Exercise 4: First Position Setup and Management

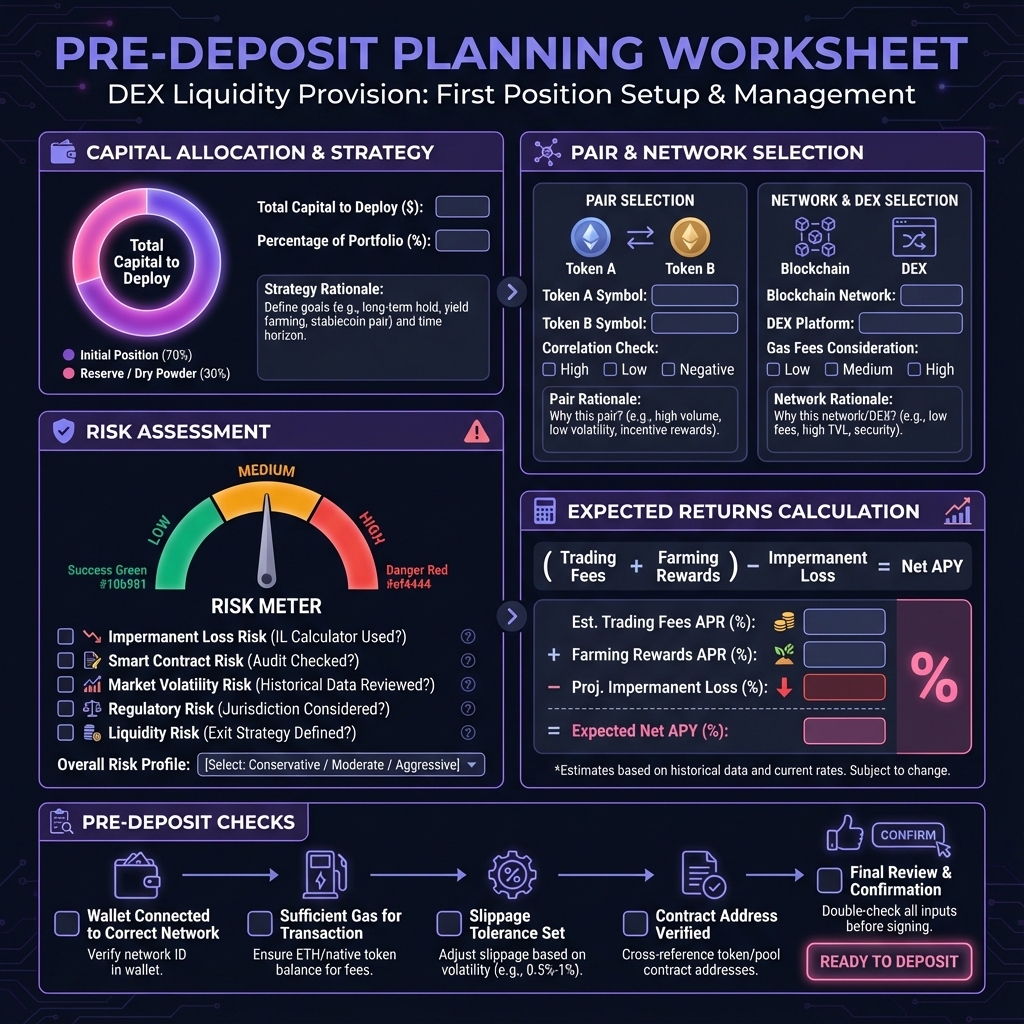

🎯 Phase 1: Pre-Deposit Planning (20 minutes)

Position Planning Worksheet

Pair Selection

Network Selection

Risk Assessment

📝 Phase 2: Position Setup Checklist (30 minutes)

Pre-Setup Checklist

Setup Process Documentation

Position Details Record

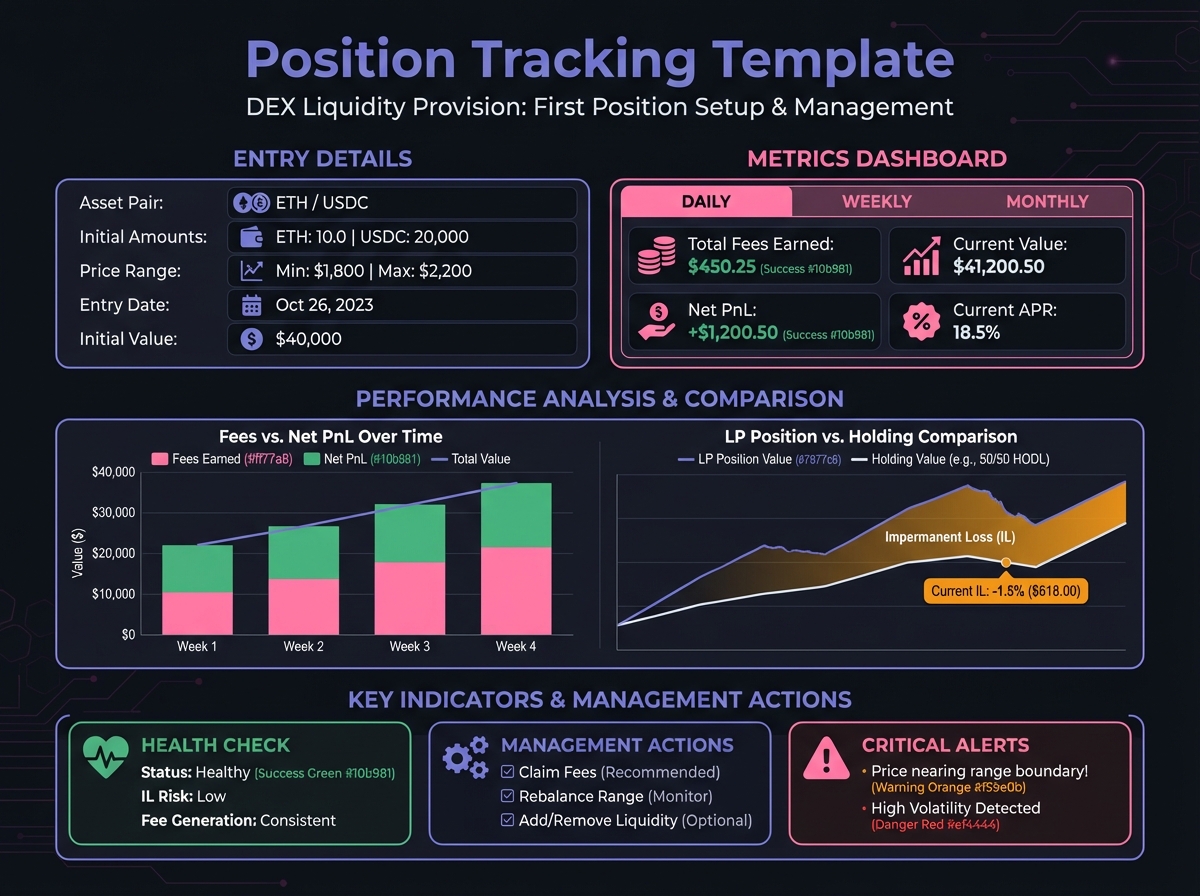

📊 Phase 3: Monitoring System Setup (20 minutes)

Tracking Spreadsheet Setup

Alert Setup

🔄 Phase 4: Management Protocol (20 minutes)

Weekly Review Template

Decision Framework

📈 Phase 5: First Month Tracking (Ongoing)

Month 1 Performance Log

Lessons Learned

🎯 Success Metrics

📚 Next Steps

Last updated