Exercise 10: Risk Management Framework Design

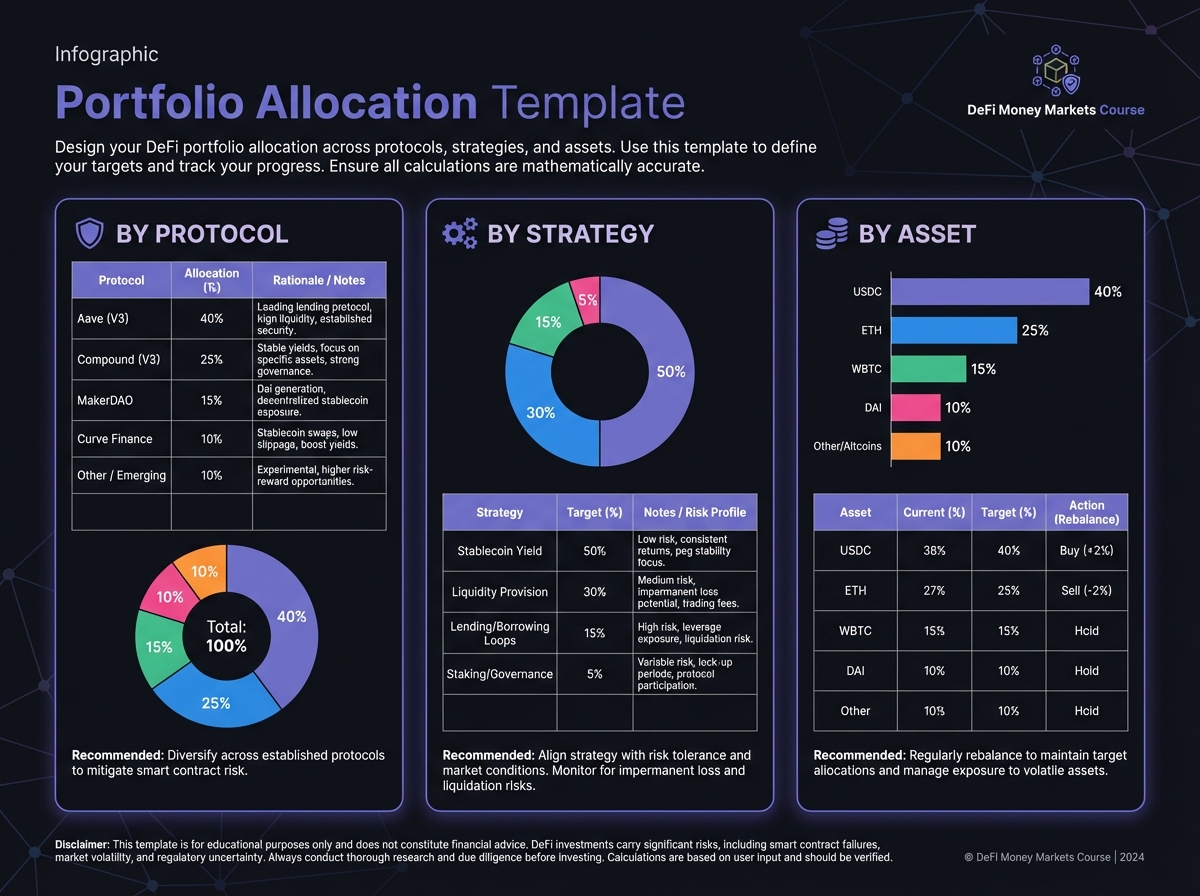

📊 Phase 1: Portfolio Diversification (20 minutes)

