Exercise 10: Risk Management Framework Design

🔍 Phase 1: Risk Tolerance Assessment (15 minutes)

Exercise 1: Personal Risk Profile

Exercise 2: Capital Allocation

Category

Amount

Percentage

Purpose

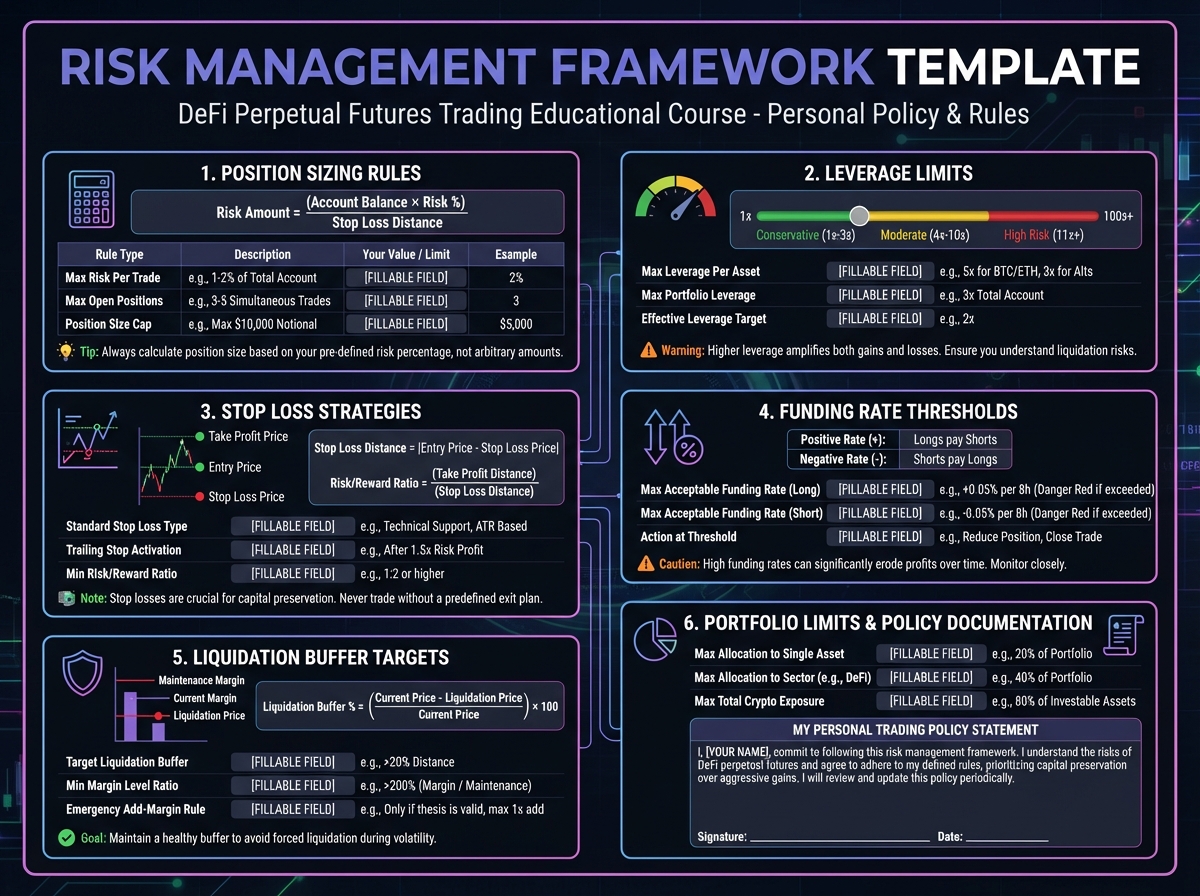

📊 Phase 2: Position Sizing Framework (20 minutes)

Exercise 3: Position Size Calculator

Exercise 4: Leverage Guidelines

Asset Type

Maximum Leverage

Reasoning

Exercise 5: Stop Loss Rules

🛡️ Phase 3: Risk Protection Strategies (20 minutes)

