Exercise 5: Aave Position Setup and Optimization

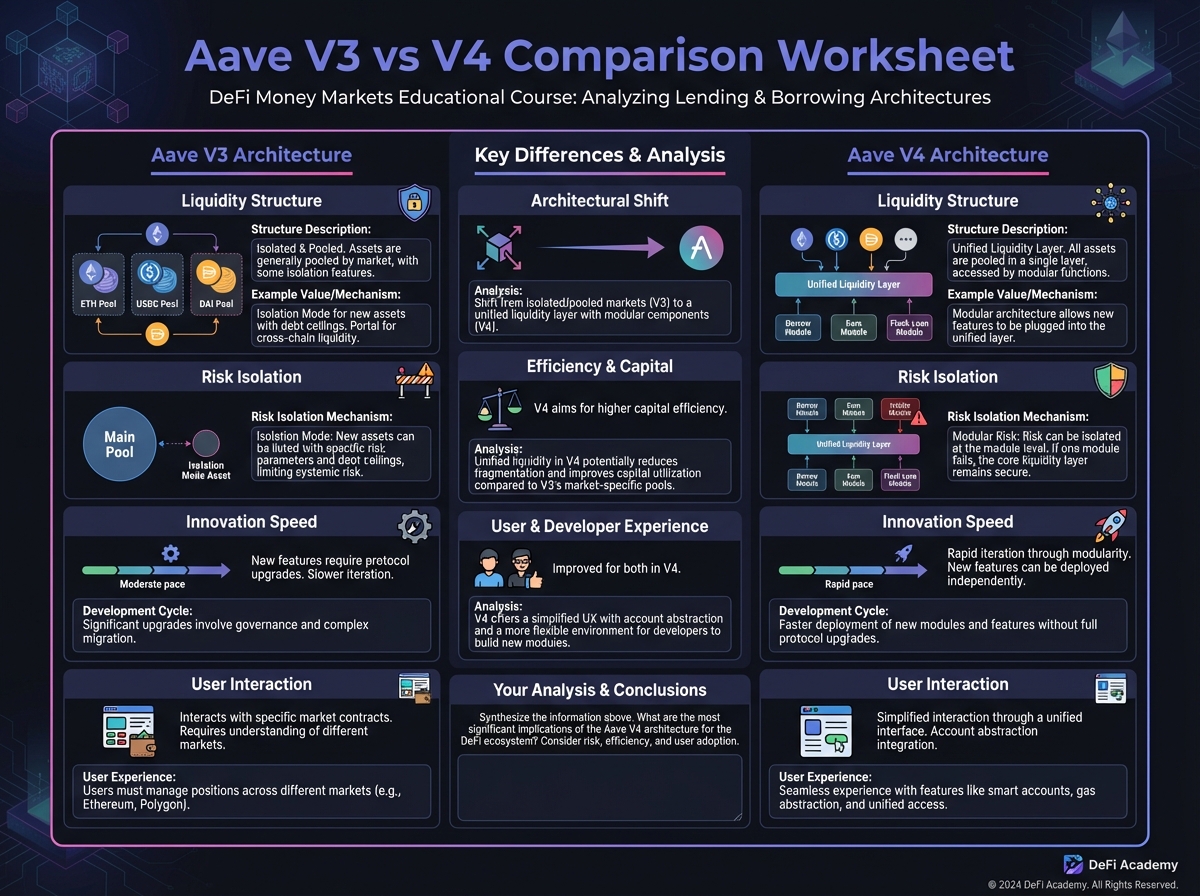

🏗️ Phase 1: Aave Architecture Understanding (15 minutes)

Feature

V3

V4

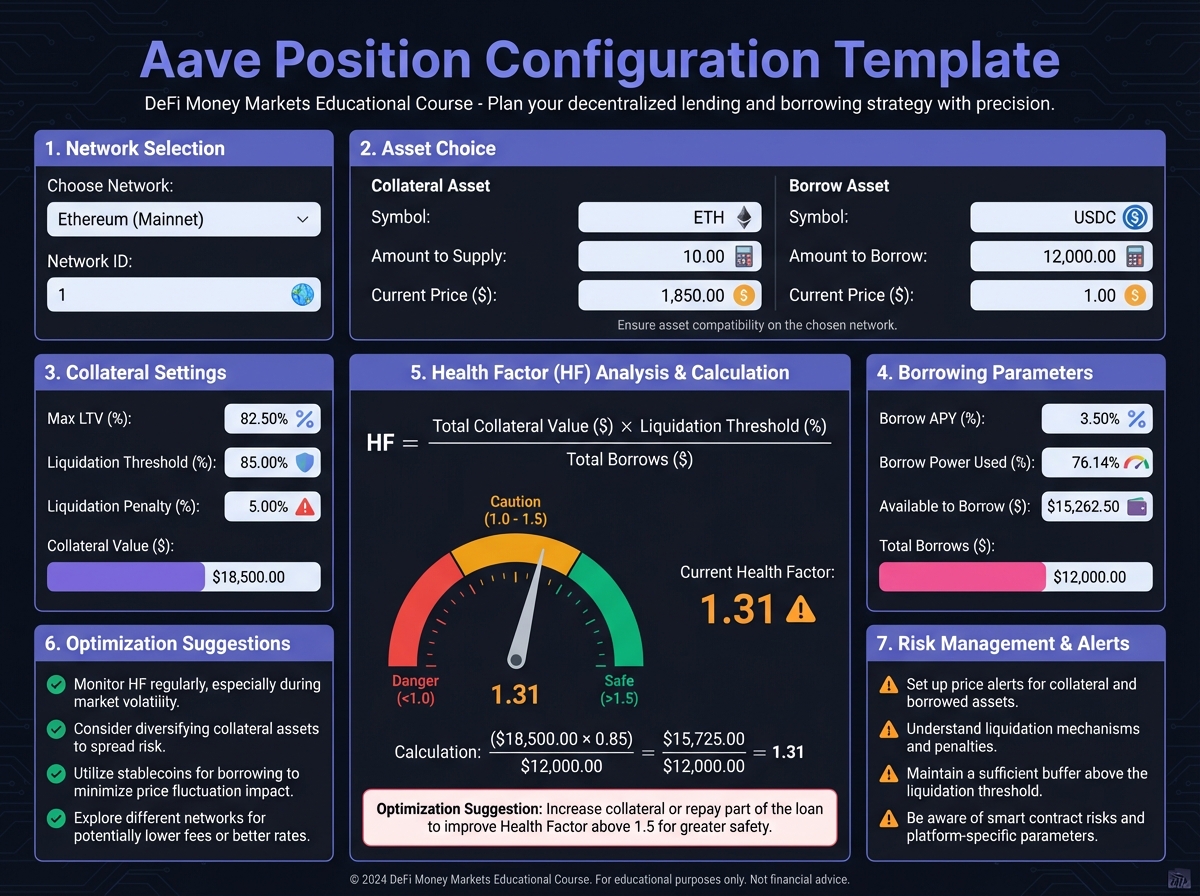

💼 Phase 2: Position Setup (20 minutes)

⚙️ Phase 3: Advanced Features (10 minutes)

📊 Phase 4: Optimization (15 minutes)

✅ Action Items

PreviousLesson 5: Aave - The Monolithic StandardNextLesson 6: Morpho - Modular Lending Infrastructure

Last updated