Exercise 3: Risk Assessment and IL Analysis

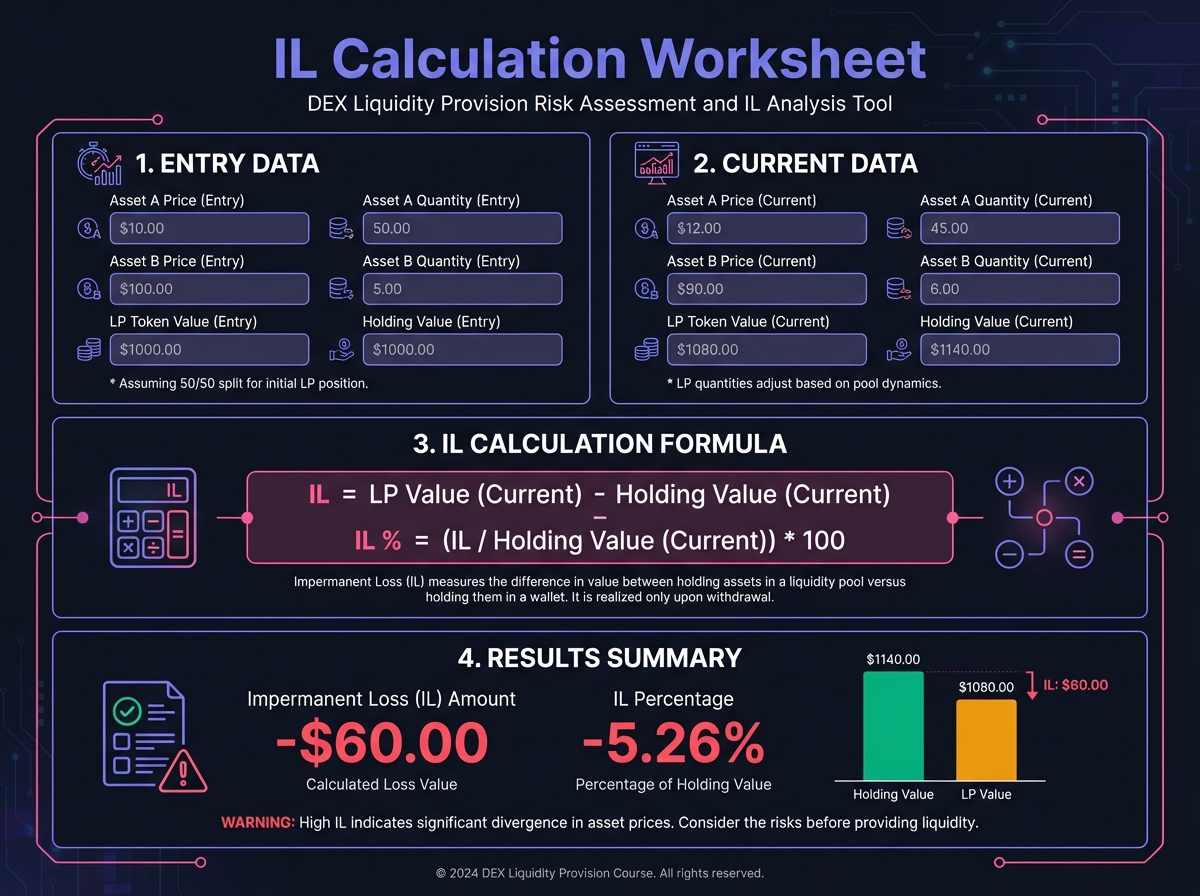

🔍 Phase 1: IL Calculation Practice (20 minutes)

