Lesson 9: Funding Rate Arbitrage Strategies

🎧 Lesson Podcast

🎬 Video Overview

Lesson 9: Funding Rate Arbitrage Strategies

🎯 Core Concept: Capturing Funding Rates Without Price Risk

Why Funding Arbitrage Matters

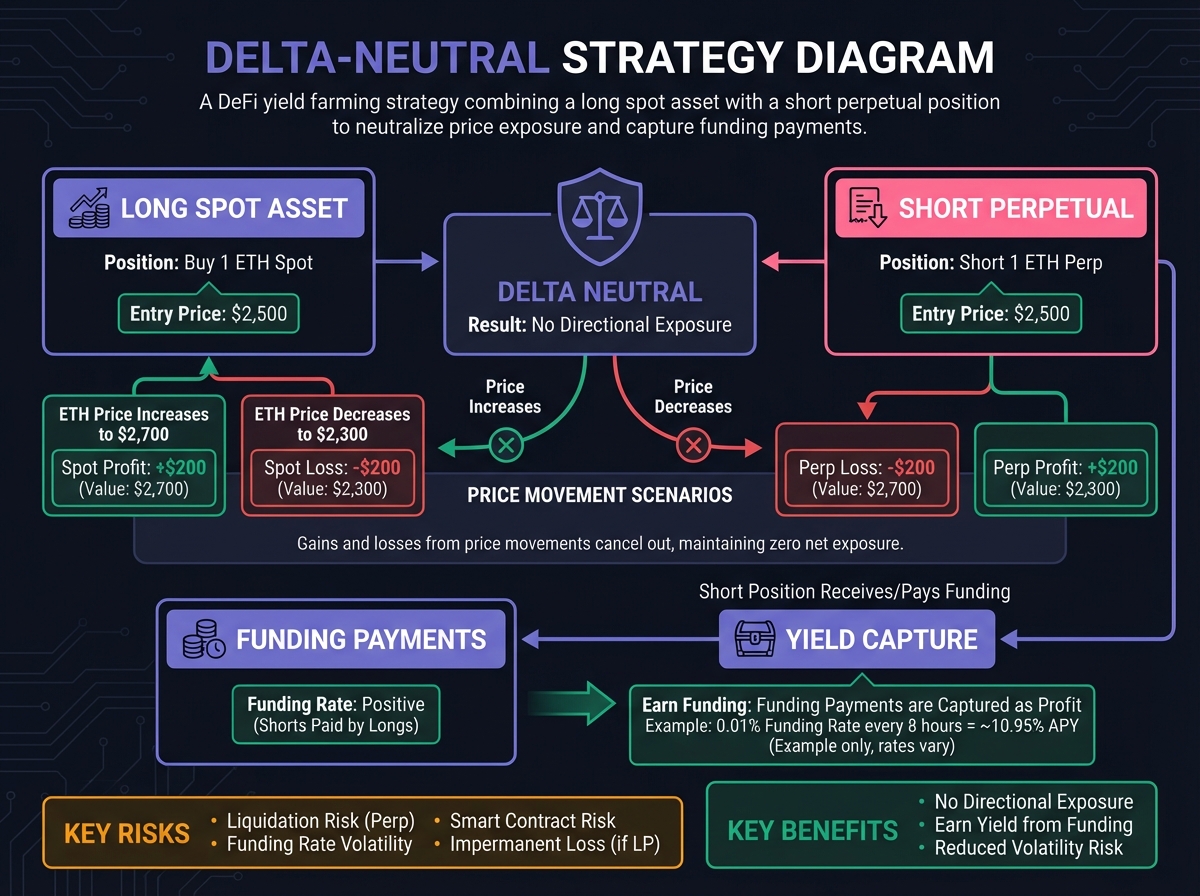

💰 Strategy 1: Delta-Neutral Yield Farming

The Basic Setup

Execution Steps

Risks and Mitigation

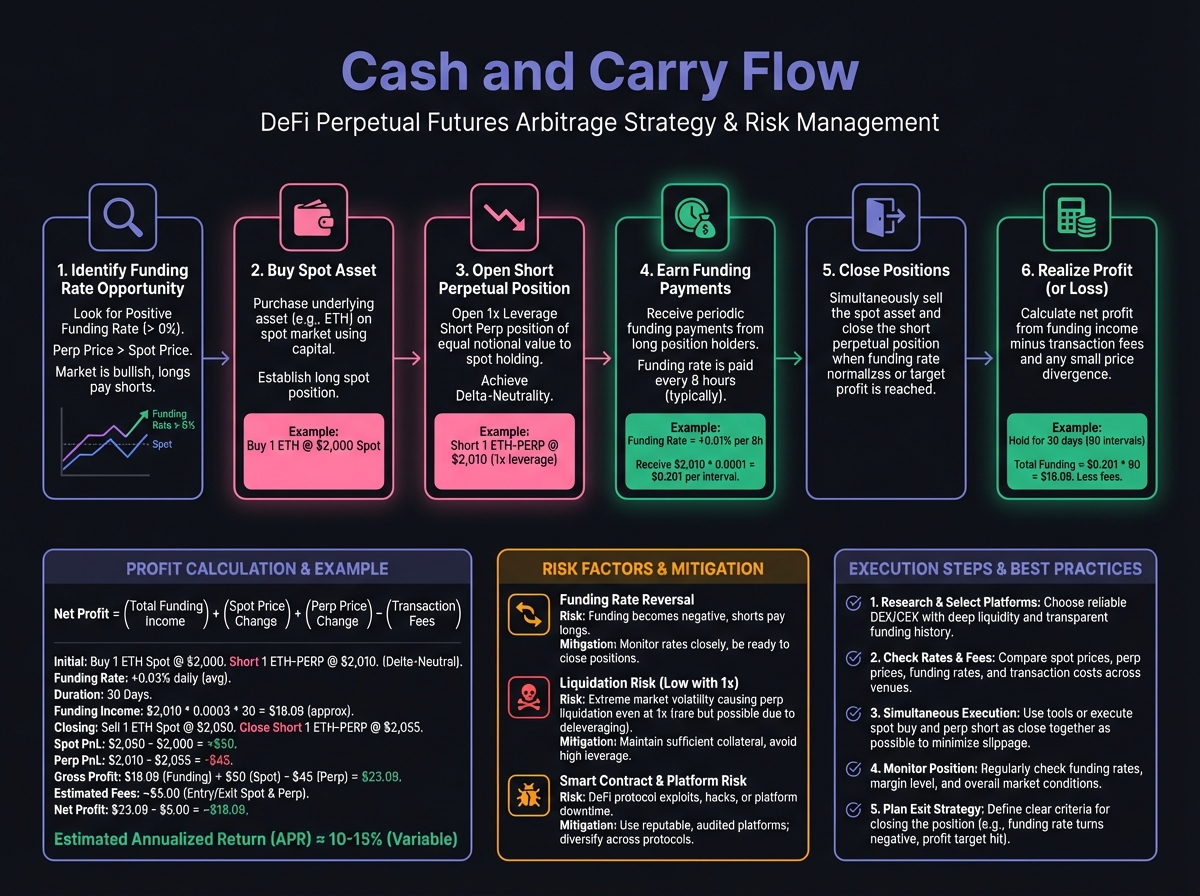

