Exercise 12: Complete System Integration

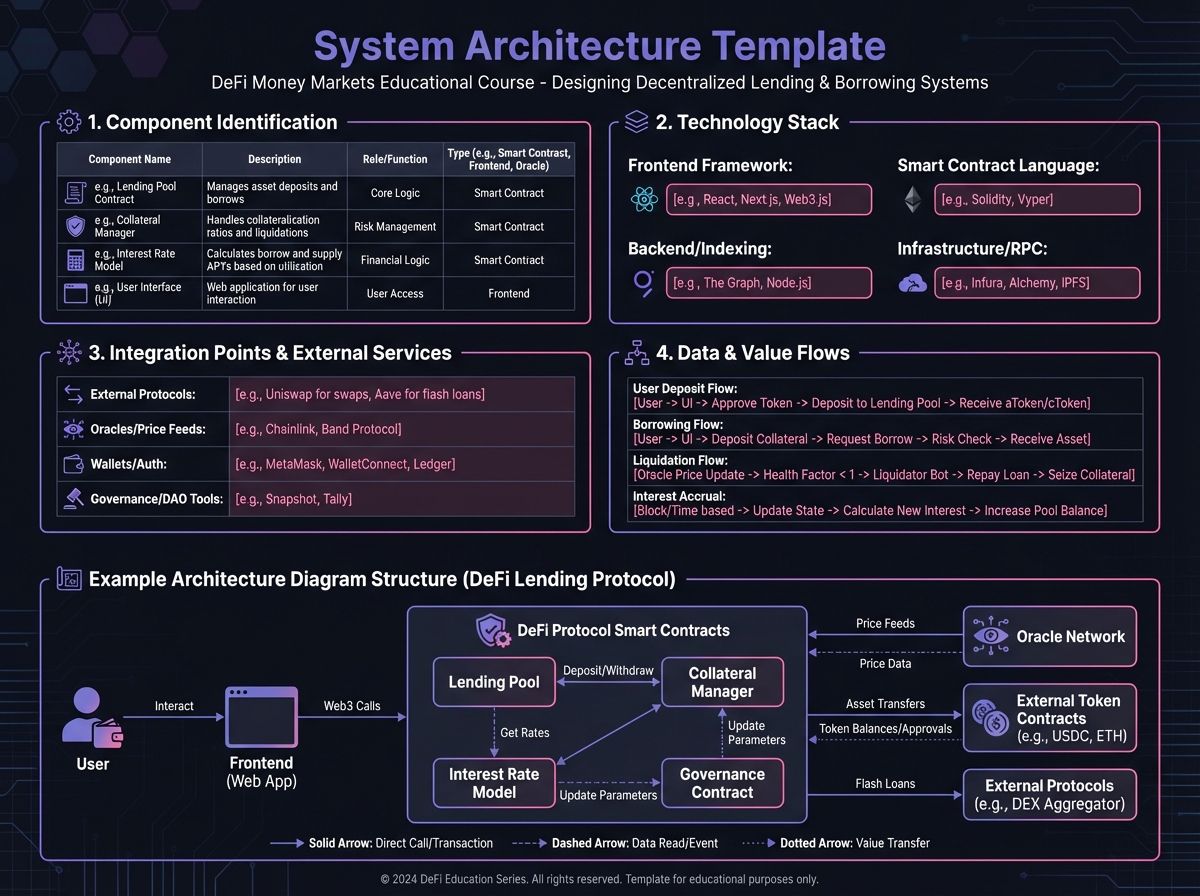

🏗️ Phase 1: System Architecture (30 minutes)

