates remain relatively stable

Supply rate: 3-5% APY

Borrow rate: 5-8% APY

Above the Kink (>90% utilization):

Rates spike exponentially

Encourages repayments

Attracts new deposits

Protects against liquidity crises

Why This Matters: High utilization means higher yields for lenders but also higher risk of liquidity freezes if too many want to withdraw simultaneously.

Liquidity Risk

The Risk: If utilization reaches 100%, lenders cannot withdraw until borrowers repay.

How Protocols Mitigate:

Interest rate spikes to attract deposits

Encourages borrowers to repay (higher rates)

Reserve funds for emergency withdrawals

Utilization caps (max borrowing limits)

📊 Real-World Example: Aave USDC Market

Let's examine a real money market to understand the mechanics:

Market Stats (hypothetical):

Total Supply: $1,000,000,000 USDC

Total Borrowed: $700,000,000 USDC

Utilization: 70%

Supply APY: 4.5%

Borrow APY: 6.5%

Your Position:

You supply: $10,000 USDC

Your share: 0.001% of pool

Daily earnings: ~$1.23 (4.5% APY / 365)

Annual earnings: ~$450

Key Insight: The 2% spread (6.5% - 4.5%) goes to protocol reserves, not to you. This is the cost of safety and liquidity.

🔑 Key Takeaways

Money markets enable permissionless lending/borrowing without traditional intermediaries

Two architectures exist: Monolithic (pooled, simpler) vs Modular (isolated, more complex)

Over-collateralization protects lenders—borrowers must deposit more value than they borrow

Interest rates are algorithmic—adjusting automatically based on supply and demand

Risk varies by architecture: Monolithic shares risk, modular isolates it

Start simple: Begin with established monolithic protocols before exploring modular options

🚀 Next Steps

In the next lesson, we'll dive deep into the mathematics that govern money markets. You'll learn to calculate Health Factors, understand Loan-to-Value ratios, and master utilization rate dynamics.

But first, complete Exercise 1 to test your understanding of money market fundamentals.

Remember: Understanding the fundamentals is the foundation. Master these concepts before moving to protocol-specific details. The architecture choice (monolithic vs modular) will guide all your subsequent decisions.

Last updated