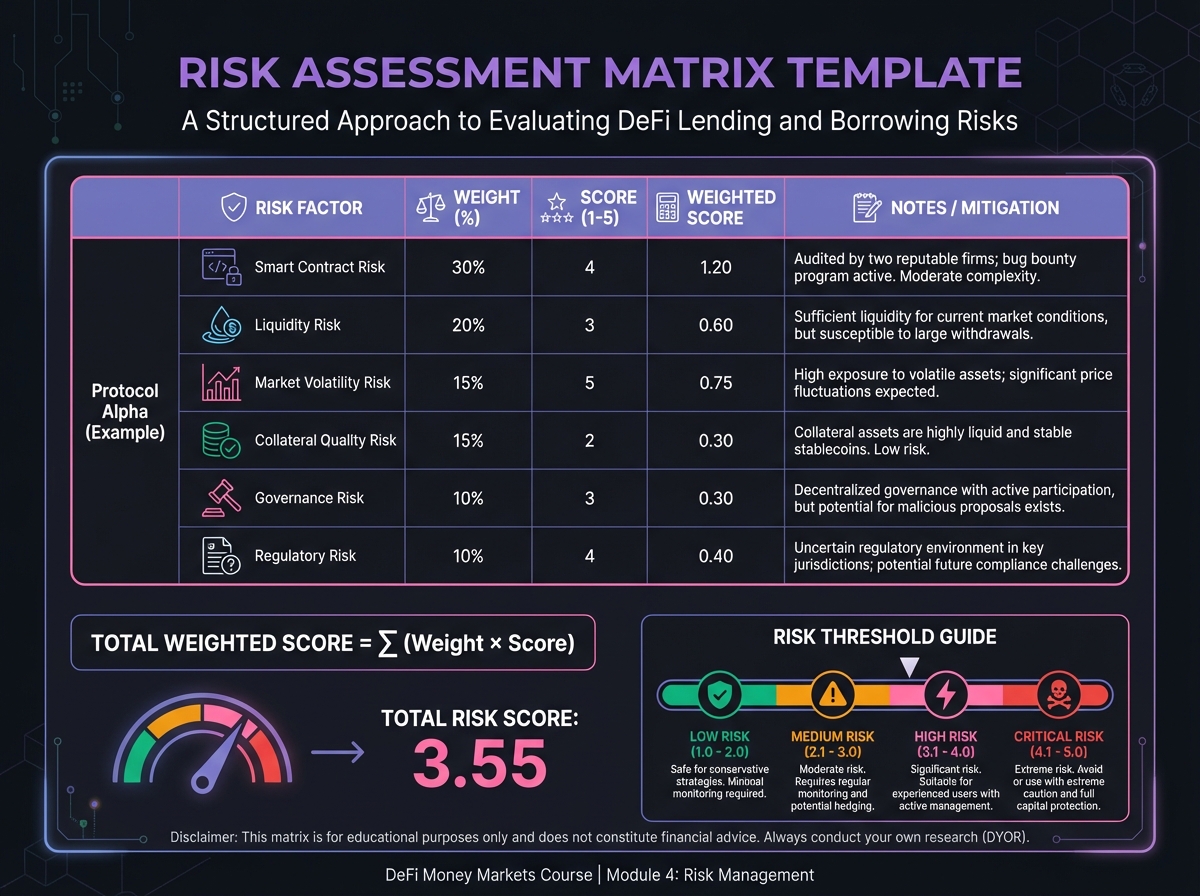

🛡️ Phase 2: Risk Assessment Matrix (25 minutes)

Position

Protocol Risk

Collateral Risk

HF

Liquidity Risk

Total Score

📈 Phase 3: Hedging Strategy (20 minutes)

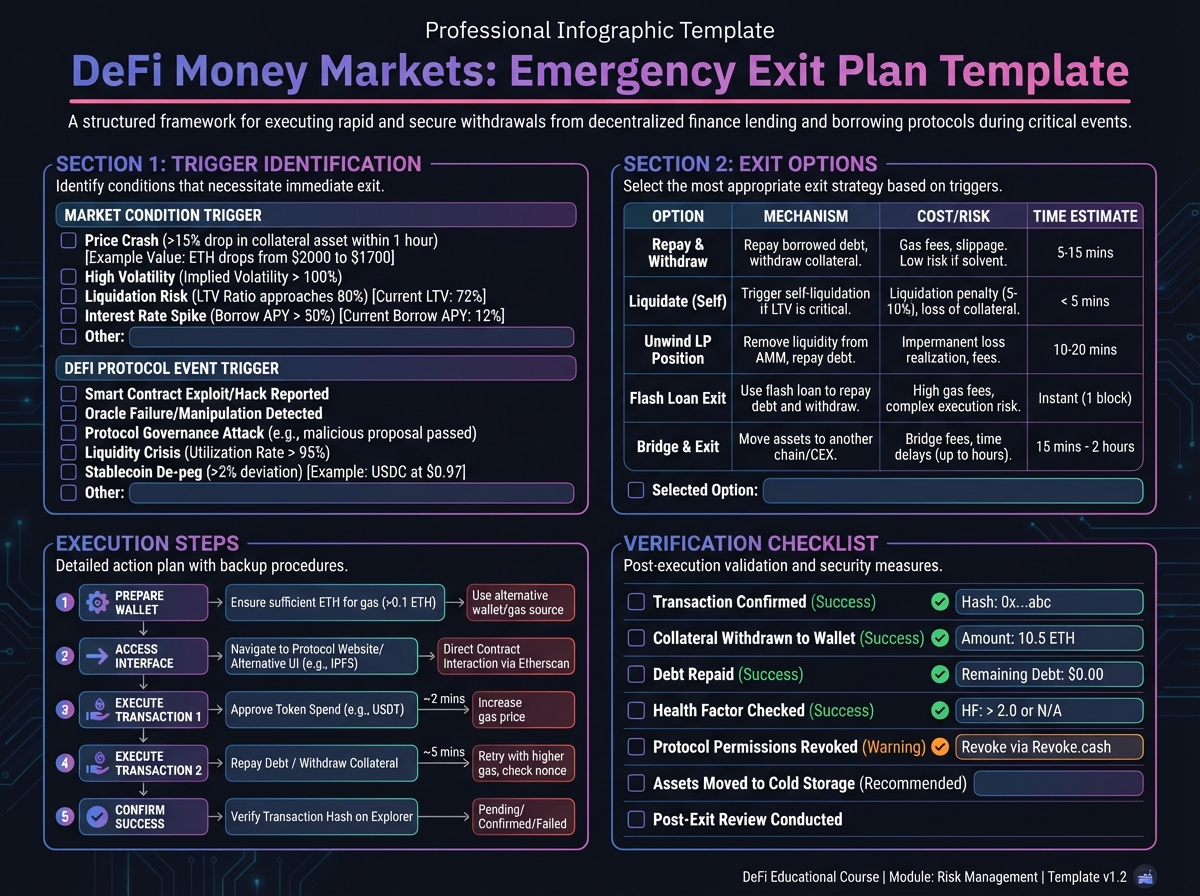

🚨 Phase 4: Emergency Procedures (25 minutes)

✅ Framework Completion

Last updated