Exercise 12: Complete System Integration

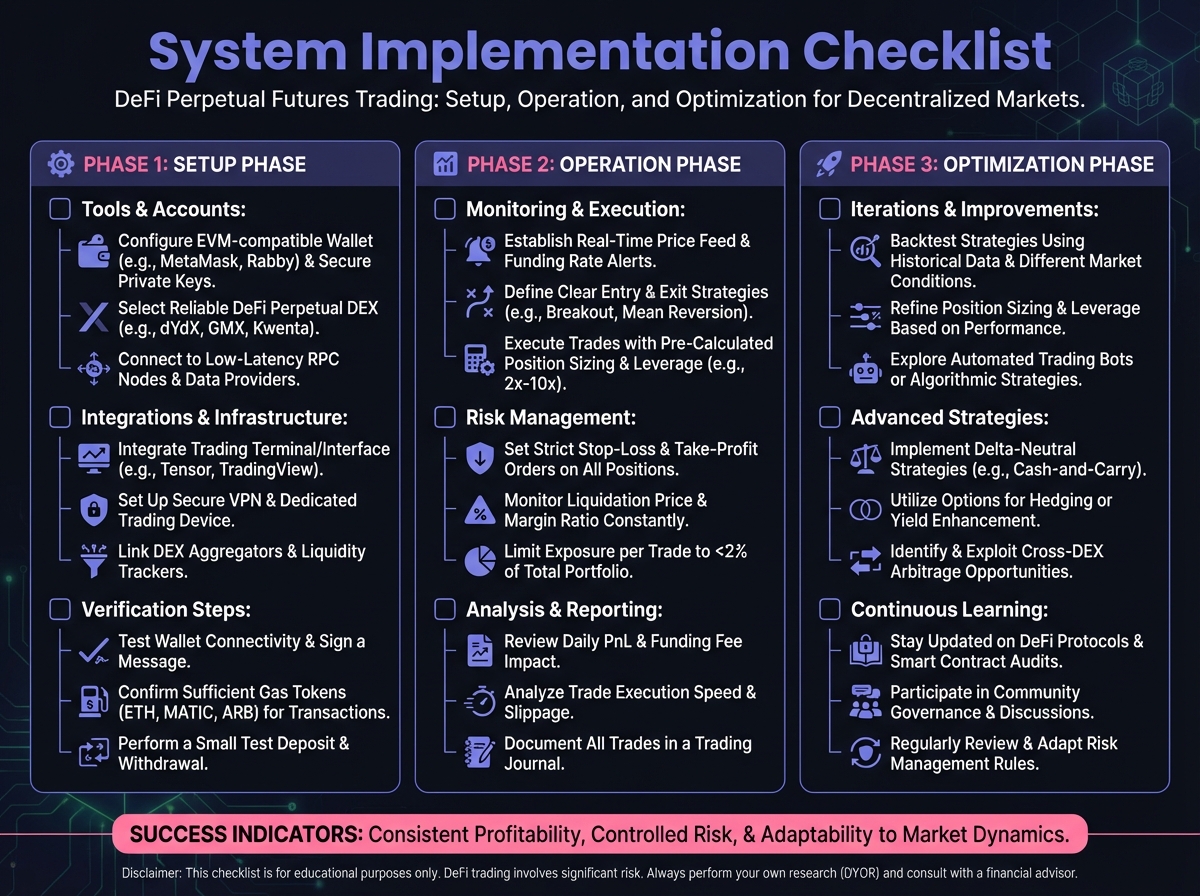

📋 Phase 1: System Foundation (30 minutes)

Exercise 1: Due Diligence Framework

Exercise 2: Protocol Selection Matrix

Protocol

Criterion 1

Criterion 2

Criterion 3

Criterion 4

Criterion 5

Criterion 6

Total

💰 Phase 2: Risk Management System (30 minutes)

Exercise 3: Complete Risk Framework

Exercise 4: Stop Loss and Exit Rules

Exercise 5: Monitoring System

📊 Phase 3: Strategy Framework (20 minutes)

