Exercise 2: Calculation Practice and Risk Metrics

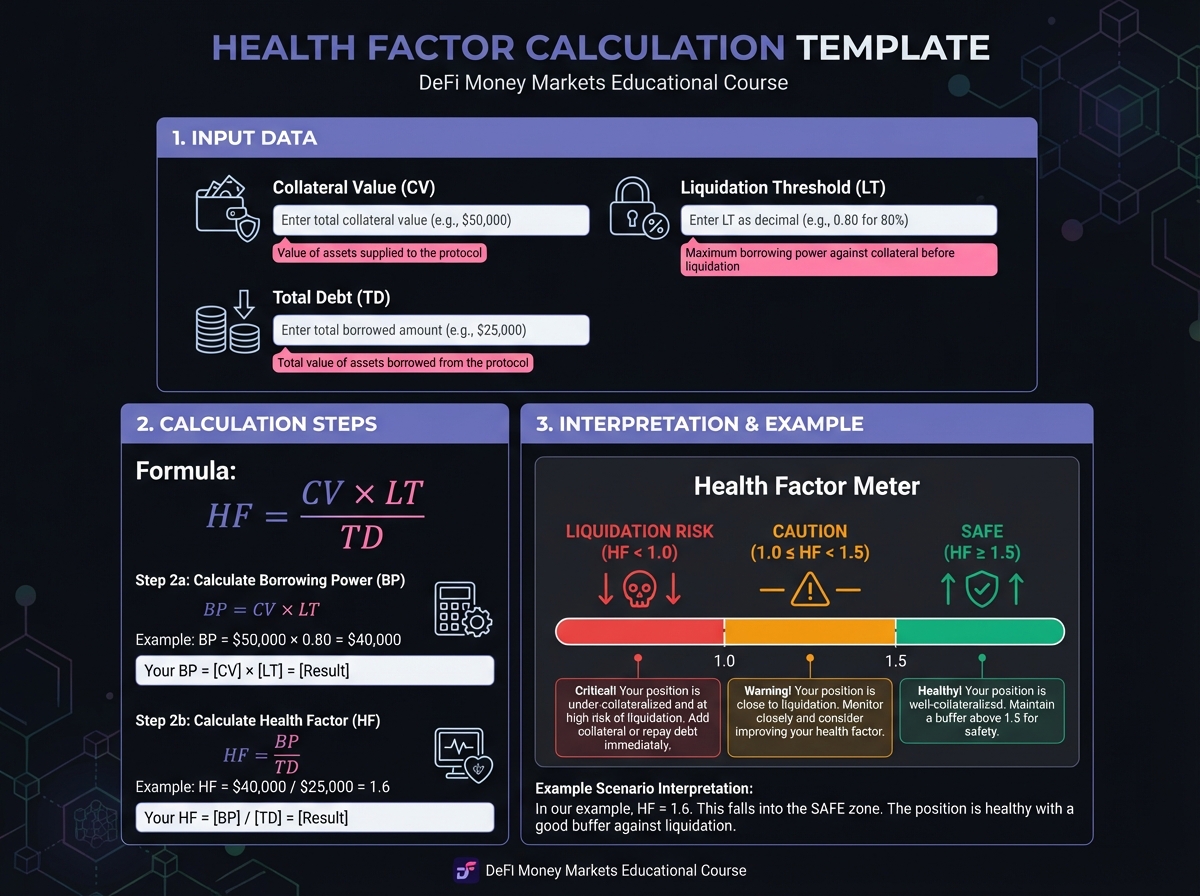

🔢 Phase 1: Health Factor Calculations (20 minutes)

Basic HF Calculation

HF with Price Changes

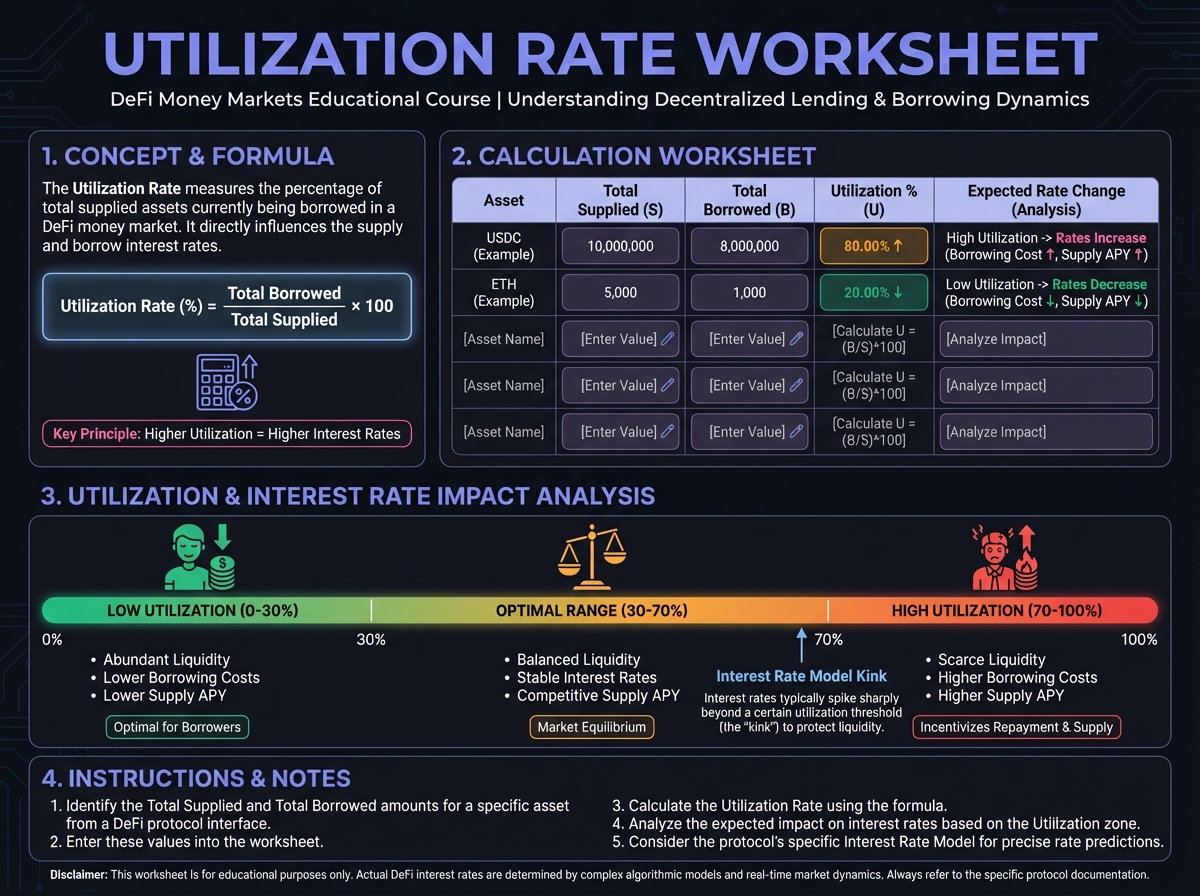

💧 Phase 2: Utilization and Interest Rates (15 minutes)

Utilization Calculation

Interest Rate Impact

📊 Phase 3: LTV Analysis (10 minutes)

Maximum Borrowing Capacity

✅ Self-Assessment

PreviousLesson 2: The Mathematics of Lending and BorrowingNextLesson 3: Risk Management Fundamentals

Last updated