Exercise 9: Funding Rate Arbitrage Framework

🔍 Phase 1: Opportunity Identification (20 minutes)

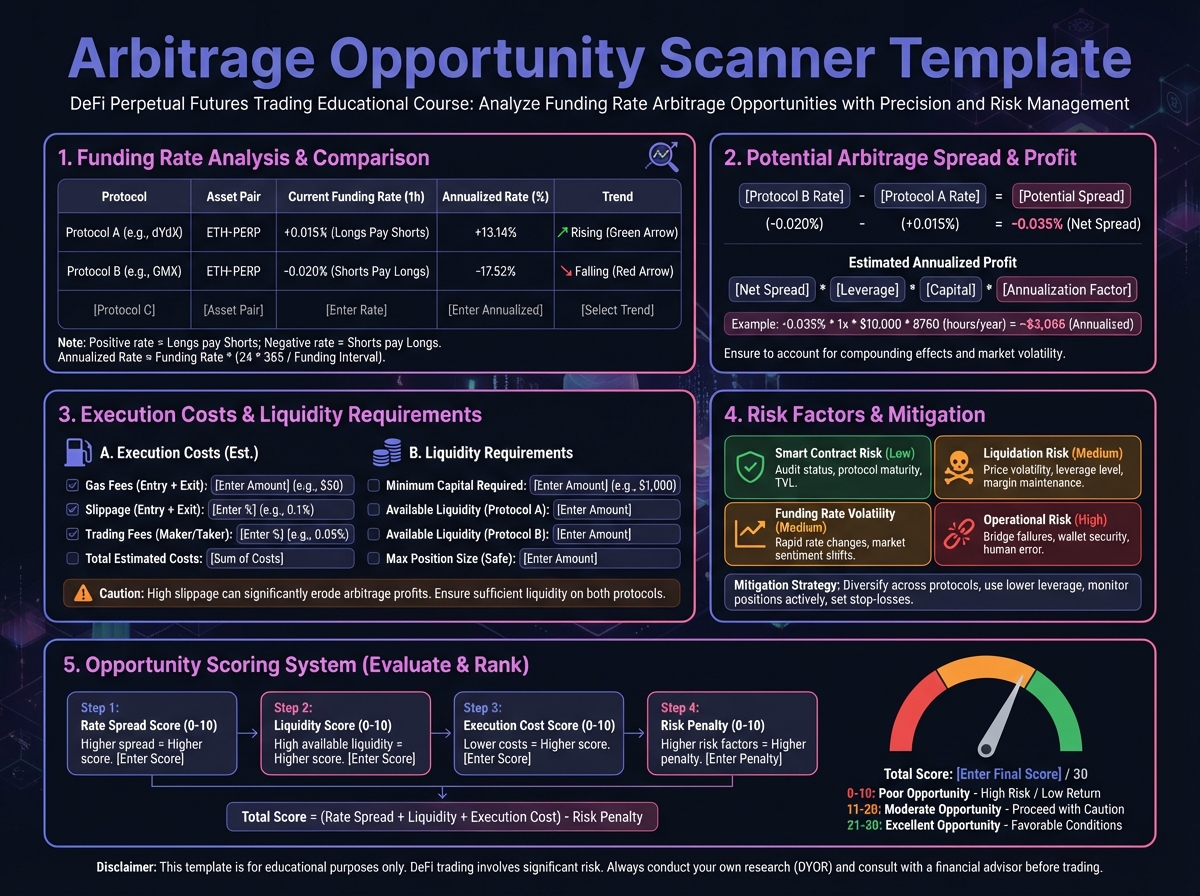

Exercise 1: Funding Rate Analysis

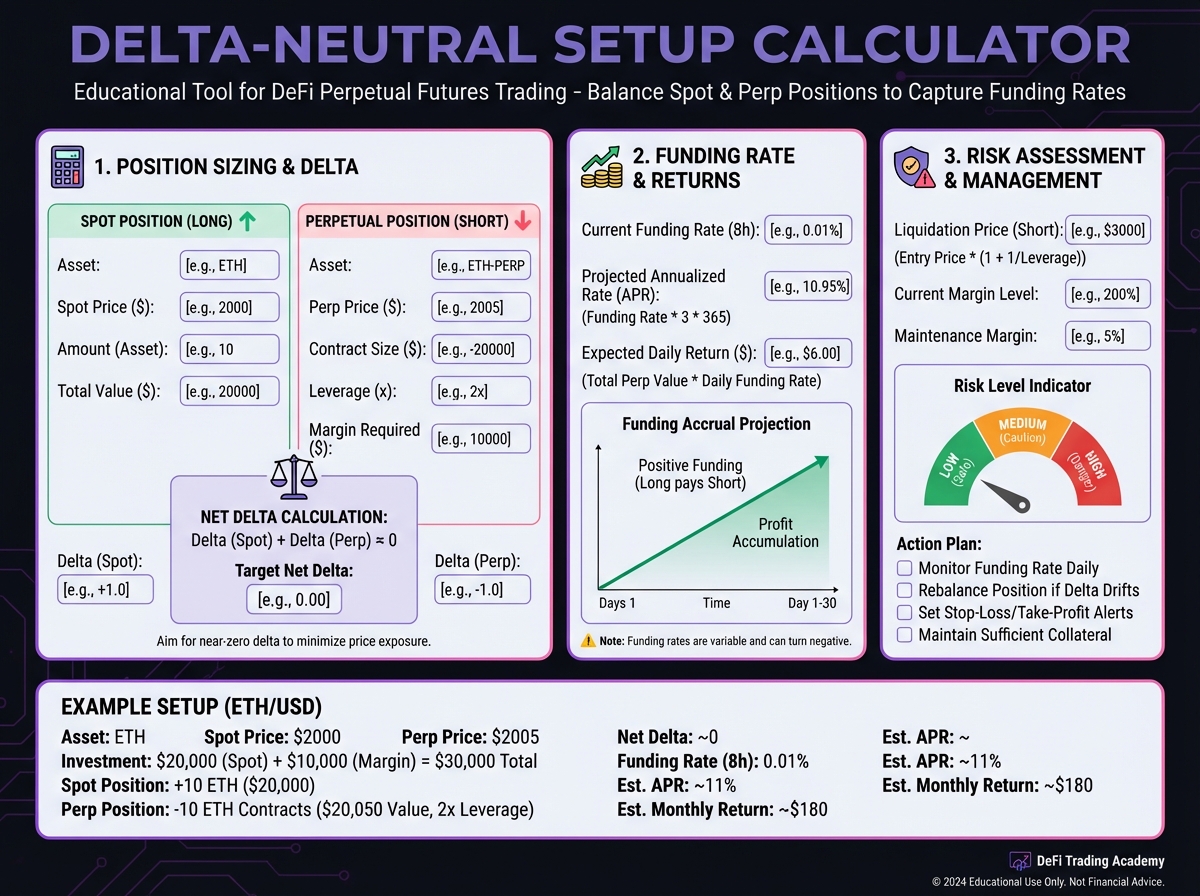

Market

Spot Price

Perp Price

Basis

Funding Rate (per hour)

Annualized

Exercise 2: Delta-Neutral Setup

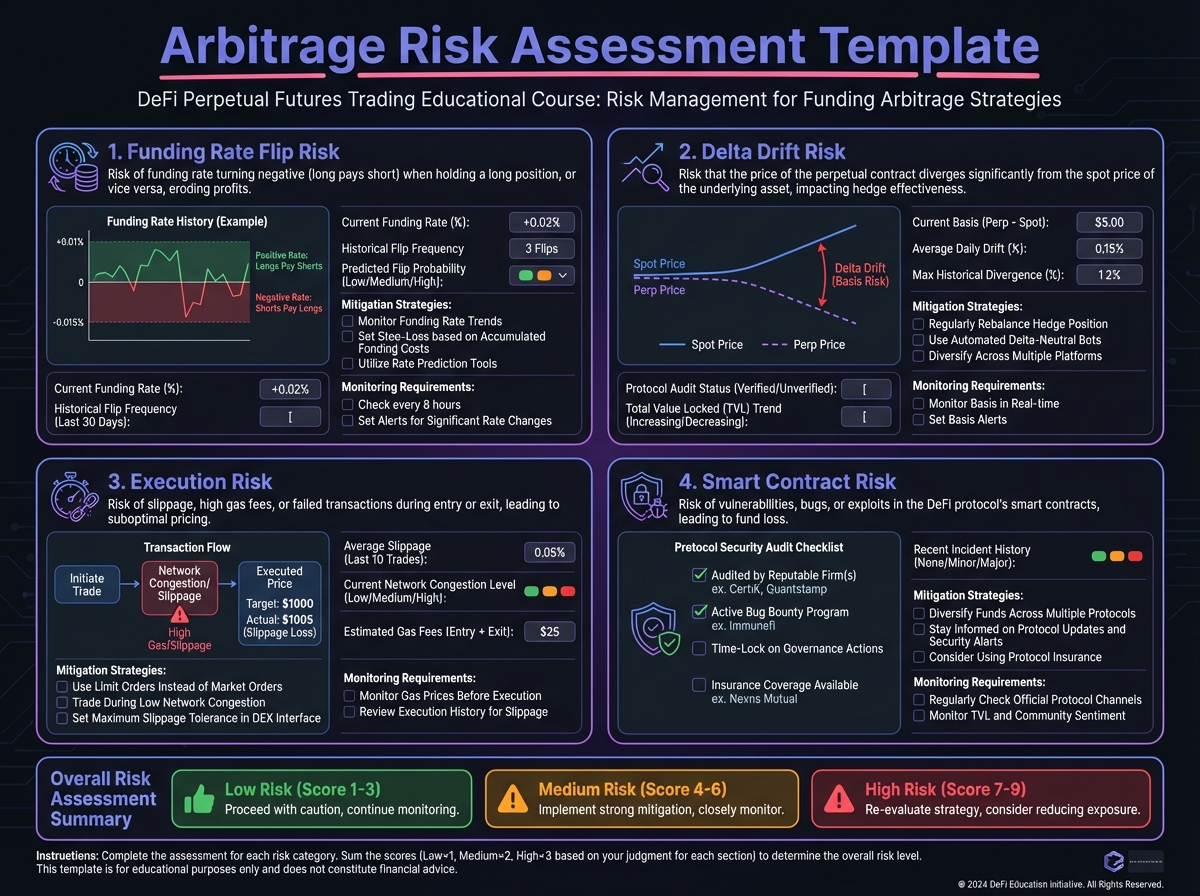

Exercise 3: Risk Assessment

📊 Phase 2: Strategy Design (20 minutes)

Exercise 4: Cash and Carry Trade

Exercise 5: Cross-Protocol Arbitrage

💡 Phase 3: Execution Planning (15 minutes)

Exercise 6: Execution Sequence

Exercise 7: Monitoring Plan

📈 Phase 4: Performance Projection (15 minutes)

Exercise 8: Return Calculation

Exercise 9: Scenario Analysis

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 9: Funding Rate Arbitrage StrategiesNextLesson 10: Risk Management and Position Protection

Last updated