Exercise 6: Multi-Strategy Allocation

Strategy

Capital

%

Protocols

Expected Return

Risk

Exercise 7: Protocol-Specific Strategies

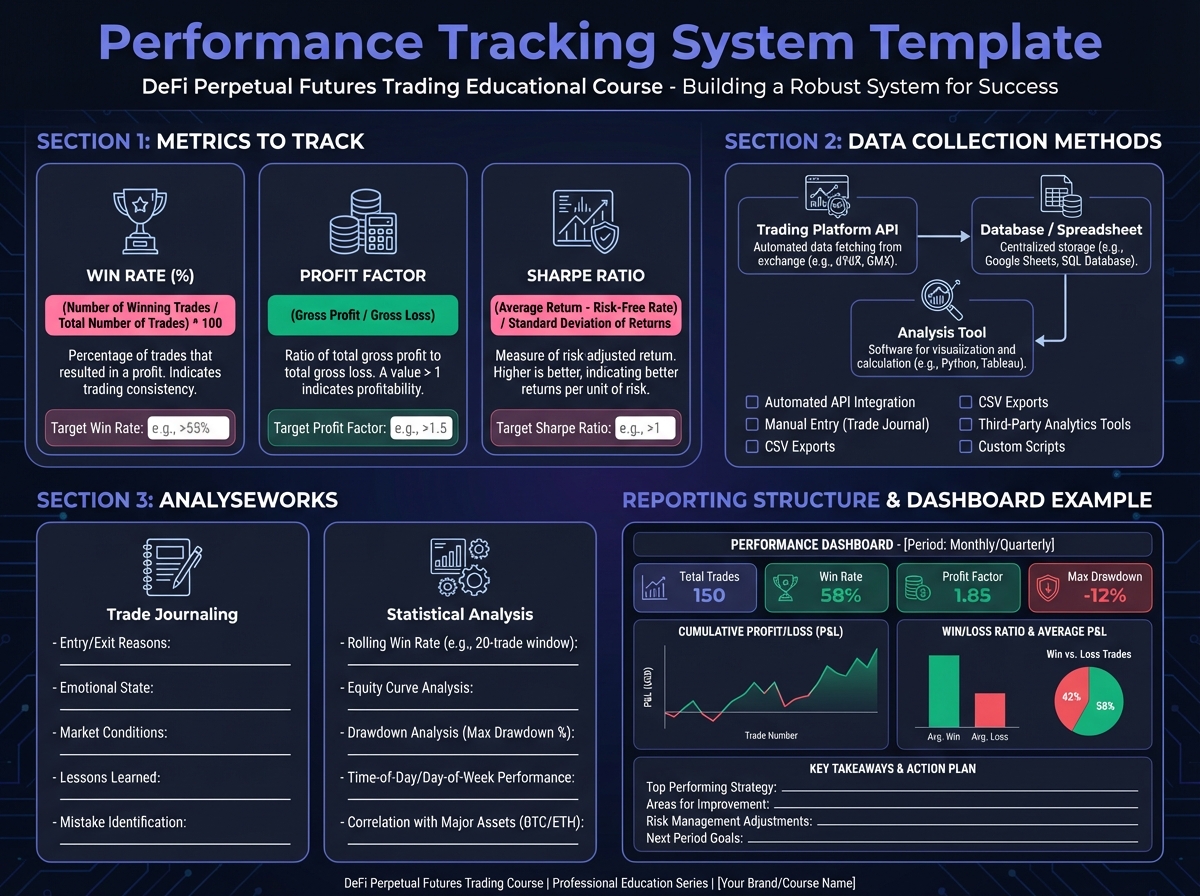

🎯 Phase 4: Performance Tracking (20 minutes)

