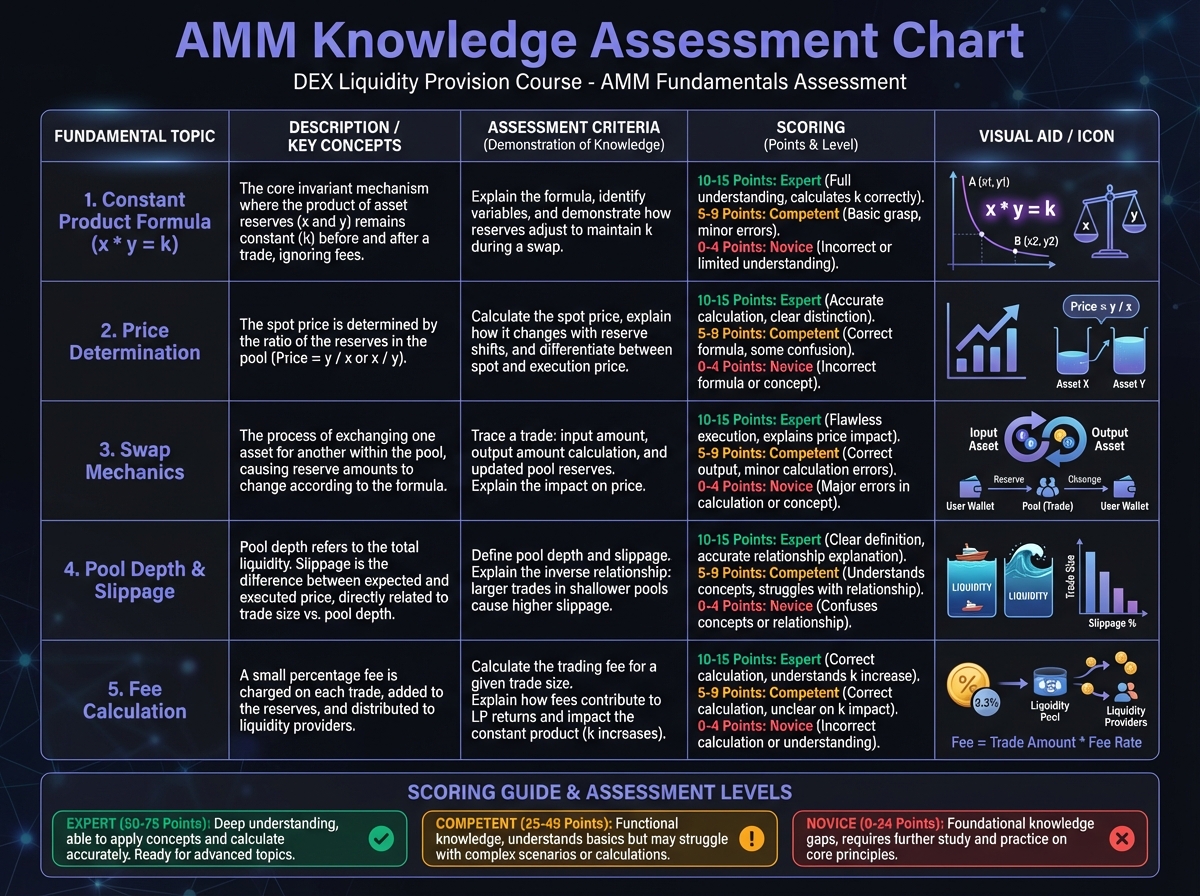

Exercise 1: AMM Fundamentals Assessment

🔍 Phase 1: Knowledge Check (10 minutes)

Understanding Check

📊 Phase 2: Calculation Practice (15 minutes)

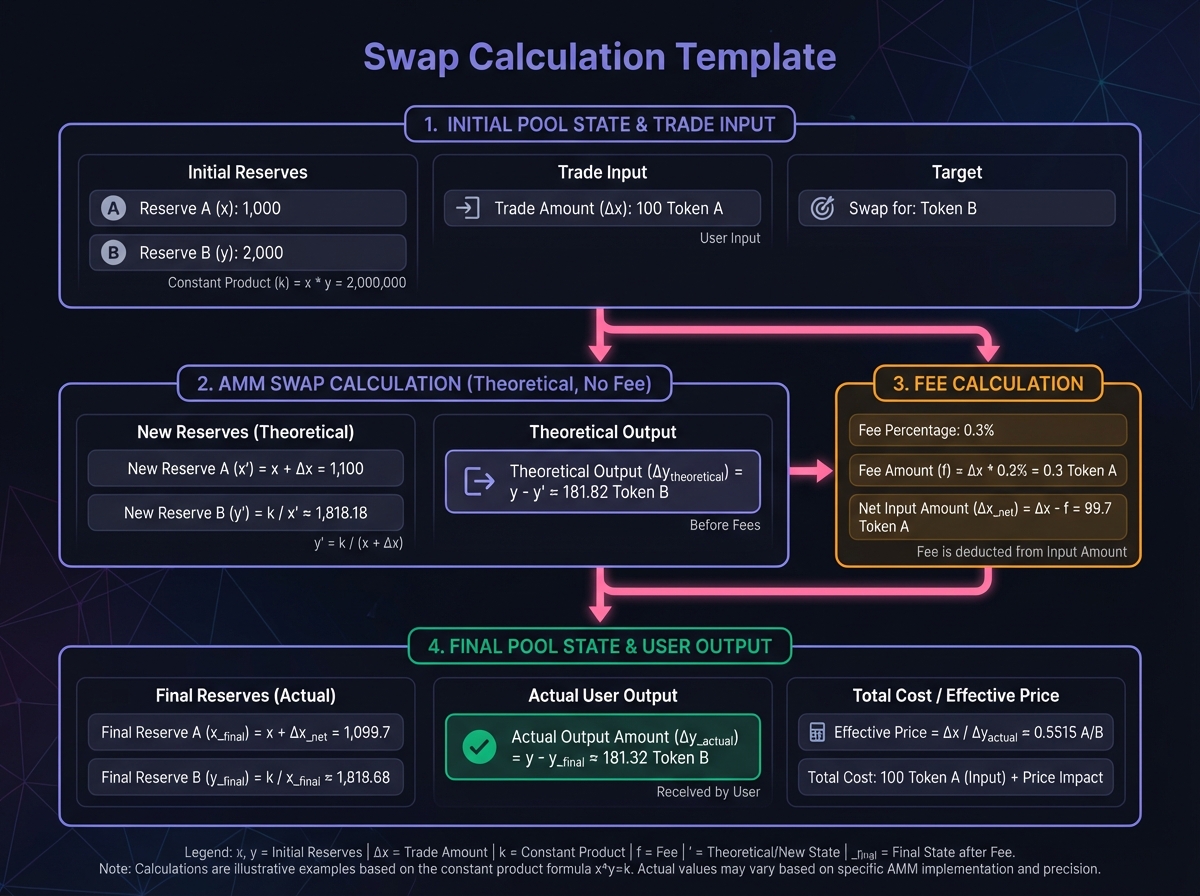

Swap Calculation Exercise

Pool Depth Exercise

💡 Phase 3: Real-World Application (10 minutes)

Pool Selection Exercise

🎯 Phase 4: Self-Assessment (10 minutes)

Knowledge Score

Gap Identification

📚 Next Steps

PreviousLesson 1: Understanding AMM FundamentalsNextLesson 2: The Mathematics of Liquidity Provision

Last updated