Exercise 9: Yield Optimization Framework

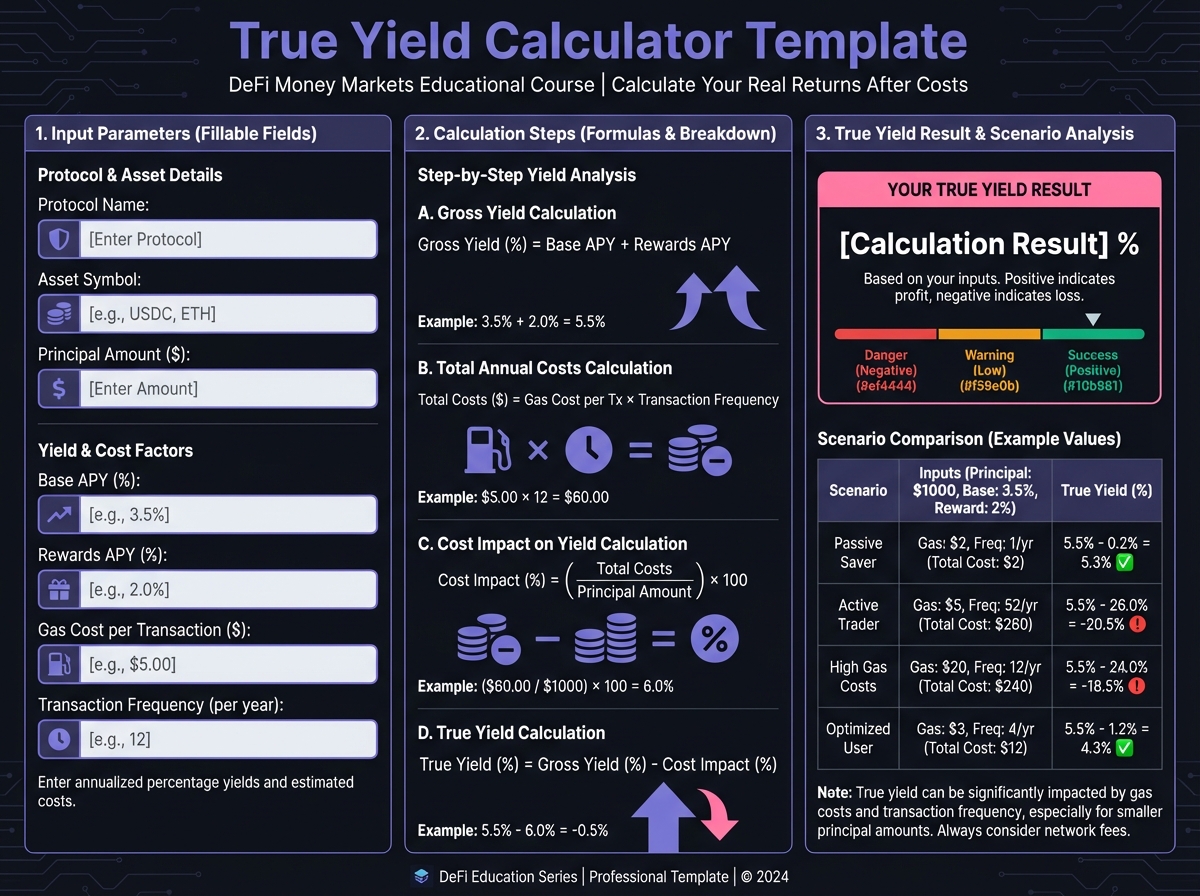

💰 Phase 1: True Yield Calculation (20 minutes)

