Exercise 2: Mathematical Calculations and Analysis

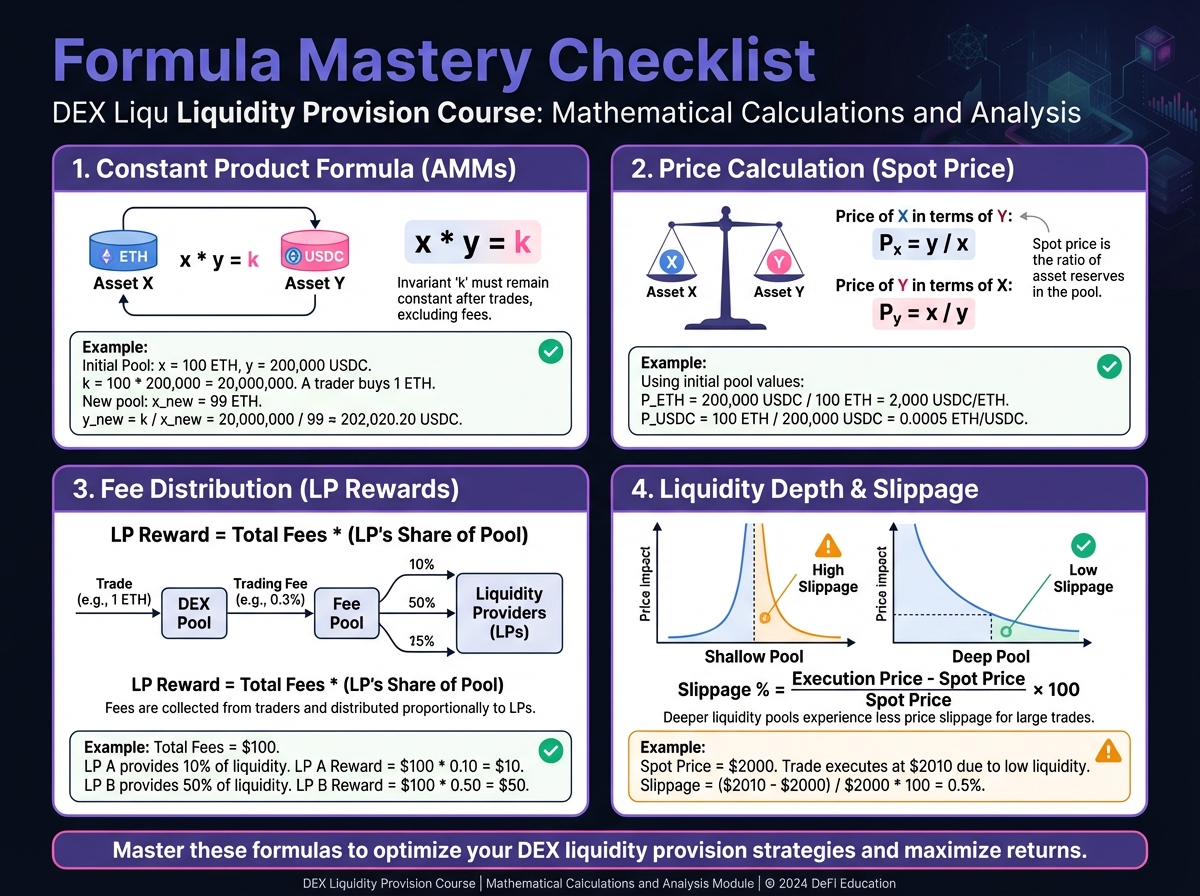

🔢 Phase 1: Formula Mastery (15 minutes)

Constant Product Formula Practice

ETH Reserves

USDC Reserves

k (constant)

Price (USDC/ETH)

Price Impact Calculation

📊 Phase 2: Fee Mathematics (15 minutes)