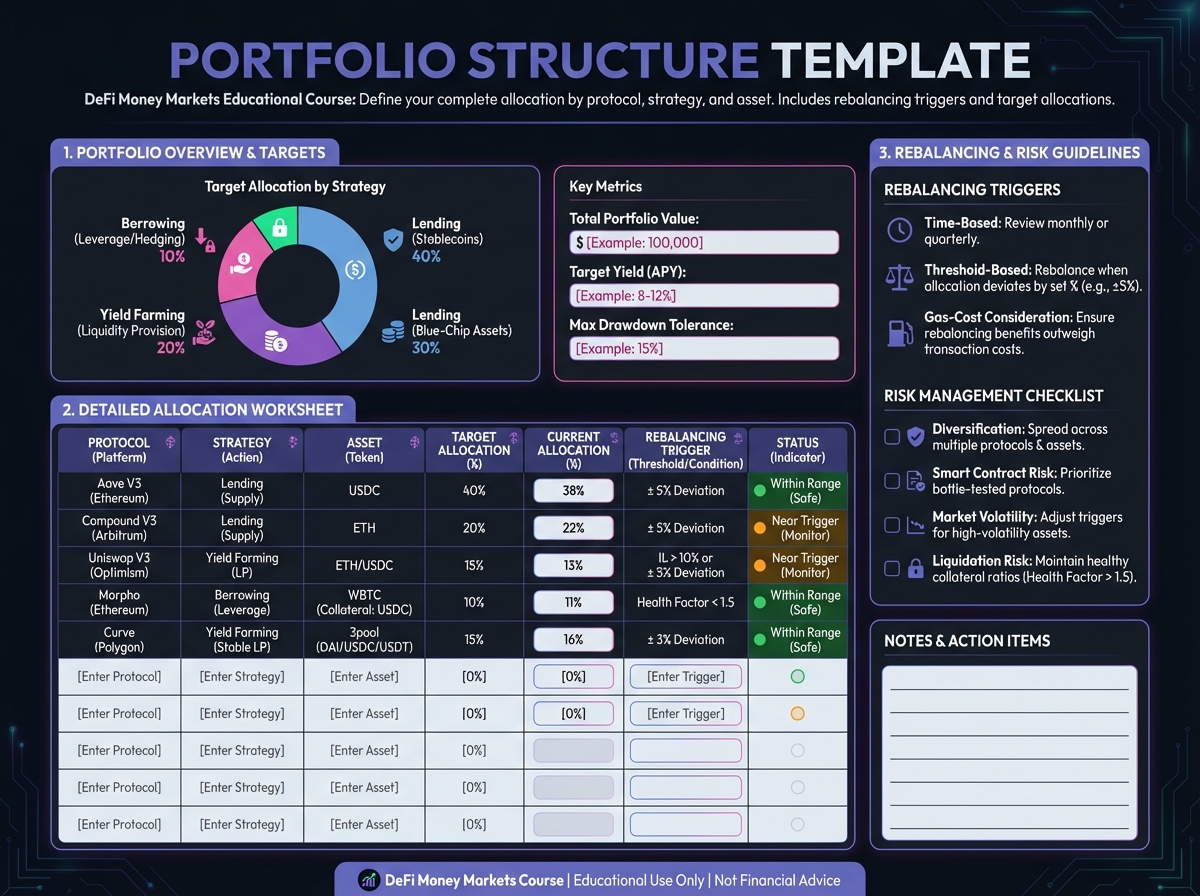

📊 Phase 2: Portfolio Structure (25 minutes)