🔄 Strategy 2: Cash and Carry Basis Trade

The Concept

Example

When to Use

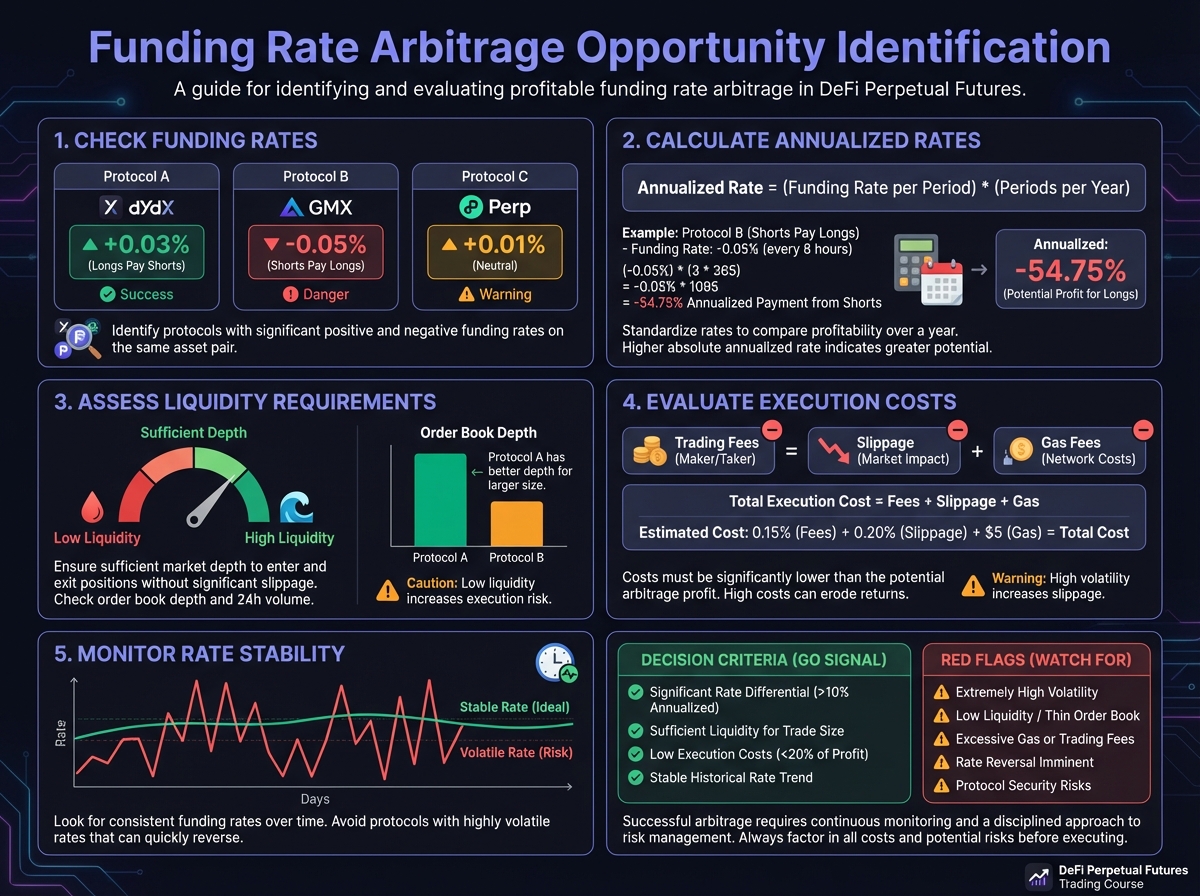

🌐 Strategy 3: Cross-Protocol Arbitrage

The Opportunity

Execution

Considerations

📊 Strategy 4: Funding Rate Prediction

The Concept

Execution

Risks

🎓 Beginner's Corner: Simple Funding Capture

Your First Arbitrage

🔬 Advanced Deep-Dive: Optimized Arbitrage