Fee Distribution Exercise

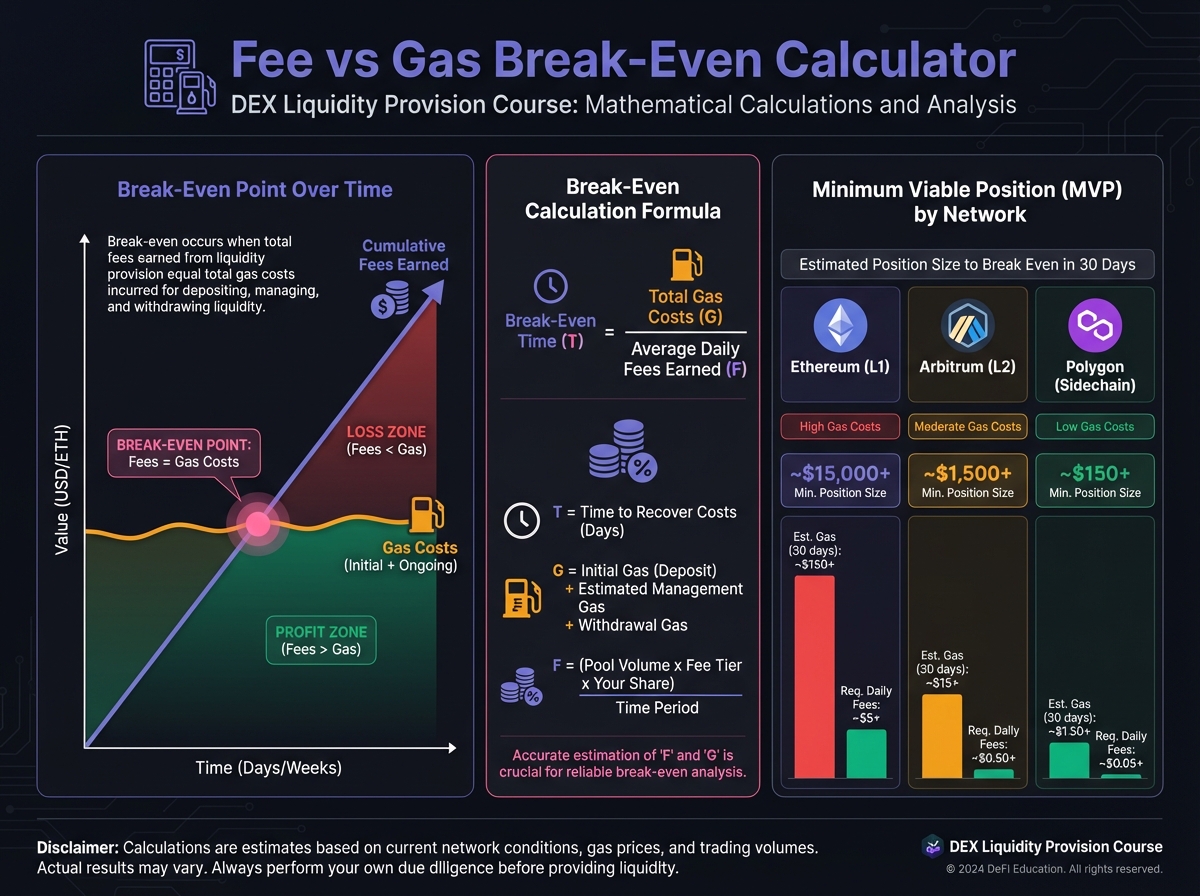

Fee vs. Gas Analysis

🧮 Phase 3: Advanced Calculations (20 minutes)

Liquidity Depth Comparison

Multi-Trade Analysis

📈 Phase 4: Real-World Scenario (10 minutes)

Complete Pool Analysis

🎯 Phase 5: Mastery Check (10 minutes)

Self-Evaluation

Key Formulas Mastered

📚 Next Steps

PreviousLesson 2: The Mathematics of Liquidity ProvisionNextLesson 3: Impermanent Loss and Risk Fundamentals

Last updated