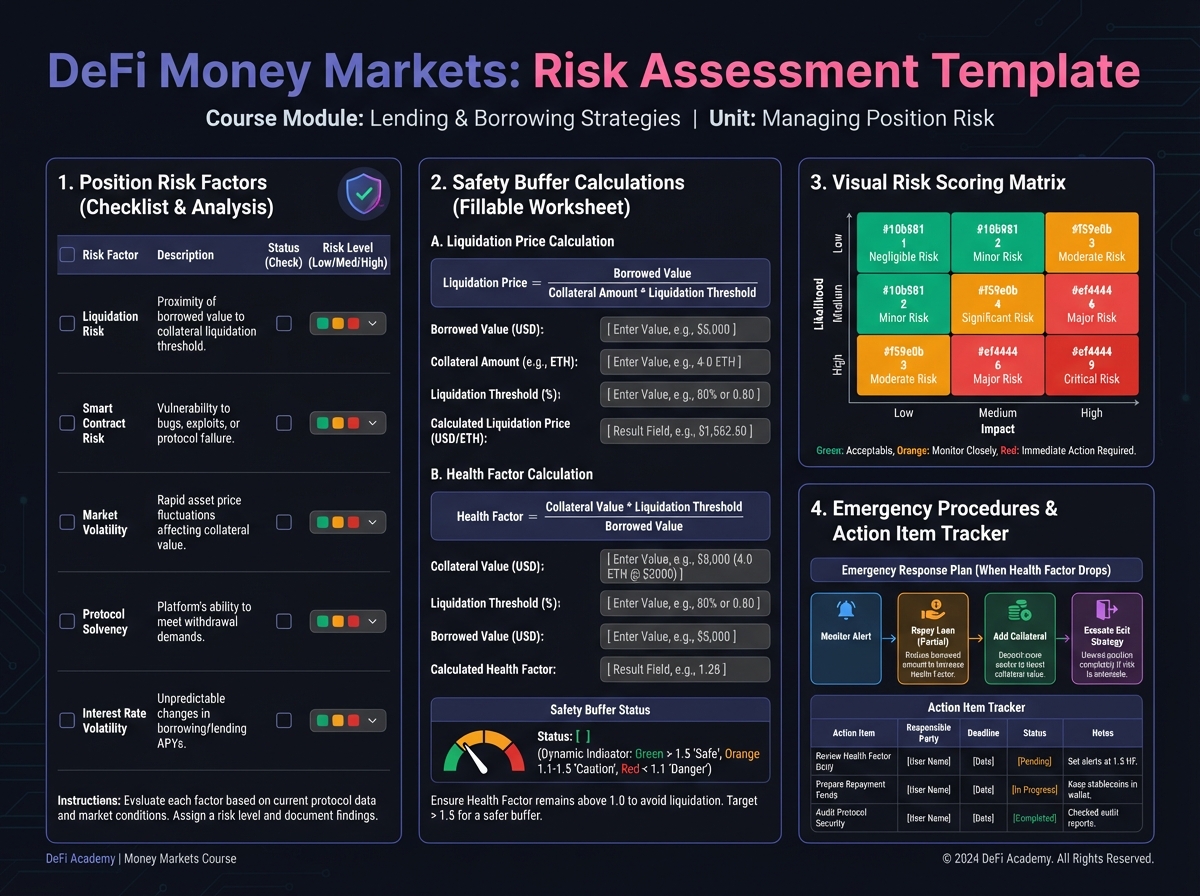

Exercise 3: Risk Assessment and Position Management

⚠️ Phase 1: Risk Identification (15 minutes)

Position Risk Assessment

Risk Factor

Assessment

Mitigation

Things to Avoid Checklist

🛡️ Phase 2: Safety Buffer Calculation (15 minutes)

Buffer Analysis

Emergency Procedures

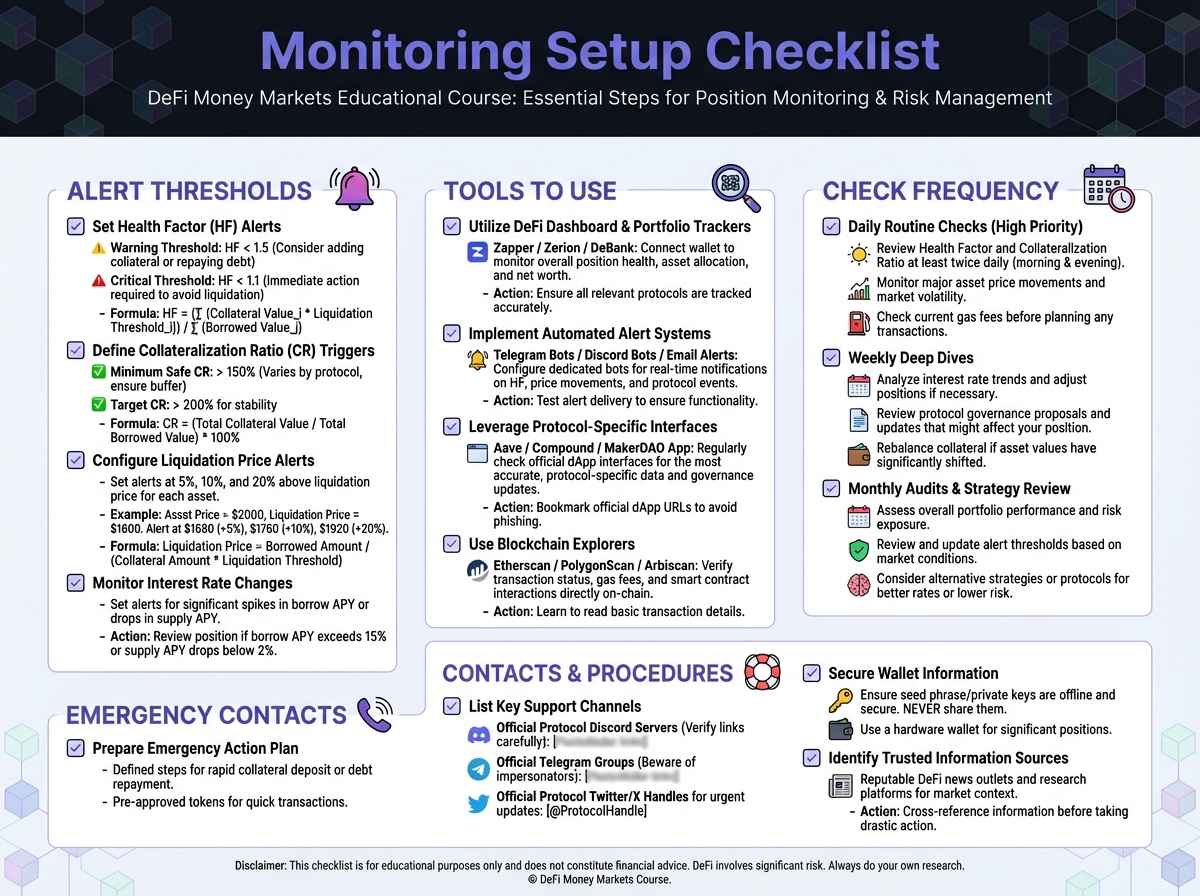

📊 Phase 3: Position Monitoring Setup (15 minutes)

Alert Configuration

Risk Dashboard

Metric

Current

Target

Status

✅ Self-Assessment

Last updated