Exercise 7: Fee Tier Selection and Gas Optimization

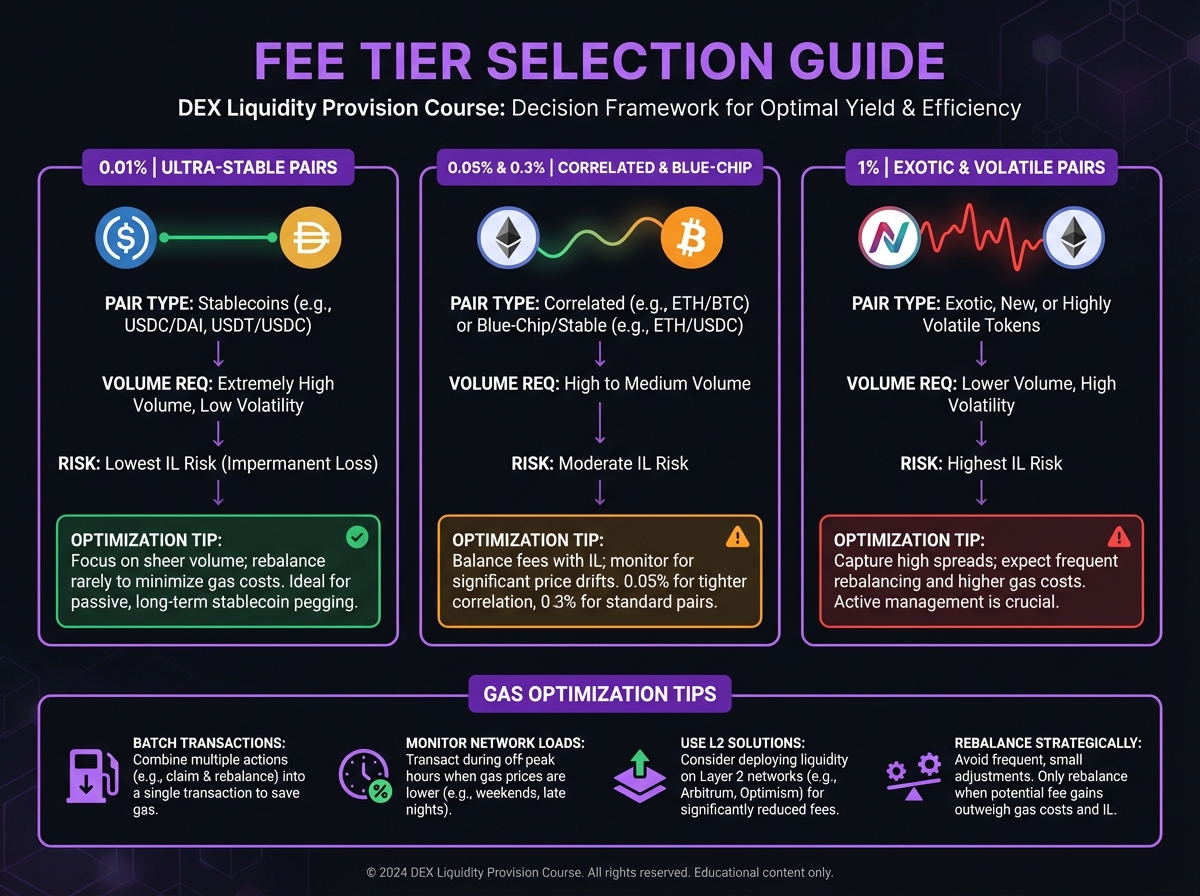

💰 Phase 1: Fee Tier Analysis (15 minutes)

Fee Tier Selection Exercise

Volume/TVL Ratio Calculation

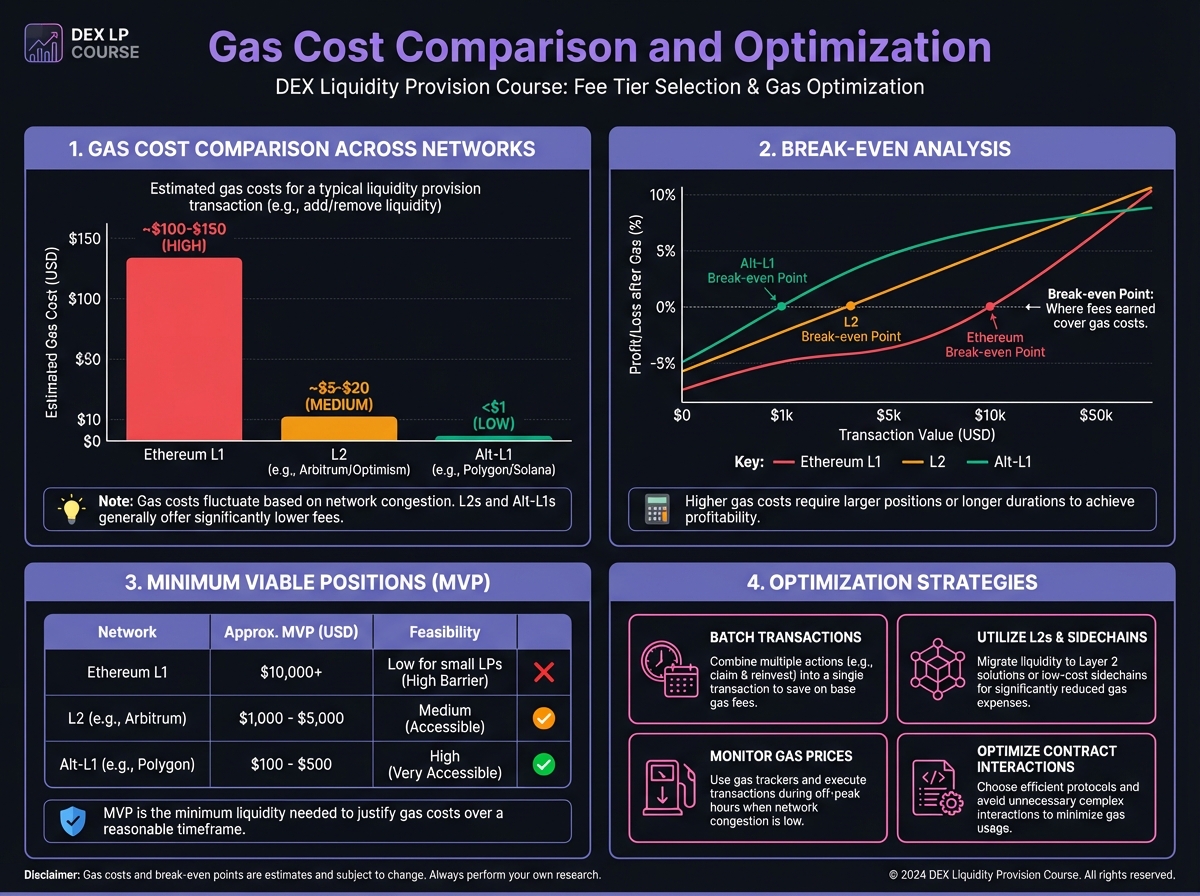

⛽ Phase 2: Gas Economics (20 minutes)

Gas Cost Analysis

Break-Even Analysis

📊 Phase 3: Fee Optimization Strategy (10 minutes)

Complete Fee Analysis

🎯 Phase 4: Optimization Action Plan (10 minutes)

Your Optimization Strategy

Gas Optimization Checklist

📚 Next Steps

PreviousLesson 7: Fee Optimization and Gas EconomicsNextLesson 8: Risk Management and Hedging Strategies

Last updated