Basic IL Scenarios

IL Formula Application

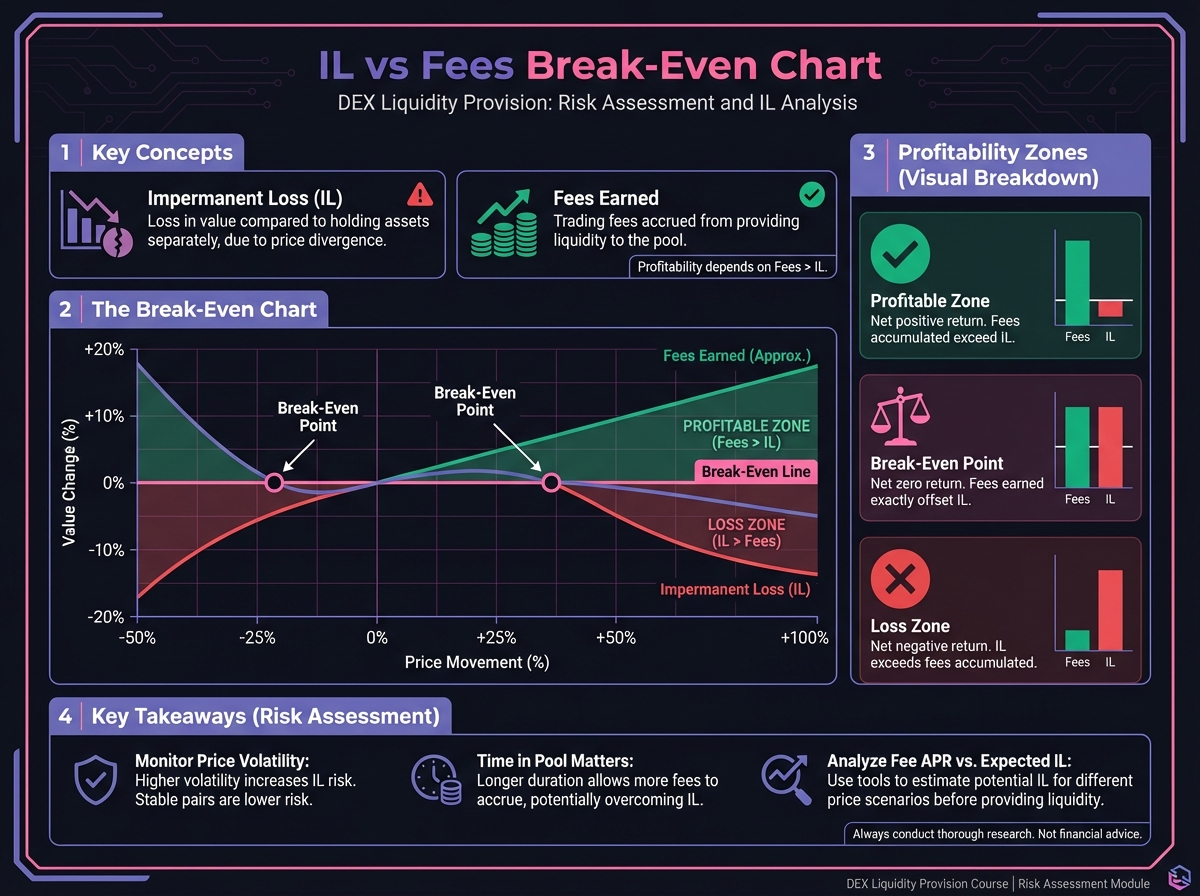

📊 Phase 2: IL vs. Fees Analysis (15 minutes)

Break-Even Analysis

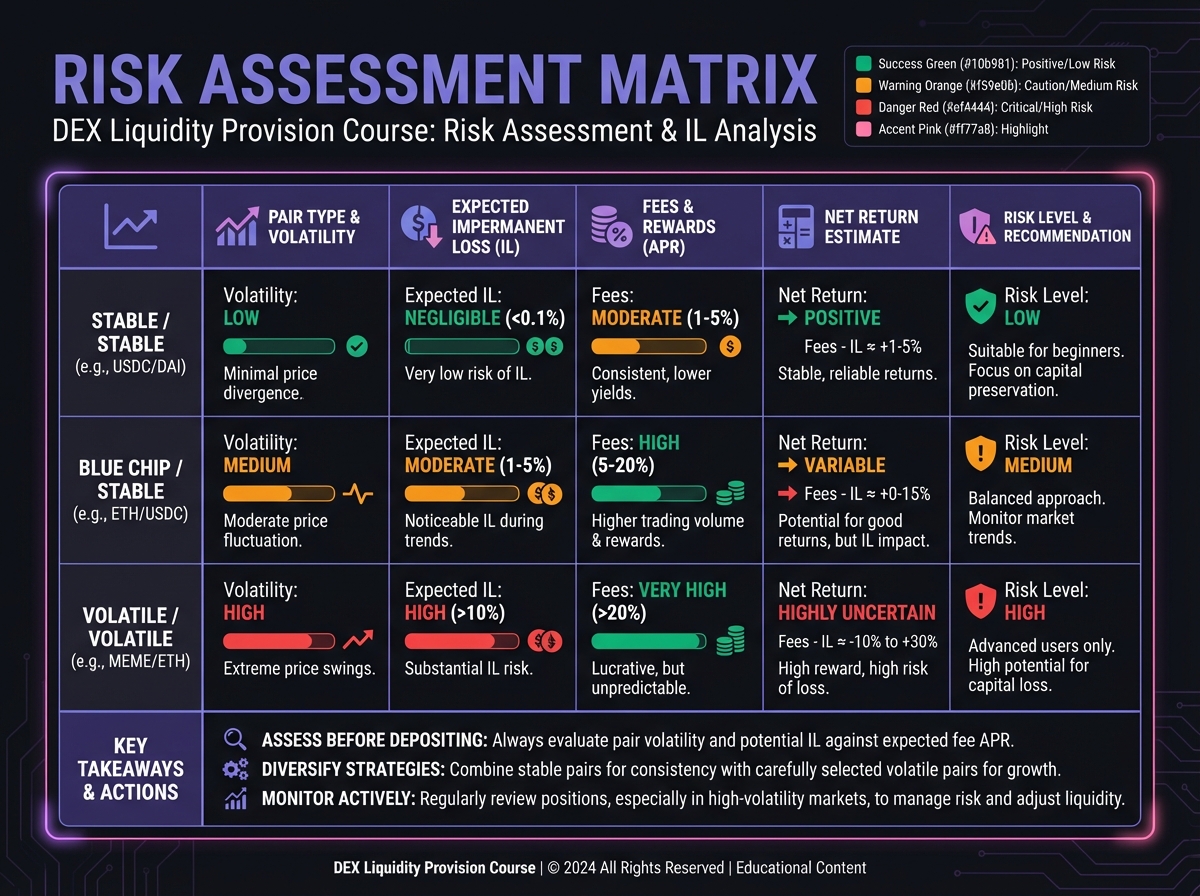

Risk Assessment Matrix

Pair

Volatility

Expected IL

Fees

Net Return

Risk Level

💡 Phase 3: LVR Understanding (10 minutes)

LVR vs. IL Comparison

LVR Impact Analysis

🎯 Phase 4: Risk Management Framework (15 minutes)

Position Risk Assessment

Risk Mitigation Plan

📚 Next Steps

PreviousLesson 3: Impermanent Loss and Risk FundamentalsNextLesson 4: Building Your First LP Position

Last updated