Exercise 6: Cross-Protocol Analysis and Selection

🔍 Phase 1: Protocol Comparison (20 minutes)

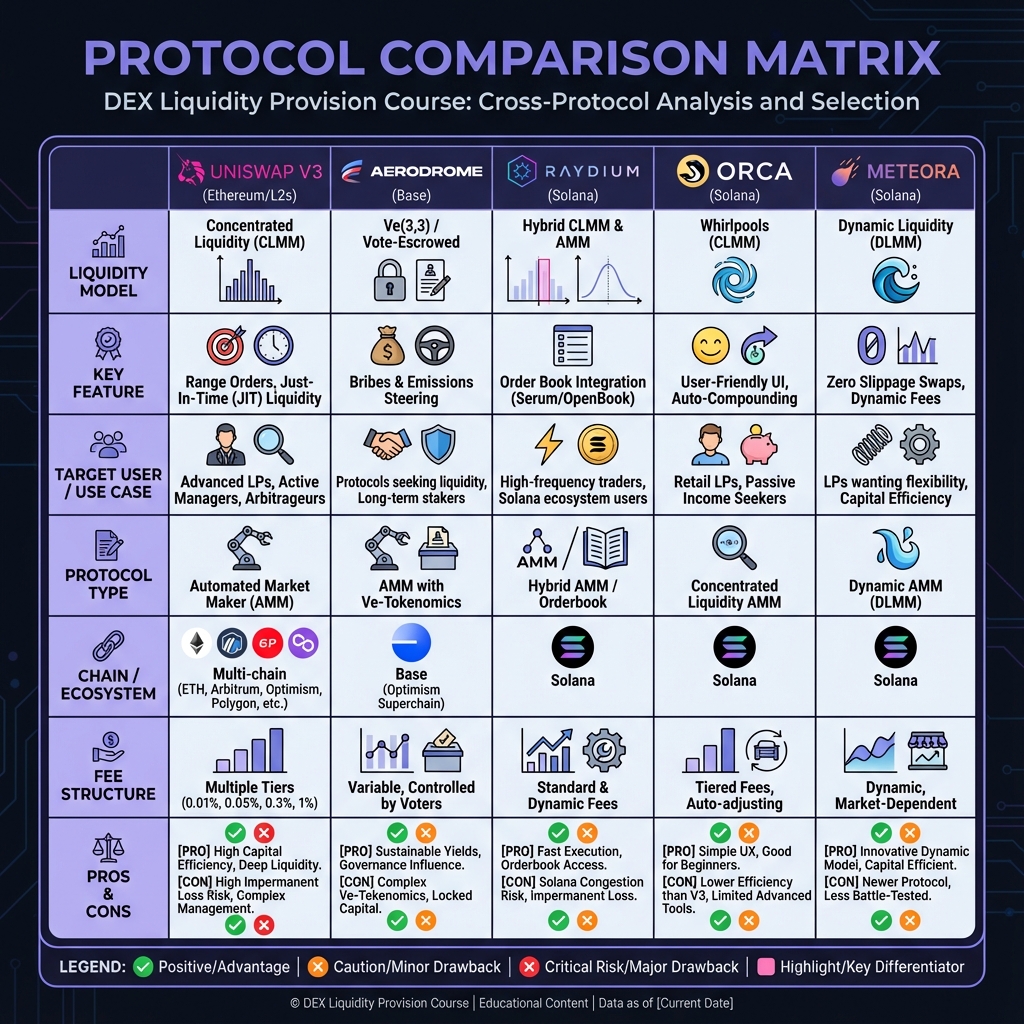

Protocol Feature Matrix

Feature

Uniswap V3

Aerodrome

Raydium

Orca

Meteora

Protocol Selection Exercise

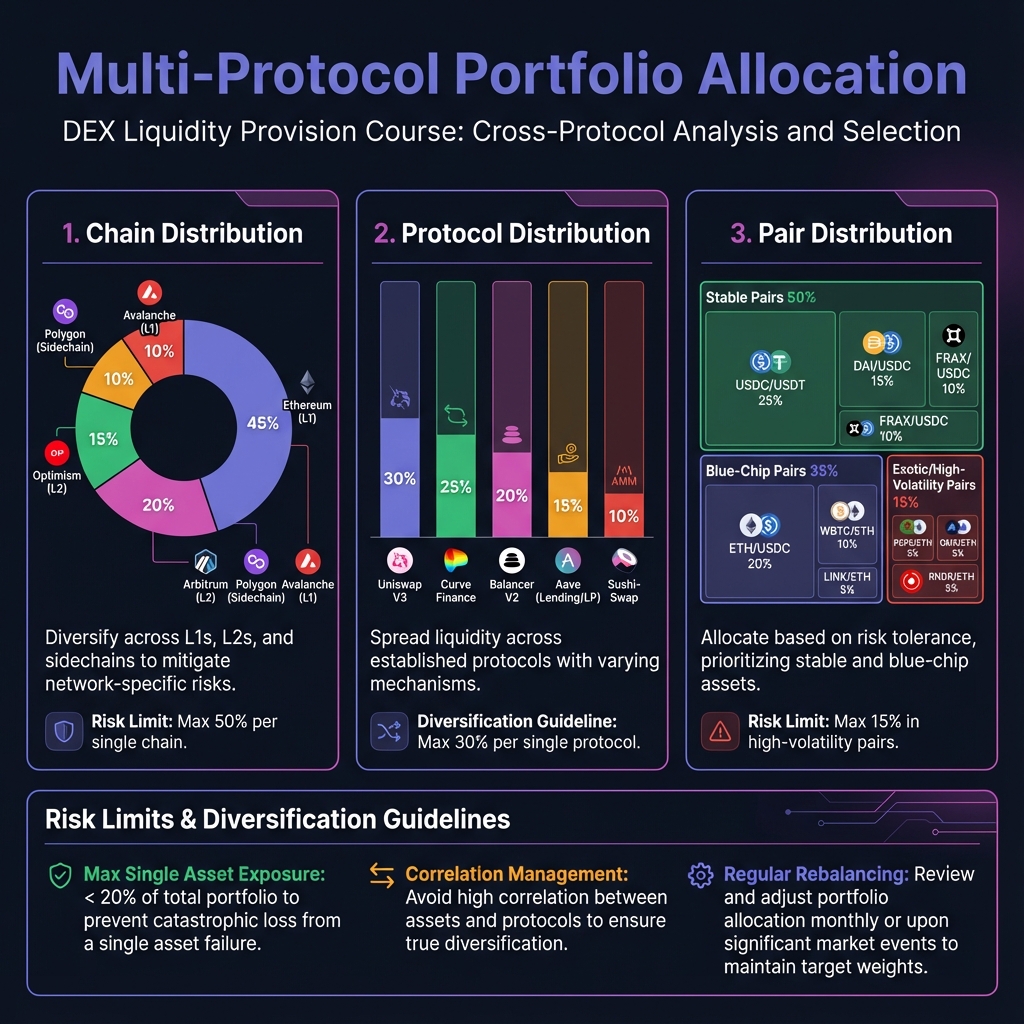

📊 Phase 2: Multi-Protocol Strategy Design (20 minutes)

Portfolio Allocation Framework

Risk Limits

💰 Phase 3: Aerodrome Strategy (15 minutes)

ve-Token Participation Plan

Bribe Efficiency Analysis

🎯 Phase 4: Complete Multi-Protocol Plan (15 minutes)

Your Multi-Protocol Strategy

Expected Returns

📚 Next Steps

PreviousLesson 6: Multi-Protocol Strategy DevelopmentNextLesson 7: Fee Optimization and Gas Economics

Last updated