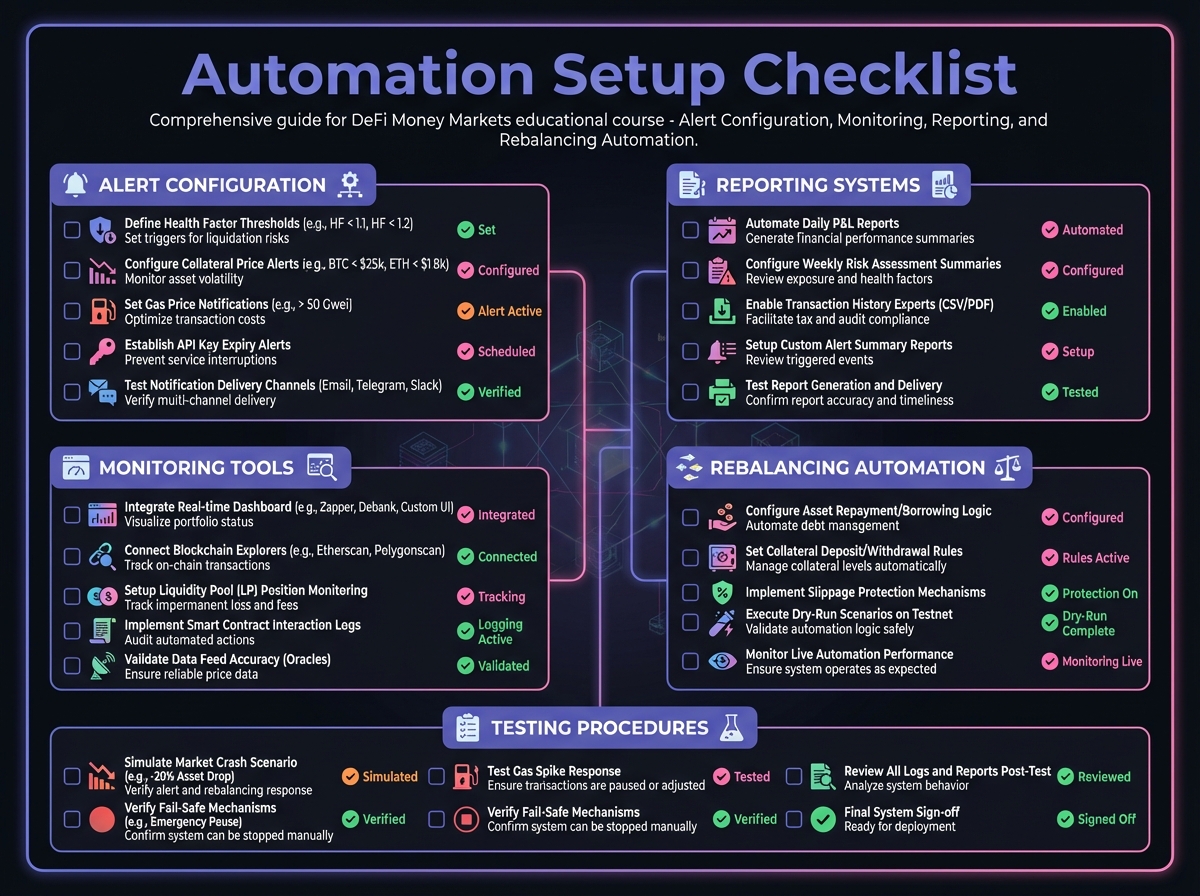

🔧 Phase 3: Automation Setup (25 minutes)

📋 Phase 4: Documentation (30 minutes)

🎯 Phase 5: Graduation Path (10 minutes)

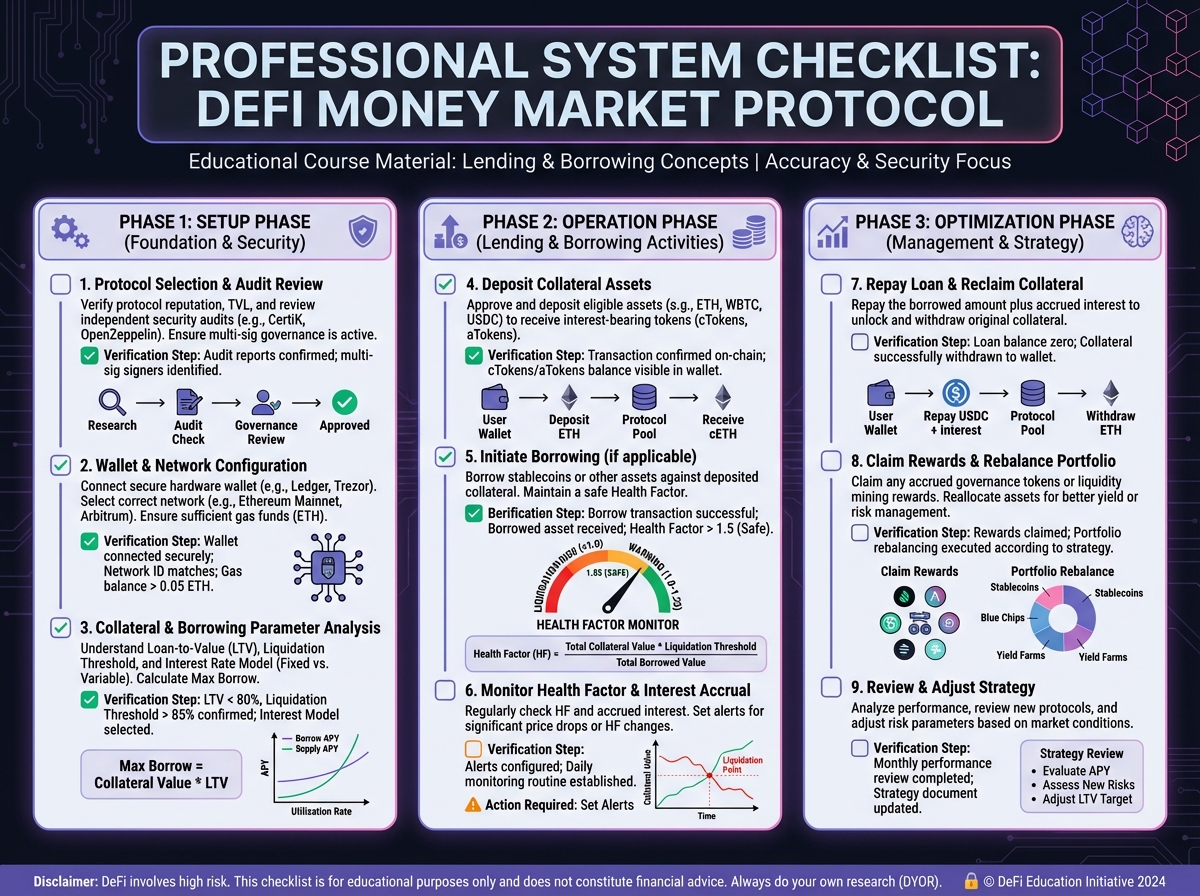

✅ System Checklist

🎓 Course Completion

Last updated