Exercise 6: Liquidation Prevention Plan

Exercise 7: Funding Rate Management

Exercise 8: Portfolio Health Monitoring

Metric

Target

Warning

Danger

Action

⚠️ Phase 4: Risk Scenario Planning (15 minutes)

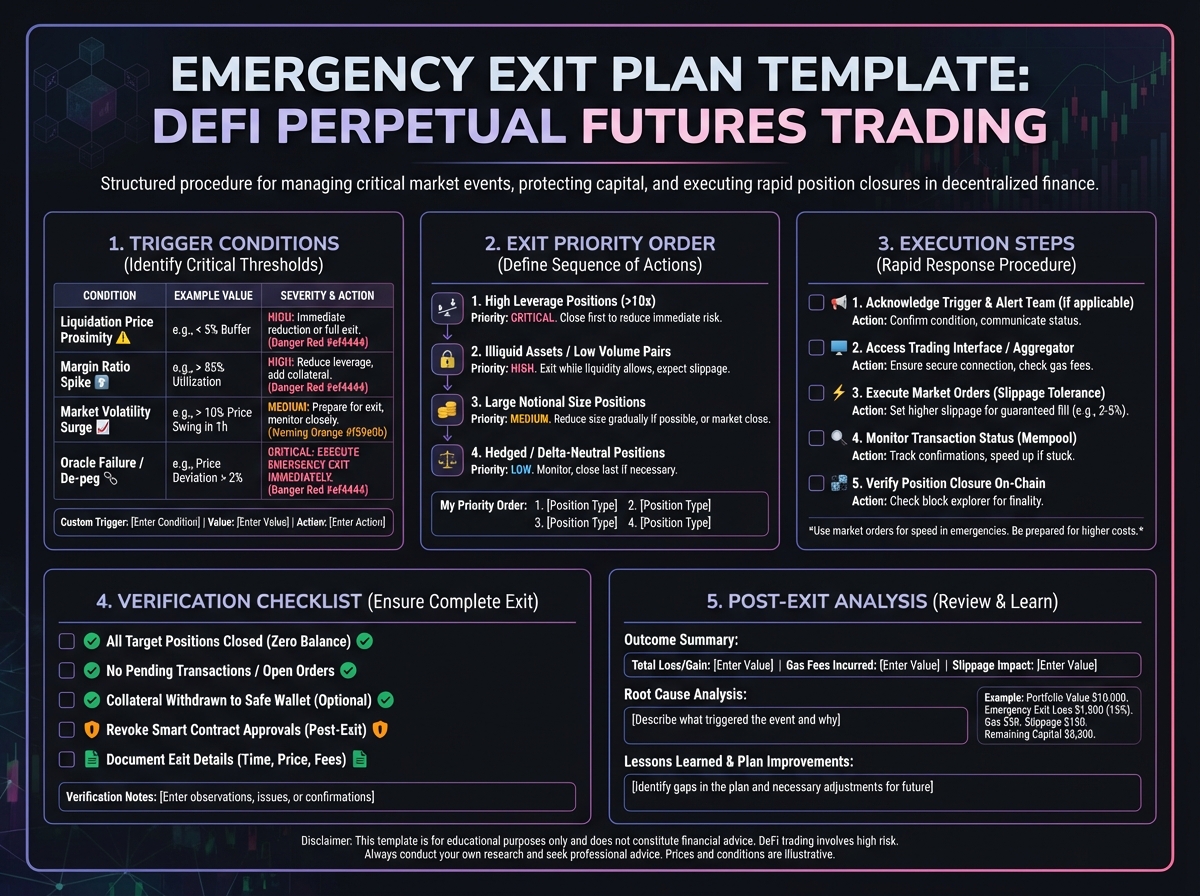

Exercise 9: Emergency Response Plan

Exercise 10: Risk Limits

📋 Phase 5: Risk Management Checklist (10 minutes)

Exercise 11: Pre-Trade Checklist

Exercise 12: Monitoring Schedule

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 10: Risk Management and Position ProtectionNextLesson 11: Advanced Topics and Emerging Trends

Last updated