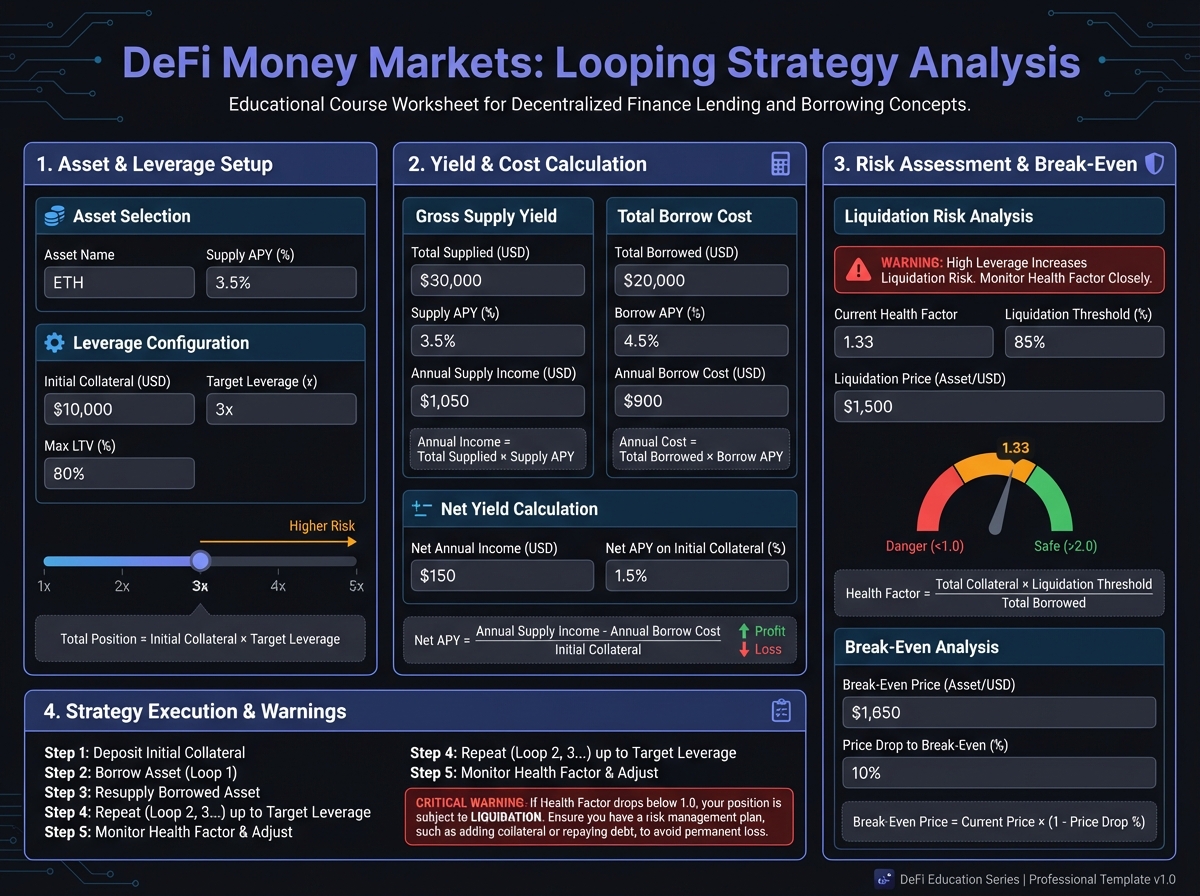

🔄 Phase 2: Looping Analysis (20 minutes)

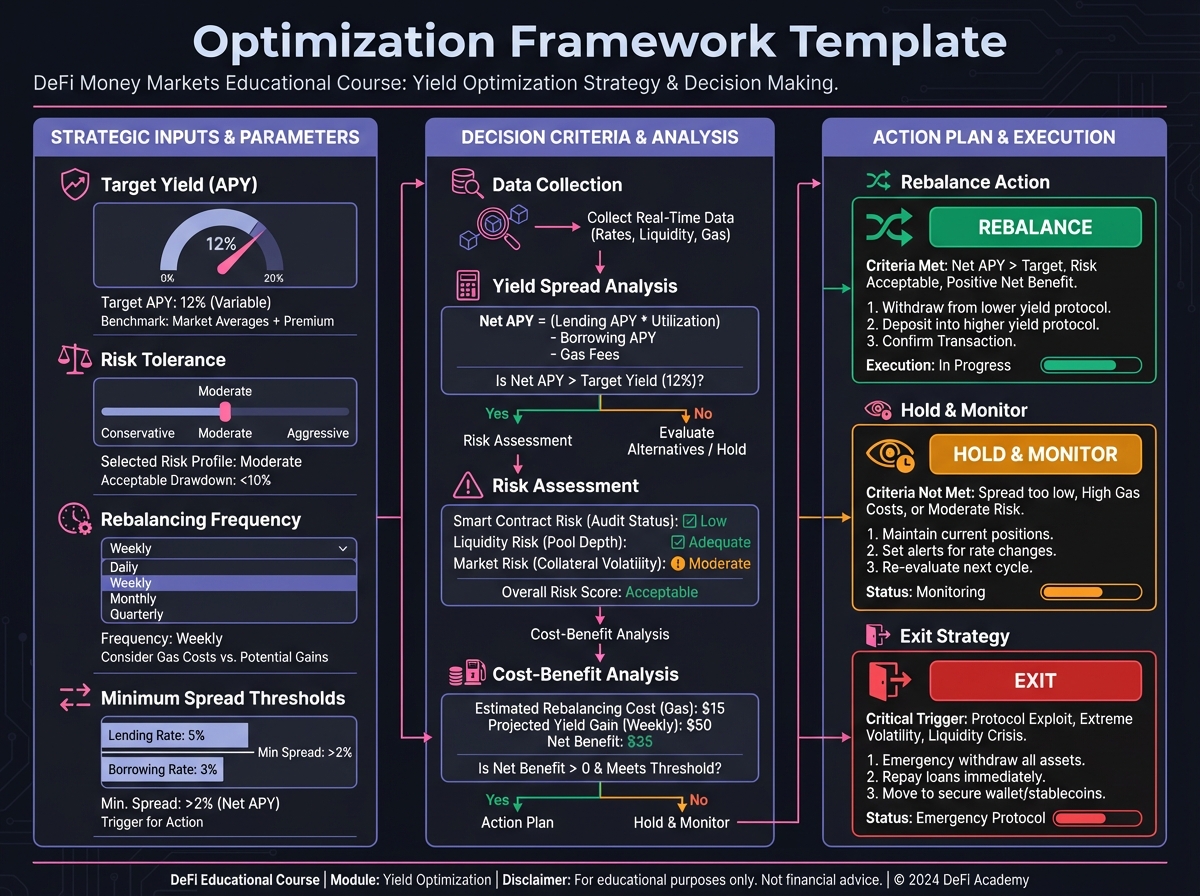

🌐 Phase 3: Cross-Protocol Optimization (20 minutes)

📊 Optimization Framework

✅ Action Plan

Last updated