Exercise 11: Advanced Strategy Integration

🔍 Phase 1: Multi-Protocol Strategy Design (20 minutes)

Exercise 1: Protocol Portfolio Allocation

Protocol

Allocation

Percentage

Primary Use Case

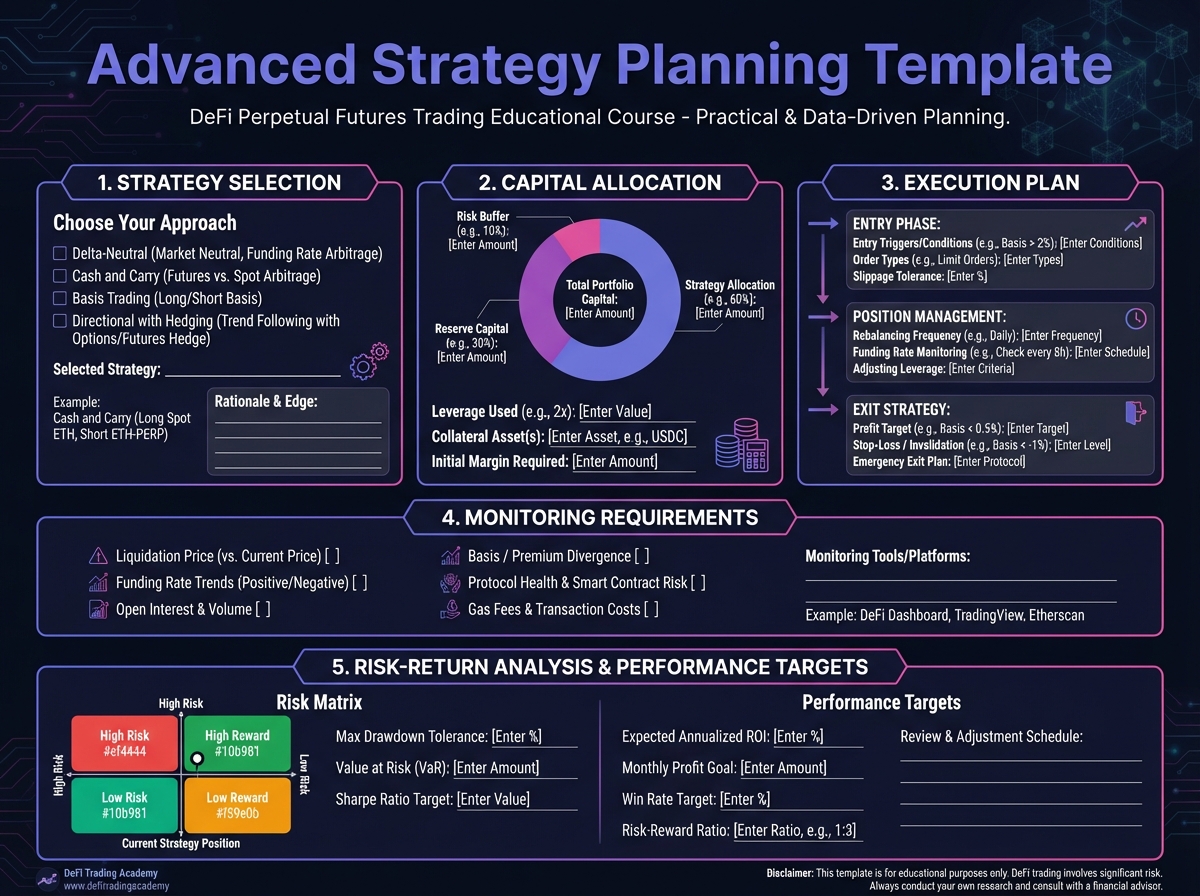

Exercise 2: Strategy Diversification

Strategy

Capital

Percentage

Protocols Used

💡 Phase 2: Advanced Feature Utilization (20 minutes)

Exercise 3: Yield-Bearing Collateral Strategy

Exercise 4: Cross-Margin Hedging Strategy

🚀 Phase 3: Automation and Optimization (15 minutes)