Multi-Asset Strategies

Automated Strategies

Yield-Bearing Collateral Enhancement

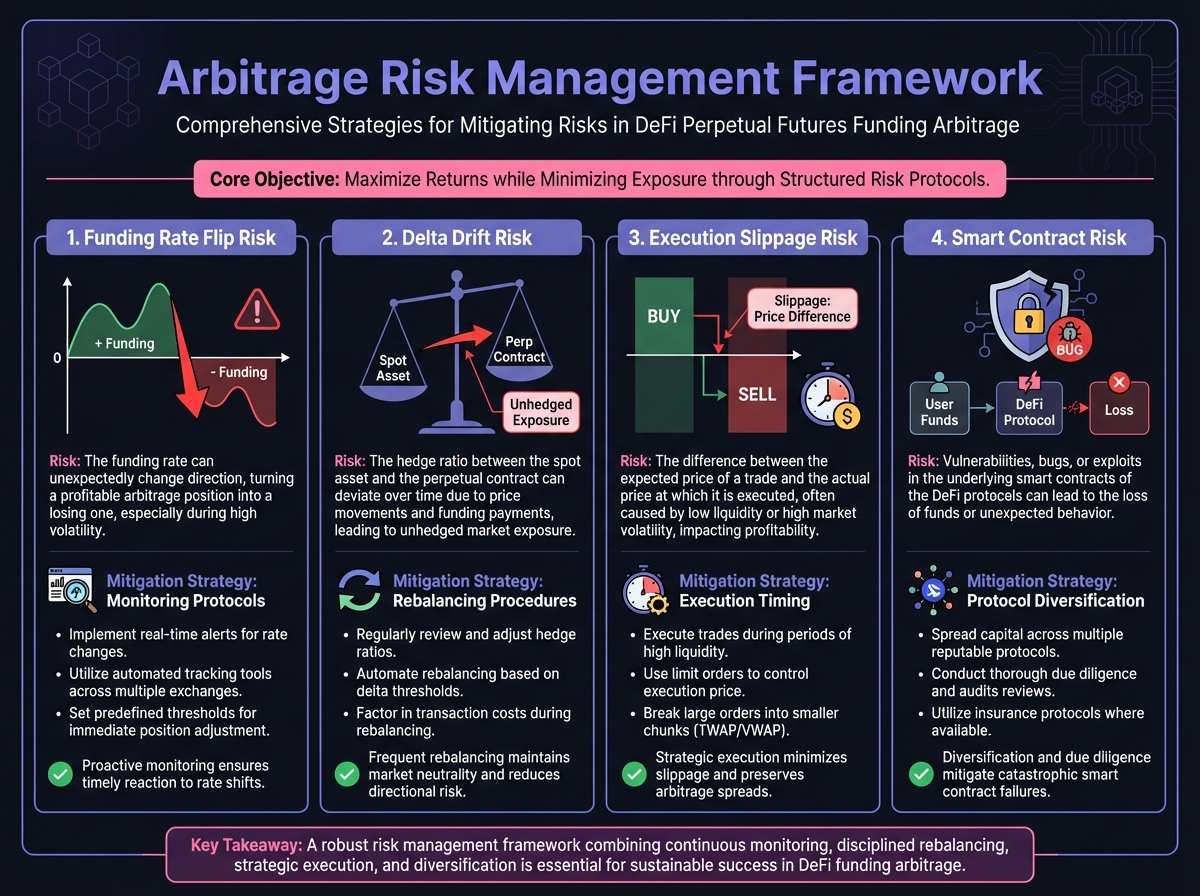

⚠️ Critical Risks

Funding Rate Volatility

Execution Risk

Protocol Risk

Capital Efficiency

📊 Real-World Example: Complete Arbitrage Setup

🛠️ Arbitrage Tools

Funding Rate Calculator

Delta-Neutral Position Builder

🔑 Key Takeaways

🚀 Next Steps

Last updated