Exercise 1: Money Markets Knowledge Assessment

🔍 Phase 1: Knowledge Check (10 minutes)

Understanding Check

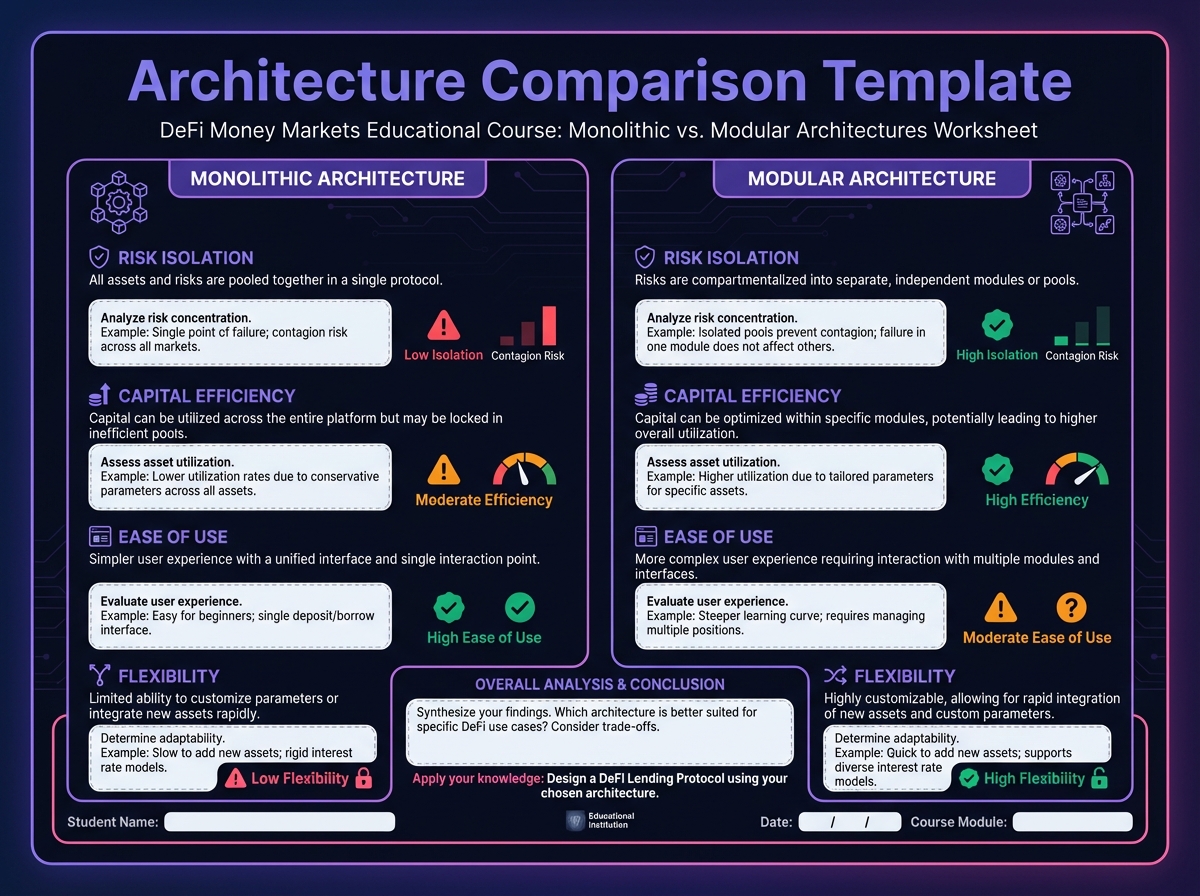

📊 Phase 2: Architecture Comparison (15 minutes)

Monolithic vs Modular Analysis

Factor

Monolithic (Protocol A)

Modular (Protocol B)

💡 Phase 3: Real-World Application (10 minutes)

Protocol Selection Exercise

📝 Phase 4: Key Concepts Review (10 minutes)

Fill in the Blanks

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 1: Understanding DeFi Money Markets FundamentalsNextLesson 2: The Mathematics of Lending and Borrowing

Last updated