Exercise 5: Bot Strategy Design

Exercise 6: Vault Strategy Evaluation

📊 Phase 4: Emerging Trend Adoption (15 minutes)

Exercise 7: Mobile-First Strategy

Exercise 8: Account Abstraction Benefits

Exercise 9: Prediction Market Integration

🎯 Phase 5: Complete System Integration (15 minutes)

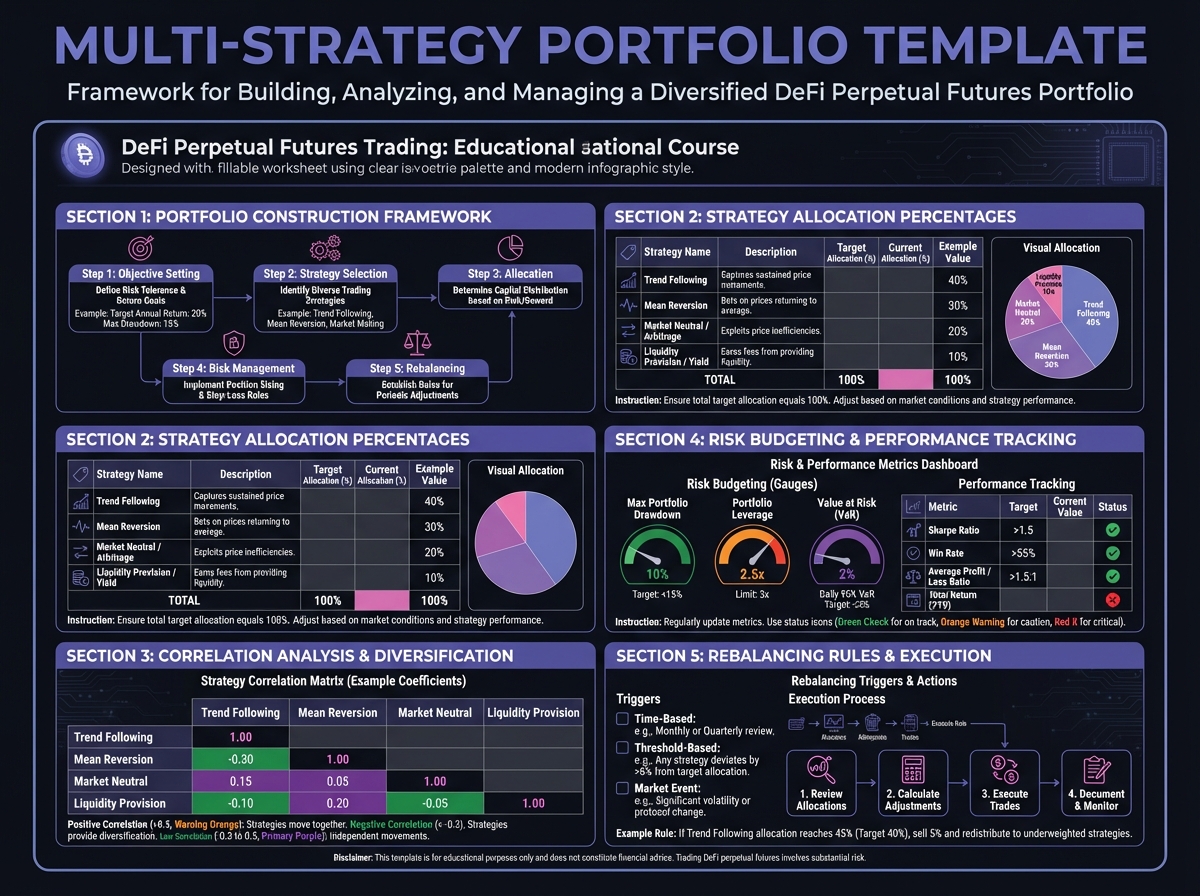

Exercise 10: Multi-Strategy Portfolio

Strategy

Capital

Protocol(s)

Expected Return

Risk Level

Exercise 11: Optimization Opportunities

✅ Self-Assessment

🎯 Next Steps

PreviousLesson 11: Advanced Topics and Emerging TrendsNextLesson 12: Building Your Professional Trading System

Last updated