Exercise 8: Trade Journal Template

Exercise 9: Performance Metrics

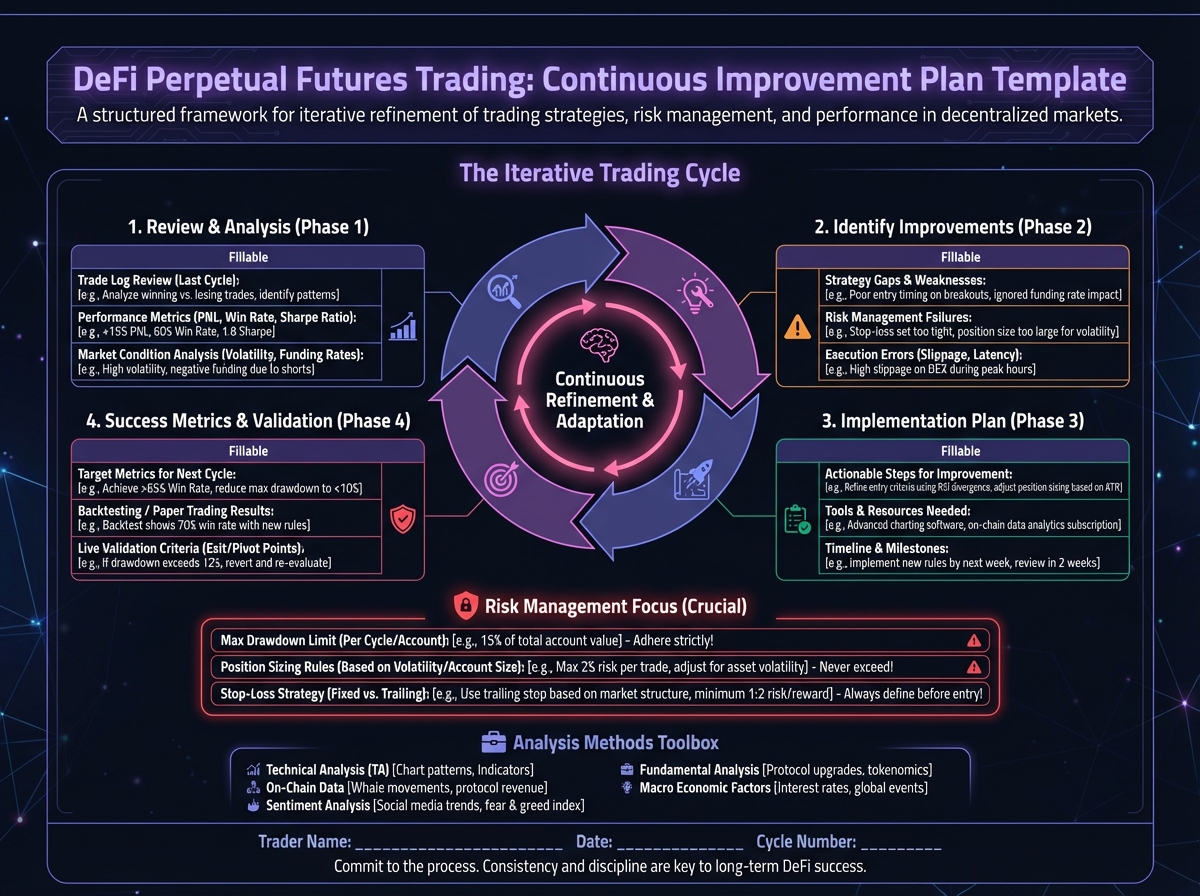

Exercise 10: System Refinement Process

📋 Phase 5: Complete System Documentation (20 minutes)

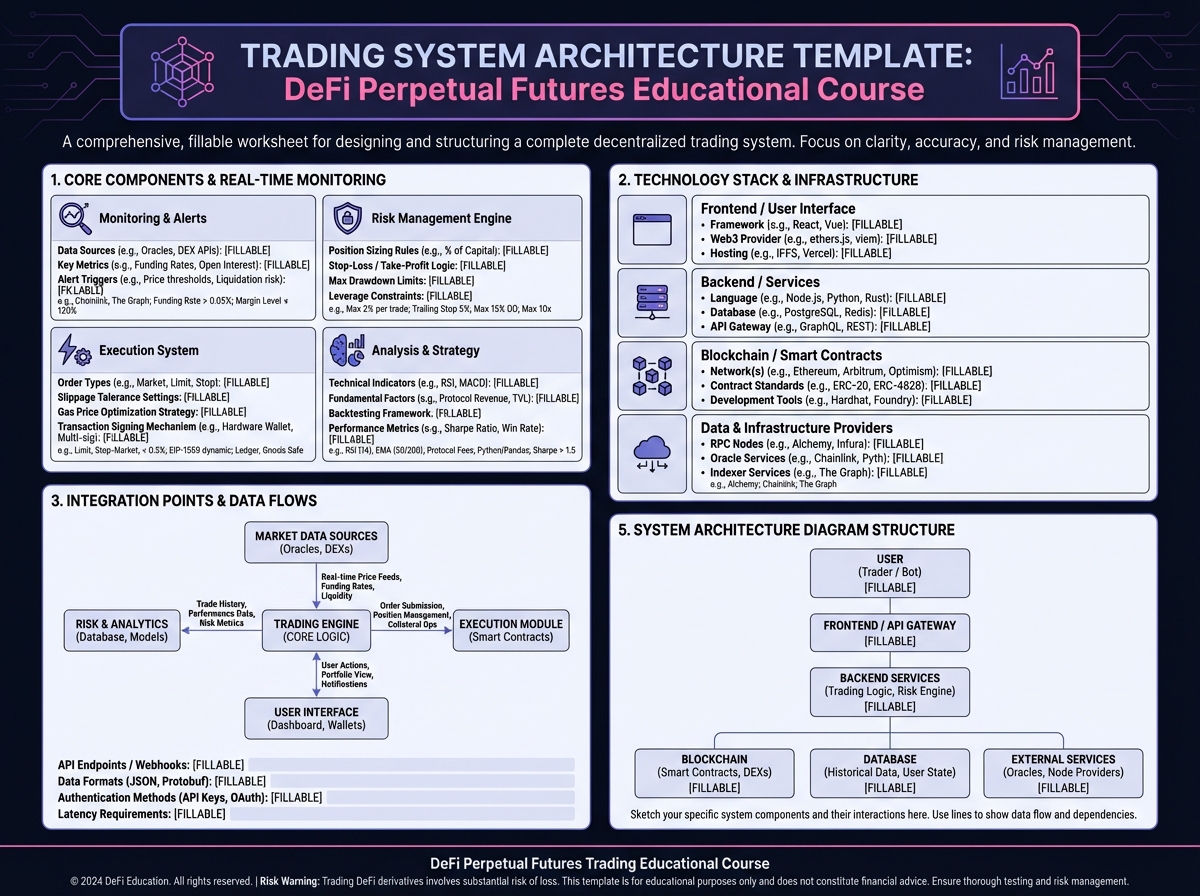

Exercise 11: System Rules Summary

Exercise 12: Implementation Plan

✅ Final Self-Assessment

🎯 Next Steps

Last updated